How to Manage a Cash Register Efficiently with SDLPOS Hardware

Are you struggling to keep your cash register running smoothly in your retail or hospitality business? Mastering cash register management can transform your daily operations, ensuring accuracy, security, and happy customers.

As a leading provider of cutting-edge cash register hardware, SDLPOS knows what it takes to streamline your transactions and boost efficiency. In this guide, we’ll share expert tips on how to manage a cash register like a pro—from setup and sales to reconciliation and troubleshooting.

Ready to simplify your cash handling and elevate your business? Let’s get started!

Your Cash Register System Basics

When you’re managing a retail business, how to manage a cash register starts with understanding the right system for your needs. Not all cash registers are created equal, and choosing the right one can make a big difference in daily operations and cash handling accuracy. Let’s break down the common types and key features to help you get started.

Cash Register Types Traditional vs POS Systems

There are two main categories of cash registers in the market today:

Traditional Cash Registers

These are standalone machines mostly used for basic sales transactions. They handle cash, print receipts, and keep a simple sales log. While they’re reliable and easy to use, they lack advanced reporting and integration capabilities.

Point of Sale (POS) Systems

POS systems are more advanced and combine software with hardware to manage sales, inventory, and customer data. They support multiple payment types, barcode scanning, discount management, and real-time sales reporting. SDLPOS is an example of a flexible, user-friendly POS solution widely used by businesses in the US.

Key Components and Features of a Cash Register

No matter the type, every good cash register should include:

- Cash drawer — secured for safe cash handling

- Receipt printer — for transparent transaction records

- Display screen — for cashier and customer to verify sales

- Barcode scanner compatibility — speeds up checkout and reduces errors

- Multi-payment processing — including cash, credit/debit, and digital wallets

- Tax and discount configuration — automated handling of sales tax and promotions

- User access controls — to limit who can perform refunds or voids

Choosing the Right Cash Register Hardware

Picking the right cash register depends on your business size, volume, and budget. Here are some quick tips:

- For small shops or kiosks, a simple traditional register might suffice if you mainly accept cash and basic card payments.

- For growing or busy stores, invest in a POS system like SDLPOS that integrates inventory, sales, and customer management in one place.

- Consider the type of hardware compatible with popular peripherals—barcode scanners, cash drawers, and receipt printers—to keep everything running smoothly.

- Look for easy-to-use interfaces so your staff can quickly learn and confidently manage everyday sales transactions.

By understanding these basics, you’re setting yourself up for smoother cash register operation and better retail cash register management. The right system lays a solid foundation for everything else, from daily cash register balancing to preventing theft and fraud.

Setting Up Your Cash Register for the Day

Starting your day right with proper cash register setup is essential for smooth sales and accurate accounting. Here’s a simple guide to get your POS system or traditional cash register ready.

Powering On and Initializing the Register

- Switch on the cash register or POS terminal first thing in the morning.

- Wait for the system to fully initialize—this usually includes self-checks and loading software.

- If using a POS system like SDLPOS, confirm all peripheral devices (barcode scanners, receipt printers, card readers) are connected and operational.

- Run a quick test transaction to ensure the system is responsive and ready for use.

Counting and Placing the Starting Cash Float

- Before opening, count your starting cash float carefully. This is the cash amount you’ll use to give customers change.

- Make sure the float is accurate to avoid discrepancies during your daily cash register balancing.

- Place the counted float into the cash drawer securely, organizing bills and coins for easy access.

- Record the float amount either on your manual log or, if your software allows, input it into the system to keep an audit trail.

Configuring System Settings Tax Rates Payment Types Discounts

- Set the correct local and state tax rates in your cash register software or system settings to ensure accurate billing.

- Confirm all accepted payment types are enabled—cash, credit/debit cards, mobile payments, gift cards, etc.

- Input any discount options or promotional pricing for the day, like loyalty discounts or seasonal sales, so cashiers can apply them easily.

