Contactless Payment Terminals with NFC and EMV Security for Business

Are you searching for the perfect contactless payment terminal to boost your business in 2025? Choosing the right POS solution can transform your customer experience, streamline transactions, and drive sales.

As a business owner, I understand the challenge of finding secure, fast, and reliable payment hardware that fits your unique needs. That’s why I’ve crafted this guide based on real-world insights to help you navigate the world of contactless POS systems.

From NFC payment terminals to seamless integration with mobile wallets, you’ll discover how SDLPOS delivers cutting-edge solutions tailored for retail, hospitality, and more. Ready to future-proof your business? Let’s get started!

Introduction to Contactless Payment Terminals and Their Role in Modern Retail

If you’re wondering what a contactless payment terminal is and why it matters for your business, you’re not alone. In today’s fast-paced world, customers expect quick, safe, and convenient ways to pay. Contactless payment terminals are devices that allow shoppers to pay by simply tapping their card, smartphone, or wearable device, eliminating the need for cash or swiping cards.

These terminals use NFC (Near Field Communication) technology, enabling fast mobile wallet payments and tap to pay technology. They support a range of digital payment options including Apple Pay, Google Wallet, and EMV-certified contactless cards, creating a seamless checkout experience.

Why Contactless Payment Terminals Are Important

- Speed up transactions: No more waiting to swipe cards or enter PINs.

- Enhance security: Encrypted wireless payment solutions reduce fraud risk.

- Improve customer satisfaction: A smooth checkout means happier customers.

- Support multiple payment methods: Perfect compatibility with smartphone wallets and other secure transaction devices.

SDLPOS Role in Contactless Payment Solutions

SDLPOS stands out as a leader in providing smart payment terminals designed specifically for U.S. businesses. Their contactless POS systems integrate seamlessly with retail POS setups, ensuring ease of use and reliability. SDLPOS offers:

- Customizable digital payment hardware tailored to your business needs.

- Robust security features to protect sensitive payment info.

- Comprehensive support for local payment systems and mobile wallet payments.

Choosing SDLPOS means investing in a future-ready payment solution that balances efficiency and security, helping your business stay competitive in the growing market of wireless payment solutions.

If you’re ready to simplify transactions and boost sales with cutting-edge contactless payment terminals, SDLPOS has the tools and expertise to make it happen.

How Contactless Payment Terminals Work

Contactless payment terminals, including SDLPOS systems, rely on Near Field Communication (NFC) technology to process transactions quickly and securely. When a customer taps their card, smartphone, or wearable device near the terminal, the device sends encrypted payment information wirelessly to the terminal. This Tap to Pay technology enables fast, smooth payments without swiping or inserting cards.

Technology Behind Contactless Payments

At the core is NFC, a short-range wireless technology that allows devices to communicate within a few centimeters. This makes transactions both quick and secure, reducing exposure to fraud. Most contactless terminals, including SDLPOS models, are EMV-certified POS devices, which means they meet strict security standards required by card networks.

Integration With Mobile Devices

Modern contactless payment terminals easily connect with smartphones and tablets, turning them into powerful smart payment terminals. This integration supports mobile wallet payments like Apple Pay, Google Pay, and Samsung Pay, letting customers pay with just a tap of their phone or smartwatch. The seamless setup helps businesses accept payments on the go or at fixed counters without hassle.

Compatibility With Digital Wallets and Local Payment Systems

A major advantage of SDLPOS contactless POS systems is their broad compatibility. They don’t just work with major digital wallets but also support local payment methods popular in U.S. markets, such as wireless payment solutions optimized for regional banks and services. This flexibility ensures you can serve a wide range of customers who prefer different payment options.

In short, contactless payment terminals mix secure wireless tech, easy device integration, and wide payment support—making checkout smooth for both businesses and customers alike.

Benefits of Contactless Payment Terminals for Businesses

Contactless payment terminals, like the SDLPOS contactless POS system, bring clear advantages for businesses across the US. Using NFC payment terminals and tap to pay technology improves how you handle transactions by making payments faster, safer, and more convenient. Here’s how these smart payment terminals benefit your business:

Speed and Efficiency

- Faster checkout times: With contactless payments, customers just tap their card or mobile wallet—no swiping or inserting cards, no PINs for small amounts. This speeds up every transaction.

