Mejores terminales de tarjeta de crédito 2025 Soluciones de pago seguras y rápidas

¿Estás buscando el el mejor terminal de tarjeta de crédito para optimizar los pagos de tu negocio? Elegir el adecuado procesamiento de pagos solución puede transformar la forma en que atiendes a los clientes e impulsar tus resultados. Como dueño de un negocio, entiendo el desafío de encontrar máquinas de tarjetas de crédito confiables y fáciles de usar que se adapten a tus necesidades, ya sea que tengas una tienda minorista bulliciosa o una tienda móvil temporal. En SDLPOS, hemos ayudado a innumerables empresas a potenciarse con sistemas POS de vanguardia, diseñadas para el mercado acelerado de 2025. En esta guía, descubrirás los mejores terminales de tarjeta de crédito, características clave como pagos sin contacto y Cumplimiento de la norma EMV, y cómo SDLPOS ofrece un soporte local inigualable. ¿Listo para simplificar las transacciones y mantener contentos a los clientes? ¡Vamos a sumergirnos!

¿Qué es un terminal de tarjeta de crédito y por qué lo necesita tu negocio?

A terminal de tarjeta de crédito es un dispositivo que procesa pagos con tarjeta, lo que permite a tu negocio aceptar tarjetas de crédito y débito de forma rápida y segura. Lee la información de la tarjeta, se comunica con los bancos o las redes de pago y completa la transacción, ya sea que los clientes deslicen, inserten o acerquen sus tarjetas.

En el mundo empresarial actual, aceptar solo efectivo no es suficiente. Los clientes esperan pagos sin contacto, billeteras móviles como Apple Pay o Google Wallet, y experiencias de pago sin problemas. Un terminal de tarjeta de crédito juega un papel crucial al habilitar estas opciones de pago modernas, mejorando tanto la comodidad del cliente y seguridad en pagos.

El uso de un terminal de tarjeta de crédito ofrece claros beneficios:

- Aumentar las ventas al aceptar más métodos de pago y reducir la fricción en el proceso de pago.

- Impulsar la satisfacción del cliente con transacciones rápidas y fáciles.

- Mejorar seguridad con tecnología de chip EMV y cifrado, reduciendo el riesgo de fraude.

Con el auge de pagos sin contacto—que han crecido significativamente en los últimos años—tener un terminal confiable es esencial para seguir siendo competitivo y satisfacer las expectativas de los clientes. En pocas palabras, si tu negocio no está equipado con un terminal de tarjeta de crédito, estás perdiendo ventas, conveniencia y confianza.

Características clave a buscar en un terminal de tarjeta de crédito

Elegir el sistema correcto terminal de tarjeta de crédito significa encontrar uno que se adapte a las necesidades de tu negocio y mantenga los pagos fluidos y seguros. Aquí tienes en qué enfocarte:

Soporte de Pago sin Contacto

Asegúrate de que el terminal soporte pagos sin contacto como Apple Pay, Google Wallet y otros métodos basados en NFC. Con más clientes prefiriendo pagar con solo tocar, contar con esta función aumenta la comodidad y acelera el proceso de pago.

Compatibilidad con Integración POS

Tu terminal debe funcionar perfectamente con tu sistema POS de Walmart, especialmente si utilizas hardware de caja registradora SDLPOS. La integración significa menos trabajo manual y un seguimiento de ventas más preciso.

Características de Seguridad

Busca estándares de la industria Cumplimiento de la norma EMV, cifrado fuerte y protección contra fraudes incorporada. Estas funciones ayudan a mantener seguros los datos de los clientes y protegen tu negocio de devoluciones costosas.

Opciones de Portabilidad

Decide si necesitas un terminal de pago móvil o una máquina de sobremesa. Los terminales móviles son ideales para food trucks y tiendas temporales, mientras que los modelos de sobremesa son más adecuados para tiendas minoristas y restaurantes.

Facilidad de Uso

Una interfaz sencilla y una configuración rápida ahorran tiempo. Elige terminales diseñados para una operación fácil por parte del personal, para evitar retrasos en horas punta.

Consideraciones de Coste

Comprende la estructura de precios: costos iniciales, tarifas por transacción y cualquier suscripción mensual. Equilibra la inversión inicial con el valor a largo plazo y elige lo que se ajuste a tu presupuesto.