- Regularly update these settings to keep up with tax changes or new payment methods, which helps avoid errors during transactions.

By following these steps every morning, you’ll maintain a reliable cash register operation that supports smooth transactions and accurate daily cash register management. This prevents common errors and prepares your staff to deliver fast, efficient service from the moment you open.

Handling Sales Transactions Properly for Cash Register Management

Managing sales transactions smoothly is key to keeping your business running efficiently. Whether you’re using a traditional cash register or a POS system, handling sales right reduces errors and keeps customers happy.

Step-by-Step Guide to Ringing Up Sales

Follow these steps to ensure accurate transaction processing every time:

- Scan Items or Enter Codes: Use your barcode scanner or manually enter the item code if a scanner isn’t available. This speeds up checkout and reduces mistakes in pricing.

- Verify Prices and Quantities: Always double-check the product details on the screen before finalizing the sale.

- Apply Discounts or Promotions: If the customer has a coupon or discount, enter it now. This keeps the discount tracking clean.

- Choose Payment Method: Select the correct payment type—cash, credit/debit card, or digital wallets like Apple Pay or Google Pay.

- Complete Transaction: Confirm the total and process payment. If it’s cash, give the correct change and print a receipt. For digital payments, wait for confirmation from the device before handing over goods.

Using Barcode Scanners Cash Card and Digital Payments Effectively

Barcode scanners streamline sales by quickly inputting product details, so train staff to handle scanners confidently and troubleshoot common scanning issues.

For cash card payments and digital wallets, ensure your system is:

- Integrated with popular payment methods accepted by most customers in the U.S.

- Updated regularly to support secure transactions.

- Able to provide fast authorizations to avoid long waits at checkout.

Offering these options not only speeds up checkout but improves the customer experience.

Applying Discounts and Managing Returns and Exchanges

Handling discounts and returns correctly helps maintain accurate daily cash register balancing and inventory tracking.

- Apply Discounts at Sale Time to prevent confusion later. Use your POS or register system to select the right discount type — percent off, dollar amount, or special pricing.

- Process Returns or Exchanges with Care:

- Check the return policy before accepting.

- Use the register’s return function to log the transaction, which adjusts inventory and sales records.

- Verify the reason for return and issue store credit or cash refunds accordingly, always printing a receipt.

- Track Discounts and Returns to spot trends that might signal fraud or operational issues.

By following clear steps when ringing up sales, using modern payment options, and carefully managing discounts and returns, you’ll ensure your cash register operation runs smoothly, reduces errors, and offers a positive checkout experience for customers and staff alike.