- Reduced queues: Quick payments mean shorter lines and less wait time, improving overall customer flow, especially during busy hours.

- Streamlined retail POS integration ensures your checkout system handles contactless transactions smoothly, saving staff time.

Security You Can Trust

- EMV-certified POS technology in contactless terminals encrypts payment data, reducing fraud risk.

- Wireless payment solutions use tokenization, meaning sensitive card data is never directly shared with your system.

- These secure transaction devices comply with industry standards, giving your customers peace of mind and protecting your business from liability.

Better Customer Satisfaction

- Customers in the US are increasingly using mobile wallet payments like Apple Pay, Google Pay, and Samsung Pay. Supporting these means meeting customers where they are.

- Contactless payments offer a frictionless, convenient experience customers expect today.

- Enhanced speed and security combined with familiar tap to pay options create a more positive checkout experience, boosting repeat business and customer loyalty.

Versatility for Any Business

- Contactless payment terminals work for all customer types—cards, smartphones, wearables, and other smart payment devices.

- Compatible across various payment networks and local payment systems common in the US, these terminals give your business flexibility.

- Whether you’re a small retail shop or a busy restaurant, the robust functionality adapts to your needs.

In , investing in contactless payment terminals like those from SDLPOS offers businesses a combination of speed, security, customer satisfaction, and versatility—all key to staying competitive in today’s fast-moving US market.

Why Choose SDLPOS Contactless Payment Terminals

When it comes to contactless payment terminals, SDLPOS stands out by offering reliable, secure, and flexible solutions tailored to the needs of U.S. businesses. Whether you run a busy retail store, a quick-service restaurant, or a local service business, SDLPOS has smart payment terminals designed to fit your workflow and customer preferences.

Key Features of SDLPOS Contactless Payment Terminals

- EMV-certified POS hardware: Every SDLPOS terminal meets industry security standards, ensuring safe transactions and peace of mind.

- NFC payment terminal capability: Supports Tap to Pay technology so customers can use credit cards, debit cards, or mobile wallet payments like Apple Pay, Google Wallet, and Samsung Pay.

- Seamless retail POS integration: SDLPOS devices easily link with existing software platforms making checkout smooth and efficient.

- Wireless payment solutions: Operating on fast, secure wireless networks, eliminating messy cables and speeding up counter space.

- Versatile compatibility: Works with popular digital wallets and local payment systems, accommodating the diverse preferences of U.S. shoppers.

Customization Options Tailored to Your Business

One size doesn’t fit all in payment solutions, and SDLPOS knows that. Their contactless POS systems come with flexible customization options:

- Customize the interface for a faster checkout experience.

- Add loyalty programs or discounts directly through the terminal.

- Choose from different sizes and designs to match your business environment.

- Opt for multi-function terminals that combine contactless payments with barcode scanning or receipt printing.

This level of customization helps businesses improve efficiency without sacrificing customer convenience.

Real-World Success With SDLPOS Contactless Terminals

Take the example of a mid-sized retail chain in Texas that switched to SDLPOS smart payment terminals. After implementation:

- Transaction speed increased by 30%, reducing wait times during busy hours.

- Customer satisfaction scores went up due to faster, contactless checkouts.

- The risk of payment fraud dropped thanks to secure EMV certification and encrypted wireless payments.

This case highlights how SDLPOS terminals not only improve operations but also build customer trust—a crucial competitive edge.

Competitive Edge of SDLPOS Terminals

Compared to other contactless payment terminal providers, SDLPOS offers:

- Local U.S.-based support for quick problem resolution.

- A focus on user-friendly design, reducing staff training time.

- Affordable pricing without compromising quality or security.

- Continuous updates to keep up with the latest payment technologies and compliance standards.

Choosing SDLPOS means you’re investing in a partner that understands the U.S. retail and service landscape, ensuring your payment system works seamlessly day in and day out.