Teniendo en cuenta estas características, podrás escoger una máquina de tarjeta de crédito que se adapte a tu estilo de negocio, apoye tus ventas y mantenga los pagos seguros.

Los mejores terminales de tarjeta de crédito SDLPOS para 2025

Elegir el sistema correcto terminal de tarjeta de crédito pueden marcar una gran diferencia en la fluidez con la que tu negocio acepta pagos. SDLPOS ofrece varias opciones diseñadas para diferentes necesidades comerciales, todas construidas para integrarse fácilmente con sus sistemas de cajas registradoras y ofrecer una fiabilidad y seguridad procesamiento de pagos.

Terminal MobilePay SDLPOS

- Características principales: Diseño portátil, compatible con NFC para pagos sin contacto como Apple Pay y Google Wallet, conectividad Bluetooth para un emparejamiento fácil.

- Mejor para: Camiones de comida, tiendas emergentes y otros negocios móviles que necesitan flexibilidad.

- Beneficios: Ligero e inalámbrico, para que puedas aceptar pagos en cualquier lugar, además de velocidades de procesamiento rápidas para mantener las filas en movimiento.

- Rango de precios: $300 – $450, con tarifas de transacción asequibles y sin cargos ocultos.

Terminal RetailPro SDLPOS

- Características principales: Configuración en mostrador, procesamiento de tarjetas de alta velocidad, soporte para múltiples tarjetas incluyendo chip, deslizamiento y sin contacto.

- Mejor para: Tiendas minoristas, restaurantes y negocios con una zona de caja fija.

- Beneficios: Sin interrupciones integración con cajas registradoras SDLPOS, seguridad robusta con Cumplimiento de la norma EMV, y diseñada para un alto volumen de transacciones.

- Rango de precios: $400 – $600, ideal para negocios que manejan pagos diarios constantes.

Terminal Todo-en-Uno TP1T

- Características principales: Combina procesamiento de tarjetas de crédito, gestión de inventario y análisis de ventas en un solo dispositivo.

- Mejor para: Negocios en crecimiento que desean una solución todo en uno para el checkout y operaciones backend.

- Beneficios: Funciones escalables que crecen con tu negocio, insights de datos en tiempo real y integración profunda con POS para una gestión simplificada.

- Rango de precios: $700 – $1,000, a smart investment for businesses planning long-term expansion.

Comparación de Terminales de Tarjetas de Crédito SDLPOS

| Característica | Terminal MobilePay | Terminal RetailPro | Terminal todo en uno |

|---|---|---|---|

| Tipo | Portátil / Móvil | Encimera | Encimera / Integrado |

| Pagos sin contacto | Sí (NFC) | Sí | Sí |

| Integración POS | Compatible con SDLPOS | Integración completa con SDLPOS | Integración completa con SDLPOS |

| Mejor para | Negocios móviles | Tiendas minoristas/restaurantes | Negocios en crecimiento |

| Gestión de Inventario | No | No | Sí |

| Análisis | No | No | Sí |

| Rango de precios | $300 – $450 | $400 – $600 | $700 – $1,000 |

Cada terminal SDLPOS ofrece soluciones seguras y fáciles de usar adaptadas a cómo y dónde haces negocios. Ya sea que dirijas un camión de comida o amplíes una tienda minorista, SDLPOS tiene una máquina de tarjeta de crédito diseñada para satisfacer tus necesidades.

Cómo elegir el terminal de tarjeta de crédito adecuado para tu negocio

Elegir el adecuado terminal de tarjeta de crédito es esencial para mantener los pagos fluidos y a tus clientes satisfechos. Aquí te mostramos cómo tomar una decisión inteligente basada en las necesidades y presupuesto de tu negocio.

Evalúa el tipo de negocio y las necesidades de pago

- Minorista, móvil o comercio electrónico: Si tienes una tienda física, un terminal de encimera puede ser lo mejor. Para camiones de comida o vendedores en mercados, los terminales portátiles o móviles tienen más sentido. Los negocios de comercio electrónico suelen necesitar soluciones de pago en línea integradas.

