Introduction to POS Systems for Small Businesses Benefits and Features

If you’re a small business owner wondering how to streamline your sales and manage inventory more efficiently, understanding POS systems for small businesses is where you need to start. These powerful tools go far beyond the old-school cash register—offering real-time insights, smoother transactions, and flexible payment options tailored to your unique needs.

In this guide, you’ll get a clear and simple introduction to what POS systems are, how they work, and why choosing the right one can transform your daily operations. Whether you run a retail shop, cafe, or service business, knowing the basics of POS systems will help you make smarter decisions and save time.

Ready to get started? Let’s dive into the essential must-knows about POS systems for small businesses and discover how they can give your business an edge.

What is a POS System for Small Businesses

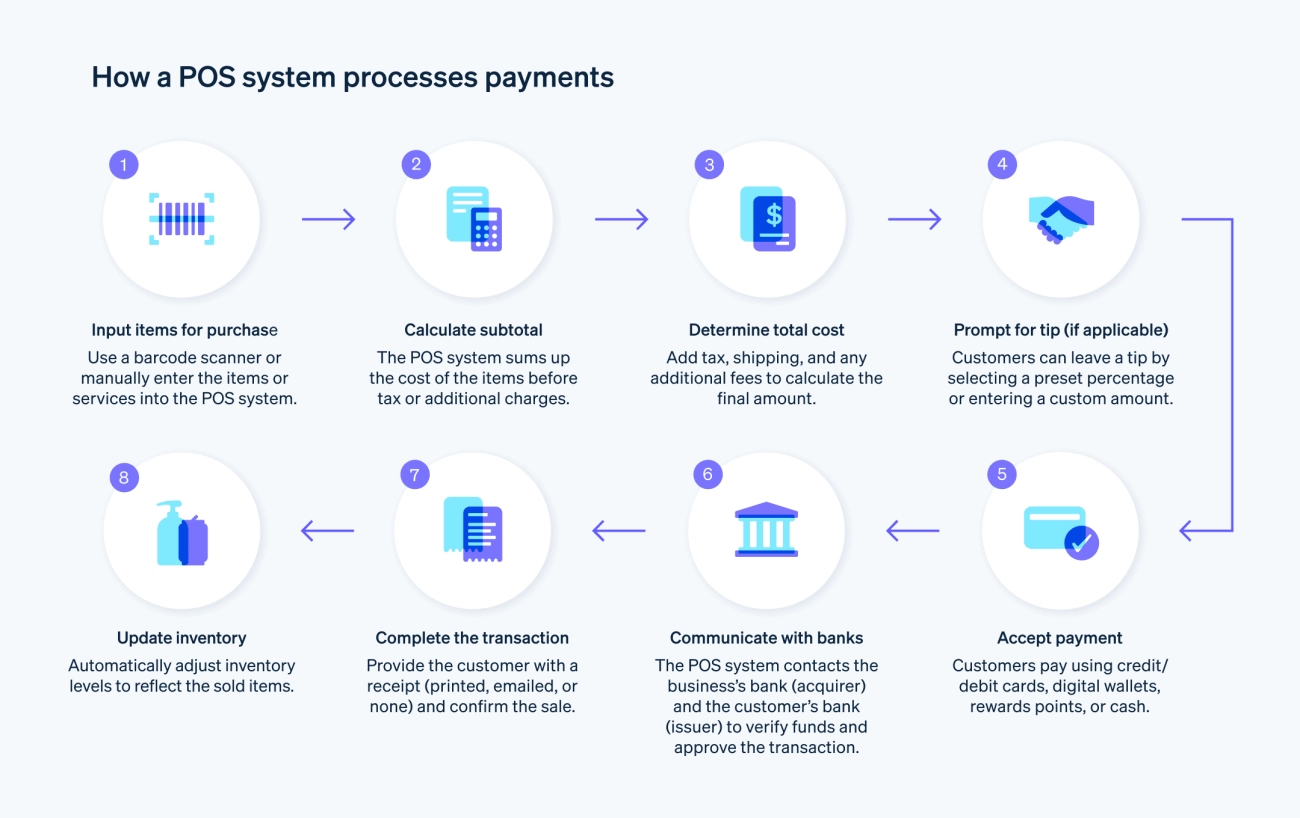

If you’re running a small business and wondering what a POS system really is, you’re not alone. Simply put, a Point of Sale (POS) system is the technology that handles sales transactions and streamlines day-to-day operations at your checkout. It’s much more than a traditional cash register—it’s a complete solution designed to improve how you manage sales, inventory, and customer data.

