Top Benefits of Using a Cash Register for Efficient Retail Sales

Why Retailers Still Need Cash Registers in 2025 The Modern Context

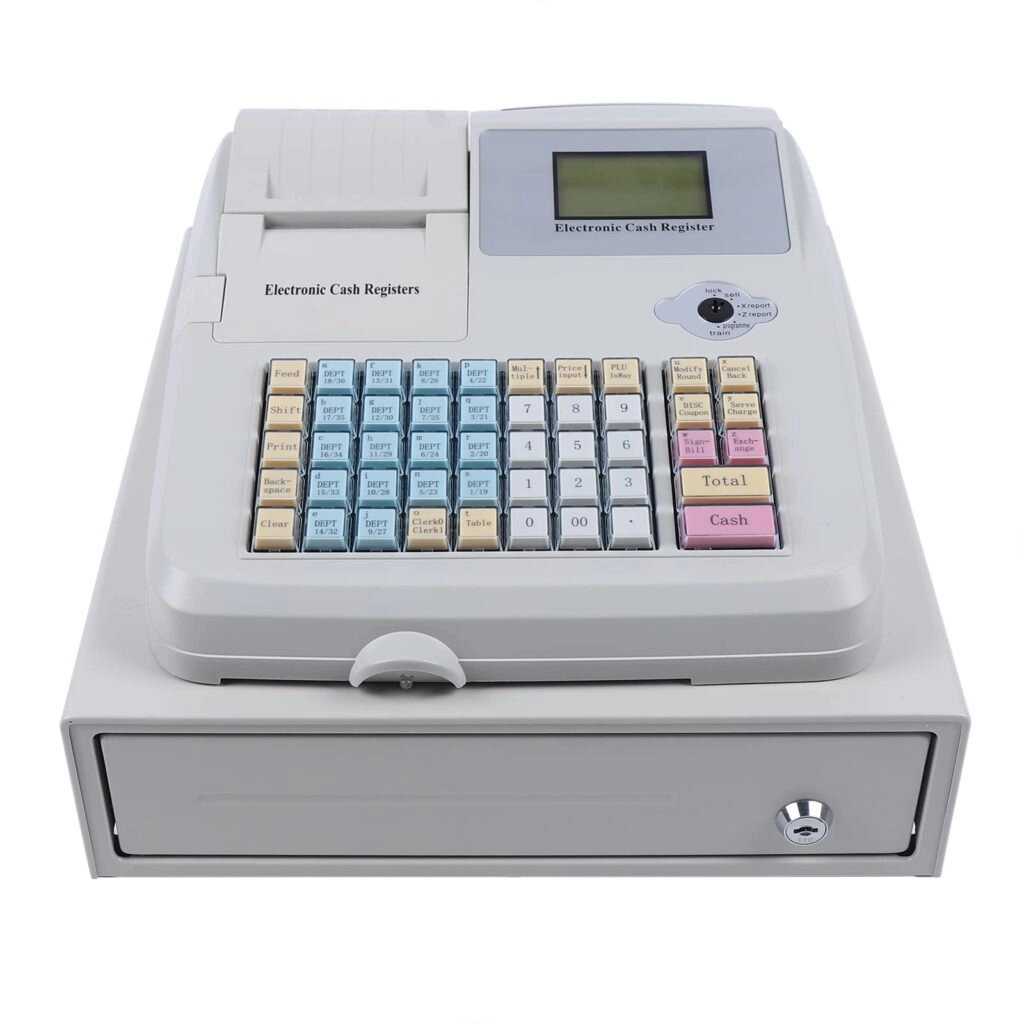

In 2025, cash registers remain essential for retail businesses despite advances in digital payment technologies and evolving point of sale systems for retail. While mobile payments and cloud-based POS solutions are growing, a traditional or electronic cash register still plays a critical role in everyday store operations, especially for small to mid-sized retailers.

Cash registers offer a reliable foundation for managing transactions by combining simplicity with critical features tailored to retail environments. Many retailers find that modern cash registers provide a perfect balance between affordability and functional efficiency, addressing classic pain points like checkout speed and accuracy. This makes them particularly valuable for stores that want to improve retail checkout efficiency without investing in costly full-scale POS systems.

The need for secure and accurate handling of cash transactions remains strong. Cash continues to be an important payment method for many shoppers, and cash registers ensure that these transactions are recorded clearly and linked to receipt printing in retail. This builds trust through transparency and helps maintain regulatory compliance for tax purposes—a crucial aspect as tax authorities in the U.S. increasingly require detailed, audit-ready records.