- Volumen de transacciones: Estima cuántos pagos procesas diariamente. Los volúmenes altos de transacciones requieren procesamiento más rápido y una disponibilidad confiable para evitar retrasos.

- Preferencias de los clientes: Más clientes esperan pagar mediante opciones sin contacto como Apple Pay o Google Wallet. Asegúrate de que tu terminal soporte NFC y pagos móviles.

Verifica la compatibilidad con tu sistema POS

- Integración sin fisuras integración con tu sistema POS actual evita doble entrada y acelera el proceso de pago.

- Si utilizas cajas registradoras SDLPOS, elegir terminales de tarjeta de crédito SDLPOS garantiza compatibilidad total y una configuración sencilla.

- Busca terminales que sincronicen automáticamente las ventas, el inventario y los datos de pago.

Planifica tu presupuesto de manera inteligente

- El coste inicial del terminal frente a las tarifas recurrentes como tarifas de transacción o suscripciones mensuales pueden afectar tus resultados finales.

- A veces, pagar un poco más por adelantado ahorra dinero a largo plazo con menores costes de transacción.

- Incluye también accesorios, costes de instalación o soporte.

Considera la disponibilidad de soporte y servicio local

- Proveedores locales como SDLPOS ofrecen reparaciones rápidas y atención personalizada al cliente.

- Un soporte rápido minimiza el tiempo de inactividad, manteniendo tu negocio en funcionamiento sin problemas.

- Tener un proveedor de confianza cerca facilita las actualizaciones y el acceso a soluciones adaptadas a tu mercado local.

Al centrarte en estos puntos—necesidades del negocio, compatibilidad del TPV, coste y soporte local—encontrarás el terminal de tarjeta de crédito adecuado que crezca con tu negocio y mejore el procesamiento de pagos cada día.

Beneficios de elegir terminales de tarjeta de crédito SDLPOS para tu negocio

Cuando se trata de procesamiento de pagos, los terminales de tarjeta de crédito SDLPOS ofrecen soluciones fiables diseñadas pensando en las necesidades de tu negocio. Aquí tienes por qué elegir SDLPOS puede marcar una verdadera diferencia:

Hardware duradero de alta calidad

Los terminales SDLPOS están construidos para soportar el uso diario sin fallar. Ya gestiones una tienda minorista concurrida o un negocio móvil, estos máquinas de tarjetas de crédito ofrecen un rendimiento constante, minimizando el tiempo de inactividad y manteniendo las transacciones en marcha sin problemas.

Integración sin fisuras con sistemas de caja registradora SDLPOS

Una gran ventaja es la integración nativa con el hardware de caja registradora SDLPOS. Esto significa que tu sistema POS de Walmart y el terminal de tarjeta de crédito trabajan juntos sin esfuerzo, sin necesidad de sincronización manual ni de gestionar múltiples plataformas de pago. Ese nivel de compatibilidad simplifica el seguimiento de ventas y la gestión de inventario.

Soporte local y entrega rápida

SDLPOS entiende lo importante que es contar con soporte rápido y útil cerca de ti. Los negocios en España pueden esperar envío rápido y servicio de atención al cliente receptivo justo en su región. Este enfoque local significa menos retrasos y ayuda real cuando encuentras un problema.

Precios competitivos con tarifas transparentes

Aquí no hay sorpresas ocultas: SDLPOS ofrece estructuras de precios claras que se ajustan a diferentes presupuestos, desde pequeñas startups hasta tiendas establecidas. Sus tarifas de transacción y costos iniciales son claros, ayudándote a planificar gastos sin complicaciones.