Components of a POS System

A modern POS system typically includes several essential parts working together:

- Hardware: This includes devices like cash registers, barcode scanners, receipt printers, touch screens, and payment terminals.

- Software: The digital platform that processes transactions, manages inventory, generates reports, and can integrate with accounting or ERP software.

- Payment Processing: Secure systems that accept various payment methods, including credit/debit cards, mobile wallets, and contactless payments.

- Connectivity: Cloud or local networks that allow your POS system to update sales and inventory data in real time.

Traditional Cash Registers vs Modern POS Systems

You might remember traditional cash registers as simple machines for handling cash and printing receipts. While they still exist, modern POS systems are a huge step up because they:

- Track inventory and sales automatically instead of manual entry.

- Offer real-time reporting to help you make smarter business decisions.

- Support multiple payment options, including chip cards, contactless, and mobile pay.

- Allow for employee management, customer loyalty programs, and more.

Unlike old-fashioned registers, today’s POS systems are designed to grow with your business and simplify operations beyond just ringing up sales.

Types of POS Systems for Small Businesses

When choosing a POS system, small businesses usually pick from three main types, each covering different needs:

Cloud-based POS: These systems operate over the internet with data stored securely in the cloud. They offer flexibility to access your sales data anywhere, automatic updates, and lower upfront costs. Great if you want affordable POS solutions for small shops.

On-premise POS: Traditional systems installed locally on your business hardware. They provide more control over your data but require a better initial investment and regular maintenance.

Mobile POS (mPOS): Running on smartphones or tablets, mobile POS systems are perfect for businesses that need mobility—think food trucks, pop-up shops, or small retailers. They’re affordable and user-friendly, making them popular for startups and growing businesses.

Understanding the type of POS system that fits your small business will help you choose hardware and software tailored to your industry, whether you operate in retail, food service, or service-based sectors.

To explore different small business POS hardware options suited to your unique needs, check out cash registers for small business and discover reliable, affordable solutions.

This foundational knowledge of what a POS system is will help you move confidently toward finding the right setup that benefits your small business now and into the future.

How POS Systems Benefit Small Businesses

A POS system offers several advantages that can seriously boost how a small business runs day-to-day. Here’s how modern POS systems go beyond just handling sales—they become essential tools for growth and efficiency.

Streamlining Sales Transactions and Reducing Errors

One of the biggest wins for any small business is speeding up sales checkout without sacrificing accuracy. Unlike traditional cash registers, a POS system automates price calculations, applies discounts, and processes sales quickly, which cuts down on human errors like wrong pricing or missed item scans. This means fewer headaches during busy hours and happier customers who don’t have to wait in long lines.

Real-time Inventory Tracking and Management

Managing stock is a constant challenge for small retailers. A POS system tracks your inventory in real time, so you always know what’s in stock, what’s running low, and what needs to be reordered. This feature avoids overselling and helps maintain a healthy stock level. Especially for small shops, this control reduces loss and ties up less cash in excess inventory.

Generating Sales Reports and Analytics for Better Decision-Making

Good decisions rely on good data. POS software gives you detailed sales reports and analytics showing which products are top sellers, peak sales times, and customer buying patterns. These insights help small business owners make smarter decisions—like adjusting promotions, stocking the right products, or even changing store hours based on demand.

Enhancing Customer Experience and Loyalty Programs

Customer retention is key to long-term success. Modern POS systems often come with built-in tools to manage loyalty programs, personalized promotions, and customer profiles, helping you connect better with your shoppers. This can increase repeat visits and build a loyal customer base, which is crucial for small local businesses competing with bigger retailers.