Shops struggling with employee theft or inventory shrinkage also find that electronic cash register advantages extend to enhanced accountability. With built-in features controlling cash drawer access and recording each sale, retailers can better prevent theft in small stores and manage their operations smoothly.

Ultimately in today’s market, cash registers are not just about taking payments. They are integrated tools that support sales reporting for small businesses, inventory tracking with POS capabilities, and can evolve alongside your business. Many hardware suppliers provide affordable POS systems that blend traditional cash register functions with digital payment options, enabling a seamless transition to hybrid cash digital payment solutions without the need for a full system overhaul.

In short, a cash register is more than a checkout device—it is a reliable, secure, and scalable asset that meets the practical demands of modern U.S. retailers, helping them navigate a complex payment landscape while keeping operations straightforward and efficient.

Core Operational Benefits of Using a Cash Register for Retail

Streamline Transactions and Reduce Checkout Times

One of the biggest reasons retailers still rely on cash registers in 2025 is their ability to streamline transactions and keep checkout lines moving fast. Efficient checkout is a game-changer, especially in small or busy stores where every second counts. A modern cash register designed for retail speeds up the payment process by:

- Quickly scanning or entering items, cutting down the time needed to ring up sales compared to manual methods.

- Automatically calculating totals and taxes, so cashiers don’t have to do the math, which slows things down.

- Easily processing multiple payment types, including cash, credit, and digital wallets, helping customers pay their way without hassle.

- Generating instant receipts, which keeps the line moving and boosts customer satisfaction.

Having a fast, reliable point of sale system for retail is essential to prevent bottlenecks in checkout lanes. Customers notice wait times, and slow checkouts can lead to frustration or lost sales. A well-configured cash register system supports smooth retail checkout efficiency, making sure employees and customers both have a better experience.

Additionally, cash registers often come with user-friendly interfaces, which reduce employee training time and errors at the register. For small and medium retail businesses, this is a huge advantage that translates directly into higher throughput and less downtime.

To support your store’s efficiency, consider reliable receipt printers for cash registers and POS hardware tailored for high-traffic environments—both important parts of creating a checkout process that works well every day. For more on choosing the right hardware, check out POS hardware for high traffic retail stores.

Core Operational Benefits Minimize Human Errors in Calculations with Cash Registers