Éxito comprobado con negocios locales

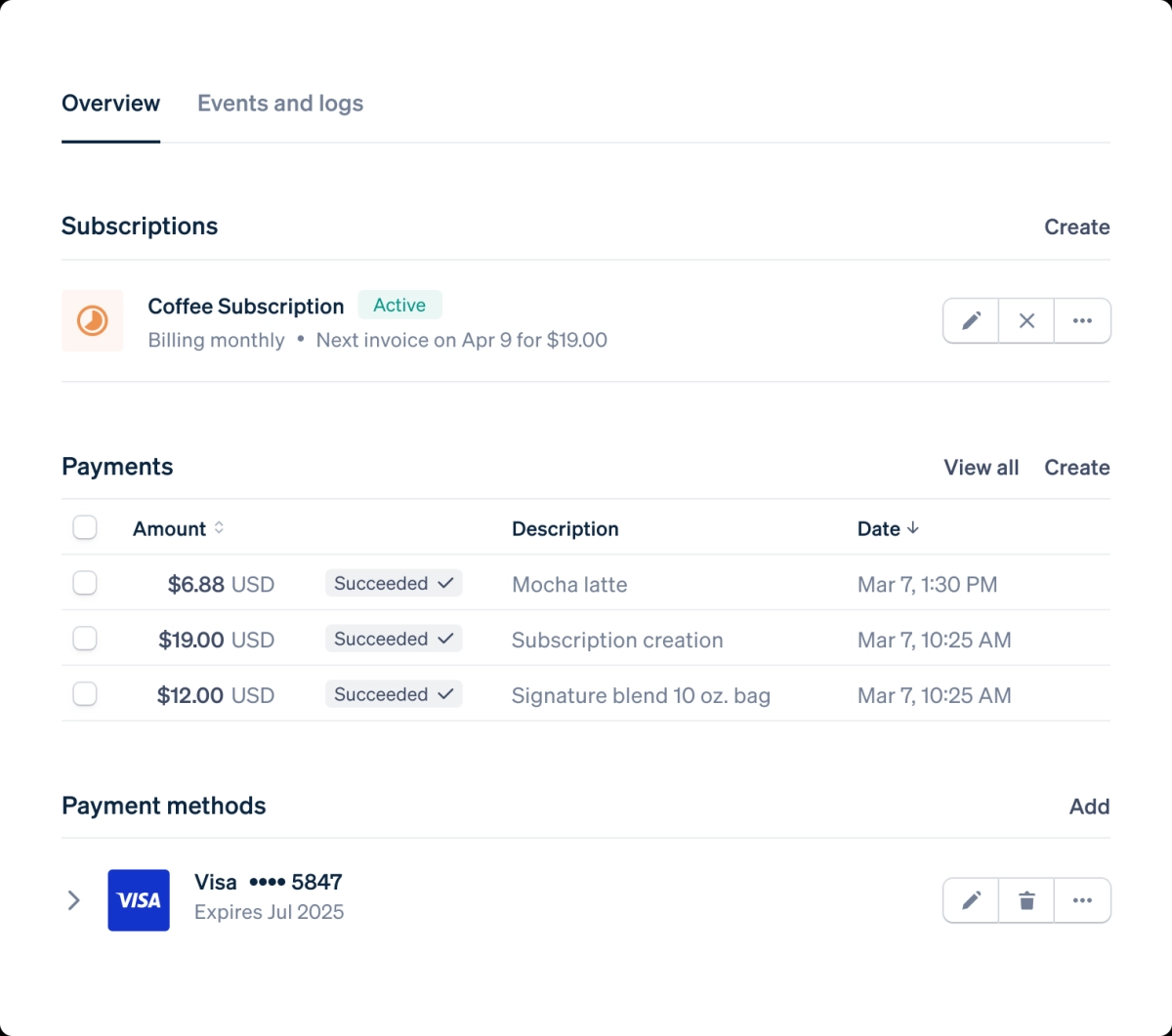

No solo nos lo digas a nosotros. Un café local compartió cómo cambiar a los terminales SDLPOS transformó su proceso de pago:

- Reducción de tiempos de espera en caja con pagos contactless rápidos

- Simplificación de la contabilidad al sincronizar los pagos directamente con su POS

- Aumento de la satisfacción del cliente gracias a transacciones más fluidas y seguras

Este ejemplo del mundo real muestra cómo los terminales de tarjeta de crédito SDLPOS pueden aumentar las ventas y mejorar la comodidad del cliente.

Elegir SDLPOS significa invertir en una solución de pago que sea duradera, integrada, apoyada localmente, con precios competitivos y probada en el mercado español. Es una decisión inteligente para cualquier negocio serio en optimizar pagos y aumentar ventas.