How to Implement Contactless Payment Terminals in Your Business

Introducing a contactless payment terminal to your business can boost efficiency and customer satisfaction. Here’s a simple step-by-step guide to get you started, with a focus on integrating SDLPOS solutions that align well with U.S. retail and service environments.

Step by Step Guide to Installing Contactless POS Systems

Assess Your Business Needs

Start by understanding the types of payments you want to accept — NFC payment terminals support tap to pay technology, mobile wallet payments (Apple Pay, Google Wallet), and EMV chip cards. Think about your transaction volume and device placement (counter, mobile, or kiosk).

Choose the Right SDLPOS Hardware

Select from SDLPOS’s range of EMV-certified POS options and wireless payment solutions designed for secure transaction devices. Their smart payment terminals work well with retail POS integration, making setup straightforward and reliable.

Prepare Your Network and Software

Make sure your internet connection is stable and secure to handle wireless payments. Integrate the terminal with your existing digital payment hardware and point of sale software for seamless operation.

Install and Configure the Device

Follow SDLPOS’s clear installation instructions or use their professional setup support. Configure settings such as transaction limits, languages, and local tax settings to ensure compliance with U.S. standards.

Train Your Staff

Ensure your team knows how to process contactless payments safely and efficiently, including handling issues like failed transactions or customer questions about digital wallets and tap to pay options.

Local Considerations for U.S. Businesses

Compliance and Security

U.S. businesses must follow EMV compliance and PCI DSS standards to protect cardholder data. SDLPOS devices are designed with these standards in mind, offering secure transaction devices that minimize fraud risk.

Support for Local Payment Systems

Consider payment preferences common in your area. SDLPOS terminals support popular U.S. credit and debit cards, as well as emerging mobile wallet solutions to keep your business versatile.

Customer Demographics

Tailor the payment options to your customers. For example, urban areas may see higher mobile wallet adoption, so a strong NFC payment terminal is key.

SDLPOS Support Throughout the Process

Technical Assistance

SDLPOS provides helpful resources and responsive customer support for installation, troubleshooting, and upgrades.

Customization Options

You can customize your contactless POS system for your business size, industry, and transaction types with SDLPOS’s flexible hardware and software options.

Ongoing Updates

SDLPOS stays current with new payment technologies and compliance updates, making sure your terminal is always up to date.

Implementing a contactless payment terminal from SDLPOS involves:

- Evaluating your business needs

- Selecting the right hardware

- Preparing your network and software

- Installing and configuring devices

- Training your staff

By keeping local U.S. payment preferences and security standards in mind, and leveraging SDLPOS’s strong support, you’ll provide a smooth, secure, and modern payment experience for your customers.

Comparing Top Contactless Payment Terminal Providers Contactless POS systems and SDLPOS

When it comes to picking a contactless payment terminal, finding the right fit for your business is key. Many options are out there, but understanding what sets SDLPOS apart from other providers helps you make an informed choice.

SDLPOS vs Competitors in Contactless Payment Terminals

Advanced Tap to Pay technology

SDLPOS terminals offer seamless NFC payment terminal features that work instantly with mobile wallet payments like Apple Pay, Google Pay, and Samsung Pay. The speed of transactions often beats competitor devices, reducing wait times.

EMV-certified and highly secure transaction devices

Security isn’t just a checkbox with SDLPOS. Their devices are EMV-certified, supporting encrypted wireless payment solutions to keep every transaction safe from fraud, a must-have in today’s market.

Superior retail POS integration

SDLPOS systems easily integrate with existing retail software, cutting down on setup headaches. Many competitors require complicated configurations or lack compatibility, but SDLPOS is designed for hassle-free integration with smart payment terminals already popular in the U.S.

Customization options

Unlike some one-size-fits-all digital payment hardware, SDLPOS offers tailored solutions. From custom branding on devices to specific software features, you can match the terminal exactly to what your business needs.

Competitive pricing with quality support

SDLPOS balances quality and cost effectively. You get premium wireless payment solutions without the premium price tag. Plus, their U.S.-based customer support team understands local business needs, unlike some competitors relying on international call centers.