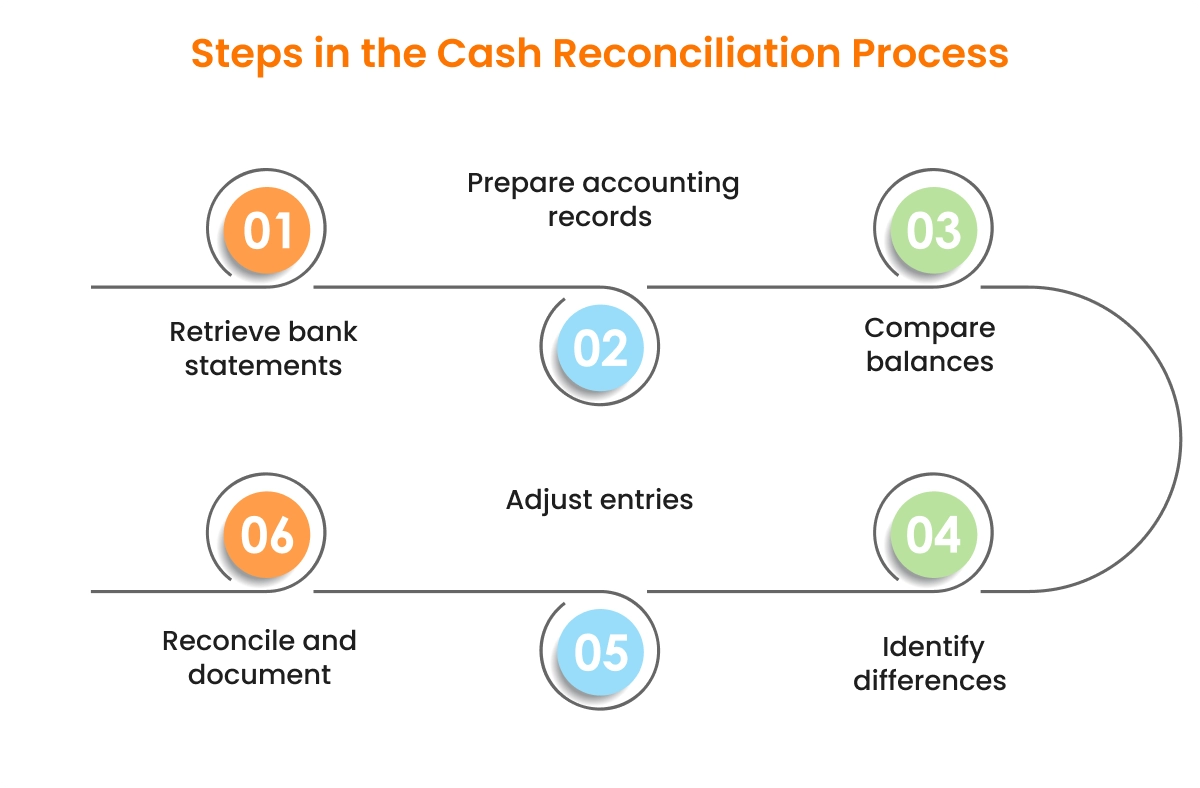

Daily Reconciliation and Cash Register Balancing Best Practices

Managing your cash register daily with care is key to keeping your business running smoothly and preventing discrepancies. Here’s how to handle daily cash register balancing and reconciliation like a pro.

Accurate Cash Counting Techniques

- Count cash systematically: Always count your starting and ending cash float in a quiet spot without interruptions. Use denominations (bills and coins) to avoid mistakes.

- Double-count during busy shifts: If multiple cashiers handle the same register, count the cash twice—once when handing over and once when receiving.

- Use a cash counting tray or sorter: These tools speed up counting and reduce errors.

- Check for counterfeit bills: Train your staff to spot fake currency using UV markers or light detection.

Keeping Audit Trails and Receipts

- Record every transaction: Whether it’s a sale, refund, or void, ensure the register logs it properly. This creates an audit trail essential for checking inconsistencies later.

- Keep receipts organized: Store receipts in order by date to make cash register reconciliation easier at the end of each day or shift.

- Save digital records: If your POS system supports it (like SDLPOS options), back up transaction data daily to prevent data loss.

- Review transaction reports: Regularly scan through sales logs to spot unusual or suspicious activity.

Daily Cash Register Balancing and Reporting

- Balance cash against sales: At the end of each day or shift, count the cash in the drawer and compare it to the sales total recorded in the register.

- Identify discrepancies promptly: If counted cash doesn’t match sales reports, investigate immediately to find errors or potential theft.

- Create daily reports: Use your POS system to print or save cash register reconciliation reports showing sales by type (cash, card, discounts).

- Train staff to review reports: Empower cashiers and managers to double-check closing reports, helping maintain accountability.

Key Tips for Streamlined Cash Register Management

- Set a fixed cash float: Having a consistent starting amount reduces errors during cash counting.

- Use separate drawers for cash and checks: This helps with organization and simplifies reconciliation.

- Limit cash drawer access: Only trained personnel should handle cash to reduce theft risks.

- Schedule regular audits: Surprise cash counts can catch issues early and improve overall cash handling discipline.

Following these cash register reconciliation processes and cash handling best practices protects your business daily, keeps your accounts accurate, and builds trustworthy retail cash register management routines.