Cómo configurar tu terminal de tarjeta de crédito SDLPOS para un procesamiento de pagos sin problemas

Configurar su Terminal de tarjeta de crédito SDLPOS es sencillo y está diseñado para que su negocio acepte pagos rápidamente. Siga esta guía paso a paso para conectar su dispositivo a su sistema POS y comenzar a procesar transacciones con facilidad.

Paso 1 Desembalar e inspeccionar su terminal

- Desembale cuidadosamente su terminal SDLPOS.

- Verifique que todos los accesorios estén incluidos: cables de carga, adaptadores, manual de usuario.

- Asegúrese de que el dispositivo esté libre de daños visibles antes de la configuración.

Paso 2 Conectar su terminal a su sistema POS

- Para terminales de mostrador, conecte el cable de alimentación a una toma cercana.

- Conecte el terminal a su caja registradora SDLPOS mediante Ethernet o Bluetooth dependiendo del modelo.

- Para terminales de pago móvil, cargue completamente la batería y habilite la conexión inalámbrica (Wi-Fi o Bluetooth) para comunicarse con su sistema POS o smartphone.

Paso 3 Configurar ajustes iniciales

- Encienda su terminal y siga las indicaciones en pantalla para seleccionar idioma, fecha y hora.

- Conecte su terminal a su red (Wi-Fi o Ethernet) para habilitar el procesamiento de pagos.

- Vincule el terminal a su cuenta SDLPOS ingresando el ID del comerciante o escaneando un código QR si se proporciona.

- Sincronice su terminal con su sistema POS para actualizaciones de pagos e inventario sin problemas.

Paso 4 Consejos para integrar con sistemas existentes

- Confirme que su software POS actual soporte la integración con el terminal SDLPOS para evitar fallos.

- Actualice su software POS a la última versión para compatibilidad.

- Realice transacciones de prueba para verificar la comunicación entre el terminal y su caja registradora.

- Capacite al personal en la operación rápida del terminal, incluyendo pagos sin contacto y captura de firma.

Paso 5 Solución de Problemas Comunes

- Problemas de Conectividad: Reinicie su terminal y dispositivo POS. Verifique las conexiones Wi-Fi o Ethernet. Restablezca la configuración de red si es necesario.

- Rechazos de Tarjeta: Verifique la validez de la tarjeta y el estado del lector de chip. Asegúrese de que el firmware de su terminal esté actualizado para manejar los últimos estándares EMV.

- Errores en Transacciones: Confirme que su cuenta de comerciante esté activa y en buen estado con su procesador de pagos.

- Para problemas persistentes, contacte con el soporte de SDLPOS para asistencia rápida y local.

Acceda a Soporte y Recursos de SDLPOS

- Visite el sitio web de SDLPOS para manuales de usuario detallados y videos de configuración.

- Llame o envíe un correo electrónico al servicio de atención al cliente de SDLPOS para ayuda personalizada en su región.

- Utilice el soporte de chat en línea para respuestas rápidas durante la configuración.

Siguiendo estos pasos, su Terminal de tarjeta de crédito SDLPOS funcionará sin problemas, aumentando la seguridad de los pagos, la facilidad de uso y la satisfacción del cliente desde el principio.

Encuentre Terminales de Tarjetas de Crédito SDLPOS cerca de usted

Elegir un proveedor local para su terminal de tarjeta de crédito es clave para obtener soporte más rápido y una entrega más ágil. Cuando compra a proveedores cercanos como SDLPOS, evita largos tiempos de espera y recibe un servicio personalizado adaptado a las necesidades comerciales de su área.

Por qué lo local importa para los terminales de tarjetas de crédito

- Configuración y soporte más rápidos: Los técnicos locales pueden ayudarle a solucionar problemas de inmediato.

- Envío más rápido: Recibe tu terminal sin demoras, para que tu negocio nunca se detenga.

- Soluciones a medida: SDLPOS entiende las tendencias del mercado local y las preferencias de pago de los clientes, ayudándote a escoger el mejor dispositivo para tu tipo de negocio.

- Servicio confiable: Tratas directamente con un proveedor que conoce tu región y entorno empresarial.