Unique Selling Points of SDLPOS

Speed and reliability in real-world settings

Their contactless POS system is built for the fast pace of U.S. retail and food service, where speed is critical to customer satisfaction.

Comprehensive local support

SDLPOS offers on-the-ground support and quick response times, important for businesses navigating regulatory and technological landscapes in different states.

Flexible deployment

Whether you run a small store or a multi-location chain, SDLPOS provides scalable options. Their terminals work across various wireless payment solutions and are future-ready for emerging payment trends.

Final Thoughts

Choosing between SDLPOS and other contactless payment terminal providers comes down to trust, ease of use, and customization. If you want a secure transaction device that fits smoothly into your U.S.-based business and offers industry-leading support, SDLPOS stands out as a top pick. Other providers may offer competitive pricing or niche features, but SDLPOS combines speed, security, integration, and local expertise all in one package.

Future Trends in Contactless Payment Technology and SDLPOS Commitment

Contactless payment terminals are evolving fast, and the future looks bright for businesses ready to embrace the latest tech. Here’s what you can expect in the coming years, especially with leaders like SDLPOS driving innovation in the U.S. market.

Growth of Contactless Payment Systems

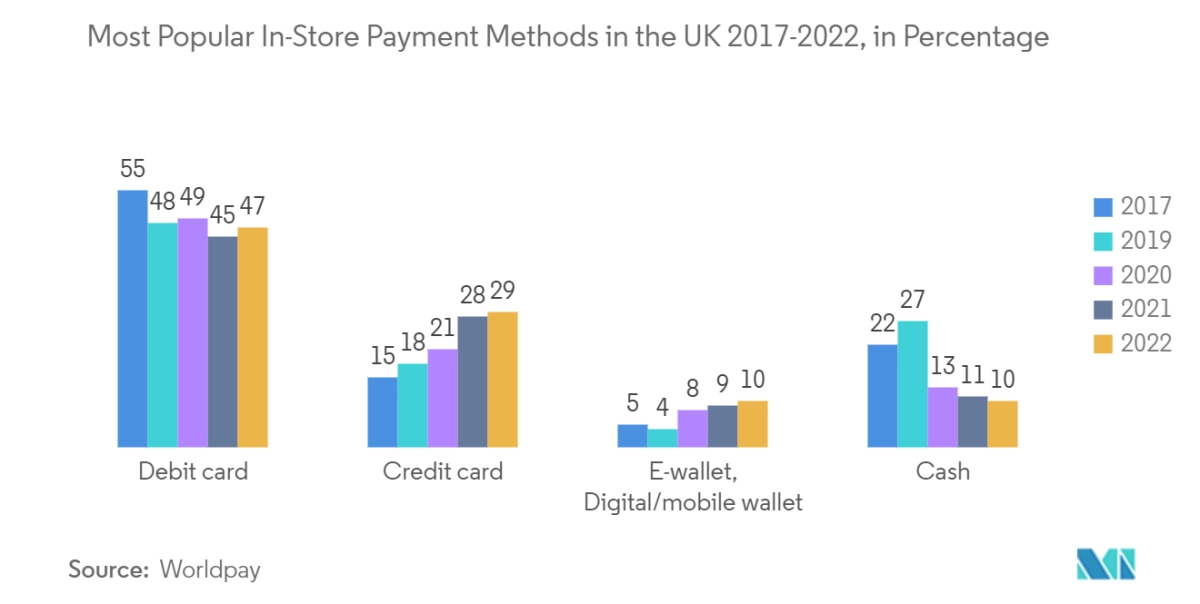

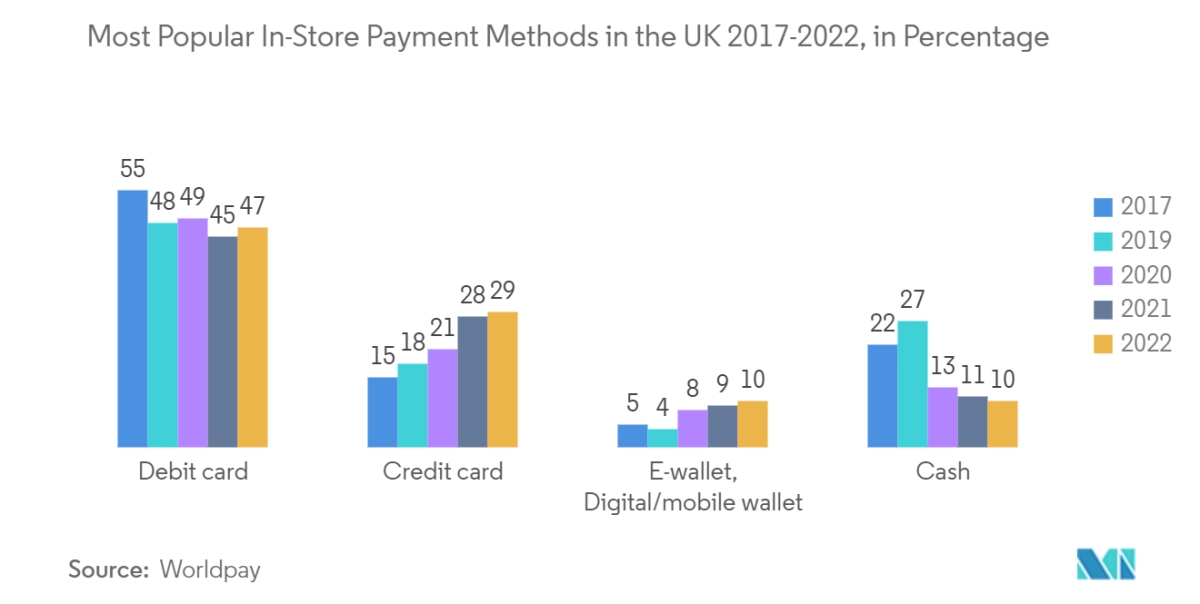

- More widespread adoption: Contactless POS systems are becoming the norm across retail, food service, and service industries. Consumers in the U.S. prefer fast, secure tap to pay technology, making NFC payment terminals essential for almost every business.

- Increased Transactions: With mobile wallet payments on the rise—from Apple Pay to Google Wallet—contactless payments now make up a significant portion of all in-store transactions.

- Expansion to new sectors: Beyond traditional retail, expect industries like healthcare, transportation, and hospitality to rely heavily on smart payment terminals for smooth customer experiences.