Facilitating Multiple Payment Options

People want flexibility with payments. A good POS system supports credit cards, debit cards, mobile wallets, and contactless payments, making it easier for your customers to pay how they want. Accepting a variety of payment methods can lead to increased sales and improved customer satisfaction.

By choosing the right POS system, small businesses in the U.S. not only simplify daily operations but also gain powerful tools for growth and customer loyalty. Whether you’re in retail, food service, or any other sector, a modern POS system is a smart investment.

Key Features to Look for in a Small Business POS System

When choosing a POS system for your small business, there are several crucial features to consider to ensure you get the best solution tailored to your needs.

User Friendly Interface and Easy Staff Training

A simple and intuitive interface is essential. It helps your team learn quickly, reduces errors during busy times, and boosts overall efficiency. Look for systems with clear menus and touch-friendly screens to minimize training time.

Hardware Compatibility for Smooth Operations

Your POS should work seamlessly with essential hardware like:

- Touch screens for faster input

- Barcode scanners to speed up product lookup and checkout

- Receipt printers that are reliable and fast

Ensuring hardware compatibility will keep your transactions running without hiccups.

Software Flexibility to Scale with Your Business

Pick a system that can grow with your business. Whether you start as a small retailer or a growing café, your POS should allow you to add new features, handle more inventory, or support multiple locations without needing a complete overhaul.

Security Features for Data Protection and PCI Compliance

Security can’t be an afterthought. Your POS must have data protection measures and comply with PCI standards to safely handle customer payment info and avoid costly breaches. Features like encrypted transactions and regular software updates help keep your business safe.

Integration with Accounting and ERP Software

To save time and cut down manual work, your POS should connect easily with your existing accounting or ERP systems. This integration helps streamline inventory management, sales tracking, and financial reporting, giving you better control over operations.

Local Customer Support and Hardware Warranty

Finally, reliable local customer support is a major plus. When technical issues come up, quick assistance keeps downtime low. Also, choose a POS provider that offers a solid hardware warranty to protect your investment in cash registers, scanners, and printers.

By focusing on these key features, you’ll find a POS system for small business that delivers trustworthy performance even as your needs evolve, helping you run smoother every day.

Choosing the Right POS System for Your Small Business

Picking the best POS system for small business starts with understanding what fits both your budget and your unique needs. Here’s how to make a smart choice:

Evaluate Your Budget and Payment Models

- Upfront costs vs subscription models: Some POS systems require a one-time payment for hardware and software, while others operate on monthly subscriptions.

- Consider which option aligns better with your cash flow. If you want lower initial costs, a cloud-based POS system with subscription fees might work. But if you prefer full ownership and fewer ongoing fees, investing in hardware from a trusted supplier like SDLPOS could be better.

Assess Your Business Type and Needs

- Is your business retail, food service, or service-based?

- Different industries have different POS demands—inventory management for retail, quick checkouts for food service, scheduling for services.

- Choose a system that supports the specific features your business needs to run smoothly and grow.

Choose Reliable Hardware Suppliers Like SDLPOS

- Having reliable POS hardware for small businesses is critical. SDLPOS offers durable cash registers and peripherals designed for local US retailers.

- Their hardware comes with quality warranties and ongoing support, which means less downtime and fewer headaches.

- For small businesses, selecting a hardware supplier you can count on means better compatibility, easier maintenance, and fast repairs when necessary.

Take Advantage of Trial Periods Demos and Reviews

- Before buying, always request a demo or trial period to see how the POS system works day-to-day.

- Hands-on experience can reveal whether the interface is user-friendly and if it fits your workflow.

- Also, check customer reviews from businesses similar to yours. Real feedback highlights potential roadblocks and benefits you might not have considered.

By keeping these points in mind—budget, business needs, trusted hardware suppliers like SDLPOS, and testing options—you’ll be well on your way to selecting a POS system that supports your small business now and in the future.