Optimizando para búsquedas y servicios locales

Si estás buscando un terminal de tarjeta de crédito en [tu ciudad], SDLPOS está listo para atender a pequeñas empresas, tiendas minoristas, restaurantes y vendedores móviles en toda España. Ellos ofrecen:

- Integración perfecta con sistemas POS locales

- Terminales de pago móvil para ventas en movimiento

- Soporte para pagos sin contacto, perfecto para los clientes de hoy en día, que son rápidos

Comienza con SDLPOS hoy mismo

¿Interesado en hacer los pagos más fáciles y rápidos? Contacta con SDLPOS para una demostración o una cotización en tu área. Su equipo te guiará para escoger el terminal adecuado y ponerlo en marcha. No te conformes con un servicio lento—elige un socio local comprometido a apoyar tu negocio en cada paso.

Preguntas frecuentes sobre los terminales de tarjeta de crédito SDLPOS

¿Qué tipos de pagos pueden procesar los terminales de tarjeta de crédito SDLPOS?

Los terminales de tarjeta de crédito SDLPOS manejan una amplia gama de métodos de pago para adaptarse a las necesidades de tus clientes, incluyendo:

- Tarjetas de crédito y débito con banda magnética o chip (EMV)

- Pagos sin contacto como Apple Pay, Google Wallet y Samsung Pay vía NFC

- Terminales de pago móvil para transacciones en movimiento

- Entrada manual de datos para pedidos por teléfono o correo cuando sea necesario

Esta flexibilidad asegura que su negocio pueda aceptar casi cualquier forma de pago popular, mejorando la comodidad del cliente y acelerando el proceso de pago.

¿Los terminales SDLPOS son compatibles con EMV?

Sí, todos los terminales de tarjeta de crédito SDLPOS lo son totalmente compatibles con EMV, lo que significa que cumplen con los más altos estándares de seguridad de la industria para tarjetas. Las tarjetas con chip EMV reducen el fraude y protegen su negocio de riesgos de tarjetas falsificadas. SDLPOS también utiliza protocolos de cifrado y protección contra fraudes seguros para mantener los pagos seguros.

¿Cómo puedo integrar un terminal SDLPOS con mi sistema POS existente?

Integrar terminales SDLPOS con su sistema POS actual es sencillo:

- La mayoría de los terminales soportan integración directa con sistemas de caja SDLPOS, sincronizando ventas, inventario y datos de transacciones en tiempo real.

- Si utiliza un POS diferente, verifique la compatibilidad—SDLPOS ofrece soluciones diseñadas para funcionar sin problemas o mediante conexiones simples de plug-and-play.

- Guías de configuración detalladas y soporte local le ayudan a poner en marcha rápidamente.

Para más información sobre terminales compatibles, visite el página de terminales POS SDLPOS.

¿Cuáles son los costos asociados con los terminales de tarjeta de crédito SDLPOS?

Los costos pueden variar dependiendo del tipo de terminal y las necesidades de su negocio. Esto es lo que puede esperar:

- Costes iniciales para la gama de hardware por modelo—desde unidades móviles ideales para food trucks hasta sistemas todo en uno para comercio minorista.

- Tarifas de transacción son competitivos y transparentes, a menudo basados en volumen y tipo de tarjeta.

- Opcional modelos de suscripción están disponibles para funciones avanzadas como análisis detallados u opciones de alquiler.

Elegir el terminal adecuado ayuda a equilibrar la inversión inicial y los ahorros a largo plazo.

¿Cómo garantiza SDLPOS la seguridad de las transacciones?

La seguridad es una prioridad principal para SDLPOS. Aseguran la seguridad de las transacciones mediante:

- Tecnología de chip EMV para combatir el fraude con tarjetas falsificadas

- Cifrado de extremo a extremo protegiendo datos sensibles de tarjetas durante el pago

- cumplimiento PCI siguiendo estrictas regulaciones de la industria de pagos

- Monitoreo continuo y actualizaciones para abordar nuevas amenazas

Esto significa que su negocio y sus clientes disfrutan de un procesamiento de pagos seguro y confiable en cada ocasión.

Si desea explorar las soluciones todo en uno de SDLPOS que combinan hardware y software de manera fluida, consulte la Terminal POS Todo en Uno página para más detalles.

Pensamientos sobre “Best Credit Card Terminals 2025 Secure Fast Payment Solutions”