Innovations Shaping the Next Generation of Payment Terminals

- Enhanced security features: EMV-certified POS devices are evolving with better encryption and biometric authentication to prevent fraud and maintain secure transactions.

- Wireless payment solutions with faster connectivity: New terminals will use 5G and advanced Wi-Fi to cut down processing times and improve reliability, ensuring no delays at checkout.

- Seamless integration: Future contactless payment terminals will work smoothly with retail POS integration systems, inventory management, and even CRM tools to offer a full business solution.

- AI and smart analytics: Expect terminals to help businesses by providing sales insights, customer trends, and fraud detection, right from the payment device.

SDLPOS Role and Commitment to Advancing Contactless Payments

- Continuous innovation: SDLPOS is committed to upgrading their digital payment hardware regularly, keeping pace with emerging standards and consumer expectations.

- Customization for U.S. businesses: They tailor their NFC payment terminals and contactless POS systems to fit local compliance rules, business types, and payment preferences.

- Reliable support and upgrades: SDLPOS ensures every partner receives ongoing software updates, secure transaction devices, and training, so businesses never fall behind in technology.

- Pioneer in sustainability: SDLPOS is moving toward eco-friendly smart payment terminals, helping businesses reduce environmental impact while modernizing payment options.

What This Means for Your Business

Choosing SDLPOS contactless payment terminals means your business will be future-ready with:

- Faster, secure tap to pay experiences customers expect

- Smooth wireless payment solutions that keep up with new tech

- Access to cutting-edge digital payment hardware backed by local expertise

- A partner invested in innovation and your long-term growth

Staying ahead with SDLPOS means more than just a payment method—it’s a smart business move for tomorrow’s marketplace.

3 thoughts on “Contactless Payment Terminals with NFC and EMV Security for Business”