Setting Up Your POS System A Quick Guide for Small Businesses

Setting up a POS system for your small business might sound tricky, but breaking it down makes it manageable. From getting your hardware in place to training your team and maintaining the system, here’s a straightforward guide to help you start strong and keep things running smoothly.

Basic Hardware Setup Overview

Start by assembling your POS hardware, which typically includes:

- Cash register or terminal – Connect it to power and your network if needed.

- Touchscreen monitors or displays – Position for easy access.

- Barcode scanners – Connect via USB or Bluetooth.

- Receipt printers – Ensure they’re properly installed and stocked with paper.

- Payment terminals – Integrated with your POS for seamless card transactions.

Check all connections and test the equipment before moving on. If you’re using a cash register system or specific hardware like those from SDLPOS, follow the included hardware manuals closely to avoid any setup issues.

Installing and Configuring the POS Software

Next up is software installation, which varies if you’re using a cloud-based or on-premise system:

- Cloud-based systems: Mostly require internet access and user login details. Software updates happen automatically.

- On-premise systems: May need you to download software and update drivers manually.

Make sure to configure tax rates, payment methods, and inventory categories to align with your business needs. Set up user profiles and permission levels to control who can access sensitive information.

Using POS software features for startups helps customize your setup for things like loyalty programs or sales tracking. A clean configuration upfront avoids headaches down the line.

Tips for Effective Staff Training

Your staff’s comfort with the POS system makes a big difference. To get everyone on board quickly:

- Provide hands-on training sessions where employees can practice transactions.

- Create simple step-by-step guides or cheat sheets.

- Encourage questions and offer ongoing support especially during the first few weeks.

- Familiarize your team with common tasks: processing sales, handling returns, and accessing reports.

This approach minimizes errors and speeds up checkout times, boosting customer satisfaction.

Routine Maintenance and Troubleshooting

A POS system needs regular care to perform well:

- Keep hardware clean and dust-free to prevent malfunctions.

- Regularly check for software updates for security and new features.

- Back up your sales and inventory data either in the cloud or on local drives.

- Prepare for troubleshooting common issues like network problems, printer jams, or software freezes by having a clear step-by-step plan.

- Establish a support line or contact your local POS hardware suppliers such as SDLPOS for quick assistance when needed.

Following these maintenance tips reduces downtime and keeps your POS system reliable all year round.

For a dependable start with your POS setup and expert hardware solutions, explore trusted options like the POS cash registers for small business offered by SDLPOS.

Common Challenges Small Businesses Face With POS Systems and How to Overcome Them

Even though POS systems bring a lot of benefits for small business owners, challenges can pop up. Knowing how to handle these issues will save time and keep your operations smooth. Here’s a breakdown of common hurdles and practical solutions.

Handling Technical Glitches and Downtimes

Technical glitches or system downtimes can bring your sales to a halt, causing frustration for both staff and customers. This is a common pain point with POS hardware and software, especially if your system is outdated or not well-supported.

How to minimize impact:

- Choose reliable hardware suppliers like SDLPOS known for robust cash register hardware and quick support.

- Set up a backup system or secondary payment method to use if your POS goes offline.

- Regularly update your POS software to fix bugs and improve performance.

- Train staff on basic troubleshooting steps to reduce reliance on technical support during busy times.

- Consider cloud-based POS systems that offer more stability and automatic updates over traditional on-premise setups.

Data Migration and Backup Best Practices

Switching to a new POS system or upgrading means moving your sales, inventory, and customer data safely—this is where many small businesses hit snags. Loss of critical data can disrupt decision-making and inventory management.

Tips to protect your data:

- Always back up your existing data before migration—consider both local and cloud backups for extra security.

- Work with vendors who offer data migration support as part of the setup.

- Test the new system with a small batch of data before fully switching over.

- Schedule regular automatic backups once your system is live to prevent data loss.

- Secure data with encryption and follow PCI compliance standards to protect customer payment information.

Customer Resistance and Adapting to New Processes

Introducing a new POS system means changes in how your team works and interacts with customers. Resistance from staff or customers who prefer old methods is common.

How to encourage smooth adaptation:

- Offer hands-on training to make staff comfortable with the new POS interface and hardware.