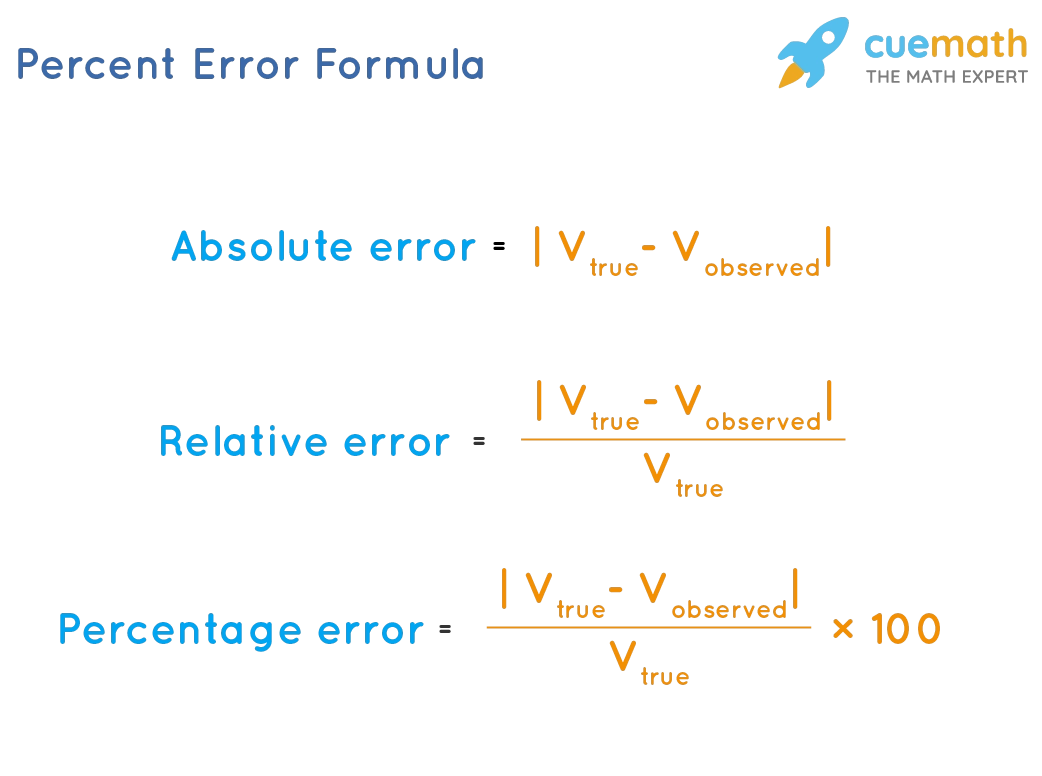

One significant advantage of using a cash register in retail is its ability to minimize human errors in calculations. When checkout processes depend on manual math, mistakes happen—wrong change given, incorrect prices entered, or discounts missed. These errors not only frustrate customers but also hurt the store’s bottom line.

A reliable point of sale system for retail, even a basic electronic cash register, automatically handles calculations with precision. Here’s how:

- Automatic price entry ensures the correct amount is charged every time, reducing mis-keying mistakes.

- Built-in calculators instantly total purchases, add taxes, and apply discounts without manual intervention.

- Receipt printing provides clear, accurate records for customers to check, which helps maintain their trust.

Because cash registers reduce calculation errors, you save time on fixing mistakes and improve checkout efficiency. This is especially important during busy hours when errors can slow down service and create lines.

For local small businesses around the U.S., where staff may be multitasking or less experienced, this reliability is critical. It helps staff focus on customer service rather than constant double-checking of totals, making transactions smoother and more accurate every time.

Core Operational Benefits Generate Accurate Receipts for Customer Trust

One of the biggest benefits of using a cash register in retail is its ability to generate accurate receipts, which plays a crucial role in building customer trust. Accurate receipts do more than just list what was bought—they provide a clear record of each transaction, helping customers feel secure about their purchases.

Here’s why this matters:

Detailed transaction records: Cash registers print receipts with exact item prices, quantities, taxes, and total amounts. This transparency reassures customers that they are charged correctly, minimizing disputes at checkout.

Proof of purchase: Receipts serve as legal proof for returns, exchanges, or warranties. Having a consistent method to print accurate receipts means your customers know they can rely on your store if issues arise.

Boosts professional image: Clean, easy-to-read receipts reflect a well-organized business, enhancing your reputation and encouraging repeat visits.

Supports tax compliance: Properly itemized receipts help both you and your customers stay compliant with tax requirements, avoiding headaches during audits or tax filings. This is one of the electronic cash register advantages retailers can’t overlook.

Enhances sales tracking: Receipts printed through your system can be tied directly to sales reports, making it easier to analyze customer buying patterns and inventory needs through tools like sales reporting for small businesses and inventory tracking with POS.

By ensuring every receipt is accurate and clear, cash registers help create a smoother, more trustworthy shopping experience that keeps customers coming back. This is especially important in the local U.S. market where customer expectations for transparency and professionalism are high.

Prevent Employee Theft and Enhance Accountability with Cash Registers

One of the biggest financial risks for small retailers is employee theft. Using a cash register for retail helps mitigate this issue by keeping money handling transparent and traceable. Modern cash registers and point of sale systems for retail offer features that hold employees accountable for every transaction, making it much harder to skim sales or pocket cash unnoticed.

Here’s how cash registers help prevent theft and improve accountability:

- Track every transaction: Each sale is logged with details like time, item sold, and employee ID. This makes it easier to spot suspicious activities or discrepancies.

- Limit cash drawer access: Only authorized staff can open the cash drawer, and it records every time it’s opened without a sale.

- Audit trails for accountability: Receipts and electronic logs create an audit trail, helping you reconcile daily sales and spot irregularities quickly.

- Help enforce cash handling policies: Employees know their work is monitored, reducing the temptation to steal.

- Integrate with security systems: Many registers connect with surveillance cameras and inventory tracking software, boosting overall loss prevention.

For small stores, preventing employee theft isn’t just about saving money—it’s about building trust within your business. A reliable cash register keeps everyone on the same page and helps maintain a smooth, secure retail environment. When employees understand that sales reporting is accurate and monitored, it encourages honesty and professionalism.

Using an electronic cash register with security features is a smart move to protect your bottom line while improving your store’s operational integrity.

Improve Inventory Tracking and Stock Management with Cash Registers

One of the big financial and security benefits of using a cash register for retail is how it helps improve inventory tracking and stock management. In any small or medium-sized store, knowing exactly what’s in stock and when to reorder can make a huge difference in preventing lost sales and wasted money.