Security Measures to Prevent Theft and Fraud in Cash Register Use

Managing your cash register securely is crucial to preventing theft and fraud in your business. Here are key strategies to keep your cash handling safe and reliable.

Secure Cash Drawer Management

- Keep the cash drawer locked when not in use. Always close and lock the drawer after transactions to prevent unauthorized access.

- Limit cash float amounts. Only keep a reasonable starting cash float in the drawer. Excess cash should be removed and stored securely elsewhere.

- Use cash drop safes if available. For larger cash volumes, drop excess bills and coins into a secure safe accessible only by management.

- Log every cash drawer open event. Modern POS systems often track when and why a cash drawer opens to spot unusual activity.

Staff Access Control and User Permissions

- Assign unique login credentials to every cashier. This makes it easier to track who handled each transaction and discourages dishonest behavior.

- Limit permissions based on role. Only allow cashiers to perform sales and returns, while managers have access to overrides and refunds.

- Use timed auto-logout features. Automatically log cashiers out after inactivity to avoid someone else misusing their session.

- Monitor shifts and audit transactions regularly. Regular reviews help identify suspicious actions early.

Tips to Spot and Prevent Theft or Fraud

- Watch for cash register discrepancies. Differences between sales recorded and cash collected can indicate theft.

- Be aware of refund or void abuse. Frequent or large refunds by the same employee can be a red flag.

- Train employees on honest conduct and fraud risks. Awareness and clear policies often prevent potential theft.

- Use surveillance systems around point-of-sale areas. Cameras deter theft and provide evidence if needed.

- Encourage staff to report suspicious behavior. Create a workplace culture that values transparency.

By following these cash drawer management best practices, controlling staff access properly, and staying alert to signs of fraud, you can significantly reduce risks and keep your cash register operations secure.

Troubleshooting Common Cash Register Problems

Managing retail cash register systems smoothly means knowing how to handle common problems quickly without disrupting your business flow. Here’s a guide to troubleshooting key issues you might face with your SDLPOS or similar cash register setup.

Handling Jams Misreads and Errors

- Paper jams in receipt printers are common. Gently open the printer cover, remove the jammed paper, and realign the new receipt roll properly. Always use quality paper rolls recommended by SDLPOS to reduce jams.

- Barcode scanner misreads can happen if the scanner lens is dirty or the barcode is damaged. Wipe the scanner lens with a microfiber cloth and ask customers to present barcodes flat and undamaged.

- If transactions do not ring up correctly, check for input errors like wrong item codes or incorrect quantities. Train staff to double-check entries before finalizing sales.

- For software errors or freeze-ups, a quick restart often solves the issue.

Resetting and Rebooting the System

- If your cash register system freezes or behaves abnormally, perform a soft reboot by powering off and back on using the main switch or touchscreen menu.

- In case of persistent errors, a factory reset might be needed, but only after backing up sales data and settings. This step wipes configurations and should be a last resort.

- Refer to your SDLPOS manual or support site for specific reset procedures tailored to your model. Proper rebooting keeps the system healthy and responsive.

When to Contact SDLPOS Support or Service

- If troubleshooting steps don’t resolve issues within a few minutes or if hardware malfunctions persist (e.g., unresponsive cash drawers, scanner failure), contact SDLPOS support right away.

- Regular system updates and maintenance can prevent problems from becoming serious, so schedule professional servicing when performance lags or hardware shows wear.

- For warranty-covered repairs or replacements, reach out to SDLPOS customer service early to avoid downtime.

of troubleshooting tips:

- Keep your cash register and accessories clean to avoid jams and scanner issues.

- Train staff to input sales carefully to minimize errors.

- Use soft resets for minor glitches; reserve factory resets for major issues.

- Don’t hesitate to call SDLPOS support when problems affect customer service or daily operations.

For a deeper dive into how SDLPOS cash register systems work and managing common issues, check out How Does a Cash Register Work and Cash Register Troubleshooting Guide.