- Communicate the benefits clearly, such as faster checkouts and more payment options, to your employees and customers.

- Use user-friendly POS software that fits your business needs without over-complicating workflows.

- Encourage feedback from your team and customers to identify pain points early.

- Gradually phase in new features rather than switching everything at once whenever possible.

By preparing for these challenges upfront and selecting the right POS system—ideally from trusted suppliers like SDLPOS—you can avoid common pitfalls and ensure your small business gains all the POS system benefits it promises.

Trends in POS Technology for Small Businesses

Small businesses in the U.S. are quickly adopting new POS system technology to keep up with changing customer expectations and improve efficiency. Here are some of the most important trends shaping modern POS solutions:

Mobile POS and Contactless Payments

Mobile POS systems let you process sales anywhere in your store or at events, giving you flexibility traditional cash registers can’t match. With contactless payment options such as Apple Pay, Google Wallet, and contactless credit cards, businesses offer customers faster, safer checkout experiences — something buyers now expect. This trend not only speeds up lines but also supports health-conscious shopping habits.

Integration with eCommerce and Omnichannel Sales

The line between online and in-store shopping keeps blurring. Today’s POS systems connect directly with eCommerce platforms and support omnichannel sales, letting you track inventory and customer data across all your sales channels in real time. This integration simplifies managing orders, returns, and stock whether you sell in-store, online, or both — crucial for small businesses growing beyond a single location.

AI-Powered Analytics and Inventory Forecasting

Advanced POS software now uses AI-powered analytics to give small business owners smart insights into sales trends, customer behavior, and inventory needs. With automated inventory forecasting, you can reduce stockouts and overordering, saving you both money and time. These intelligent tools help you make data-driven decisions to optimize your product mix and boost profits.

Keeping up with these modern POS hardware and software features ensures your business remains competitive and responsive in a fast-changing market. Choosing systems from reliable local POS hardware suppliers like SDLPOS can give you access to cutting-edge solutions tailored to U.S. small business needs.

Why SDLPOS is the Preferred POS Hardware Supplier for Small Businesses

When it comes to cash register hardware and POS systems for small businesses, SDLPOS stands out as a trusted supplier that understands local business needs across the United States. Here’s why many small retailers and service providers choose SDLPOS as their go-to source for reliable hardware and complete support.

Comprehensive POS Hardware and Solutions

SDLPOS offers a wide range of high-quality POS hardware solutions tailored to fit small business operations, including:

- Affordable cash register systems ideal for retail shops, food service, and other service-based businesses

- Modern POS hardware like touchscreen terminals, barcode scanners, and receipt printers

- Cloud-based and on-premise POS equipment to match your business preferences

- Integrated payment systems that support multiple payment options securely and smoothly

By providing flexible hardware bundles, SDLPOS helps small businesses get the best POS equipment for their budget without compromising functionality or scalability.

Localized Customer Support and Installation

One significant advantage of working with SDLPOS is the localized customer service and installation support. This means:

- Quick response times tailored to your business location

- On-site installation and setup assistance from technicians

- Support for hardware and software troubleshooting without long wait times

- Training resources that help your staff get comfortable fast

This local focus ensures you aren’t just buying hardware—you’re getting a partner committed to keeping your POS system running smoothly day to day.

Commitment to Quality Reliability and Post-Sale Assistance

SDLPOS understands small businesses cannot afford costly downtime. That’s why they prioritize:

- Durable POS hardware built to last through busy retail or service environments

- Comprehensive hardware warranties that cover repairs or replacements

- Ongoing post-sale assistance including upgrades and hardware maintenance

- Transparent and fair pricing without hidden costs

This commitment means fewer interruptions to your sales, smooth inventory management, and confident customer experiences—everything a small business needs to thrive in today’s competitive market.

To sum up, SDLPOS combines affordable, scalable POS hardware, localized expert support, and strong reliability. For small business owners in the U.S. looking for a trusted POS hardware supplier, SDLPOS delivers solutions designed to meet both present needs and future growth—all backed by solid customer care every step of the way.