Training Your Staff to Use the Cash Register Confidently

Getting your cashiers up to speed with your cash register is crucial for smooth retail cash register management. Confident and knowledgeable staff reduce errors, speed up transactions, and help prevent theft or fraud. Here are some key training points and best practices to make sure your team handles the register like pros.

Key Training Points for New Cashiers

- Start with the basics: Teach cashiers how to power on the system, ring up sales, apply discounts, and handle returns. Focus on the step-by-step cash register operation tips.

- Explain payment methods: Make sure they understand how to process cash, credit cards, and digital payments like mobile wallets.

- Practice cash drawer management: Show them how to count the starting float, give correct change, and handle the cash drawer securely.

- Teach reconciliation process: Train cashiers on how to count and balance the cash drawer at the end of shifts to avoid discrepancies.

- Stress security measures: Highlight the importance of user permissions, logging out when away, and spotting suspicious actions to reduce theft risk.

- Simulate real scenarios: Use role-playing for common situations such as refunds, discounts, or voided transactions so cashiers gain hands-on experience.

Creating Quick Reference Guides and Cheat Sheets

- Simple step guides: Create one-page sheets that recap key procedures like ringing up sales, applying discounts, or closing out the register.

- Visual aids: Use screenshots or pictures of the POS screens to help them quickly identify functions.

- Update regularly: Keep these materials current with new features or changing tax rates.

- Accessible location: Place the cheat sheets right next to the register, so cashiers can easily glance at them when needed.

Encouraging Accurate and Honest Cashier Conduct

- Set clear expectations: Explain that accuracy and honesty are top priorities, showing how errors or dishonesty impact the business.

- Regular reviews: Conduct cash register reconciliation and audits frequently to catch and correct mistakes early.

- Positive reinforcement: Recognize cashiers who consistently follow procedures and handle cash responsibly.

- Open communication: Encourage staff to ask questions when unsure instead of guessing or skipping steps.

- Use user permissions wisely: Limit access to sensitive features like refunds or discounts to trusted employees only.

By focusing on these training essentials, you’ll create a team that feels confident on your POS system, improves daily cash register balancing, and helps maintain smooth and secure retail operations.

Maintaining Your Cash Register Hardware for Reliable Operation

Keeping your cash register in top shape is essential for smooth daily use and long-term performance. As a user of SDLPOS equipment, following some straightforward cash register maintenance tips will help you avoid downtime and costly repairs.

Routine Cleaning and Care

- Clean the cash drawer and keyboard regularly to prevent dust and debris buildup. Use a soft, dry cloth to wipe surfaces; avoid harsh chemicals that could damage components.

- Keep barcode scanners and touchscreens free of smudges to ensure accurate scanning and input.

- Check for loose cables or worn connections periodically. Secure or replace them as needed to maintain a stable system.

Software Updates and Data Backups

- Install periodic software updates provided by SDLPOS. These updates often include bug fixes, security patches, and new features that improve cash register performance.

- Back up your transaction data and settings regularly. This helps protect your business records in case of system crashes or hardware failure.

- Consider using automated backup options if your POS system supports it to reduce manual errors.

Extending the Lifespan of Your SDLPOS Equipment

- Handle all equipment gently. Avoid slamming drawers or forcefully pressing keys.

- Use surge protectors to safeguard hardware from unexpected power interruptions or spikes, a common concern in many U.S. retail locations.

- Schedule routine hardware checkups according to SDLPOS recommendations or your store’s volume of transactions. Regular inspections catch issues early before they become major problems.

- Train your staff on proper cash register operation tips to minimize misuse and accidental damage.

By staying on top of these maintenance tasks, you’ll ensure your SDLPOS cash register operates efficiently, supports accurate cash handling, and reduces the need for emergency repairs. This proactive approach is key to hassle-free retail cash register management and helps you get the most out of your equipment investment.