Modern cash registers, especially those with integrated point of sale systems for retail, automate inventory updates every time a sale is made. This means you’re not relying on manual counts or spreadsheets—which can easily lead to errors or outdated info. With real-time inventory tracking, you get:

- Accurate stock levels at a glance, so you always know what’s selling fast and what’s sitting on shelves.

- Alerts to reorder products on time, preventing out-of-stock situations that turn customers away.

- Clear visibility into slow-moving items, helping you plan discounts or promotions to free up shelf space.

Better inventory control also boosts security by highlighting unusual discrepancies that might suggest theft or errors. Plus, many cash register systems sync sales data with back-office reports, so you get easy-to-understand sales reporting for small businesses and better control over your stock.

For local U.S. retailers, using a cash register with inventory management features means less room for human error and more time focused on serving customers, rather than chasing down missing items or chasing receipts to balance stock.

All in all, cash registers offer an affordable, efficient way to keep your inventory tight and your store running smoothly, from daily sales all the way through to tax season compliance.

Ensure Regulatory Compliance and Audit Ready Records with Cash Registers

Using a cash register in retail goes beyond just handling sales—it plays a crucial role in meeting regulatory requirements and keeping your business audit-ready. In the U.S., retailers must follow strict rules around tax reporting and record-keeping. A solid point of sale system or electronic cash register helps ensure your records stay accurate and organized.

Here’s how cash registers support compliance and audits:

- Accurate sales tracking: Cash registers automatically log every sale, including amounts, tax collected, and payment methods. This helps you stay compliant with tax laws like sales tax reporting.

- Detailed receipts: Issuing clear, itemized receipts builds trust with customers and provides a paper trail for returns and tax purposes. Receipt printing in retail ensures you meet local and federal guidelines.

- Audit-ready reports: Most modern cash registers generate daily, weekly, and monthly sales reports. These detailed summaries make it easier to prepare for tax audits or financial reviews without digging through messy paperwork.

- Secure transaction records: By minimizing manual input, cash registers reduce errors and potential discrepancies in your sales logs. This transparency protects you during audits and investigations.

- Tax compliance support: Electronic cash register advantages include built-in tax settings adjusted to your state or city requirements—helping you stay compliant without constant oversight or guesswork.

By having audit-ready records at your fingertips, you cut down on stress and confusion during tax season or any financial inspection. This clear, reliable documentation ensures your retail business stays in good standing with tax authorities and regulators, simplifying compliance in a complex environment.

Growth and Scalability Benefits

Cost Effective Cash Registers for Small Retail Budgets

For small retailers in the U.S., managing costs while maintaining efficiency is critical. Cash registers remain one of the most budget-friendly tools available for handling day-to-day sales without breaking the bank. Compared to advanced point of sale systems for retail, electronic cash registers offer a simpler setup and lower upfront costs, making them an ideal choice for businesses just starting out or operating on tight budgets.

Here’s why cash registers make financial sense for small retailers:

- Lower initial investment: Unlike complex POS systems that require pricey hardware and software subscriptions, cash registers provide all essential functions at a fraction of the cost.

- Minimal maintenance fees: Most cash registers need little to no ongoing maintenance or software updates, saving money over the long term.

- Affordable hardware suppliers: You can find cash register models designed specifically for small business budgets, with options that are built tough and priced competitively.

- Reduced need for extensive employee training: Because cash registers are straightforward to operate, you avoid the training costs associated with sophisticated POS setups.

For those curious about where to find quality and affordable cash register suppliers to fit their budget, check out where to find cash register suppliers in your area.

By choosing a cash register, small retailers can keep costs low while ensuring smooth checkout processes—a perfect balance that supports both daily operations and longer-term growth without expensive upgrades.

This cost-effectiveness is a core reason many small stores continue to prefer cash registers alongside or even instead of hybrid cash digital payment solutions. It’s a choice that protects their bottom line and helps create a strong foundation for scale as sales volumes and customer expectations grow.

Growth and Scalability Benefits

Boost Sales Through Faster Smoother Customer Experiences with Cash Registers for Retail

Faster checkout times mean happier customers and higher sales. When your retail store uses a reliable cash register system, transactions are processed quickly and accurately. This reduces wait times and keeps lines moving, which is a big plus in today’s busy retail environment.

Here’s how a cash register helps boost sales through a smooth customer experience:

- Speedy Transactions: A well-configured cash register streamlines scanning, pricing, and payment processing. This cuts down checkout time and improves overall efficiency at the point of sale.

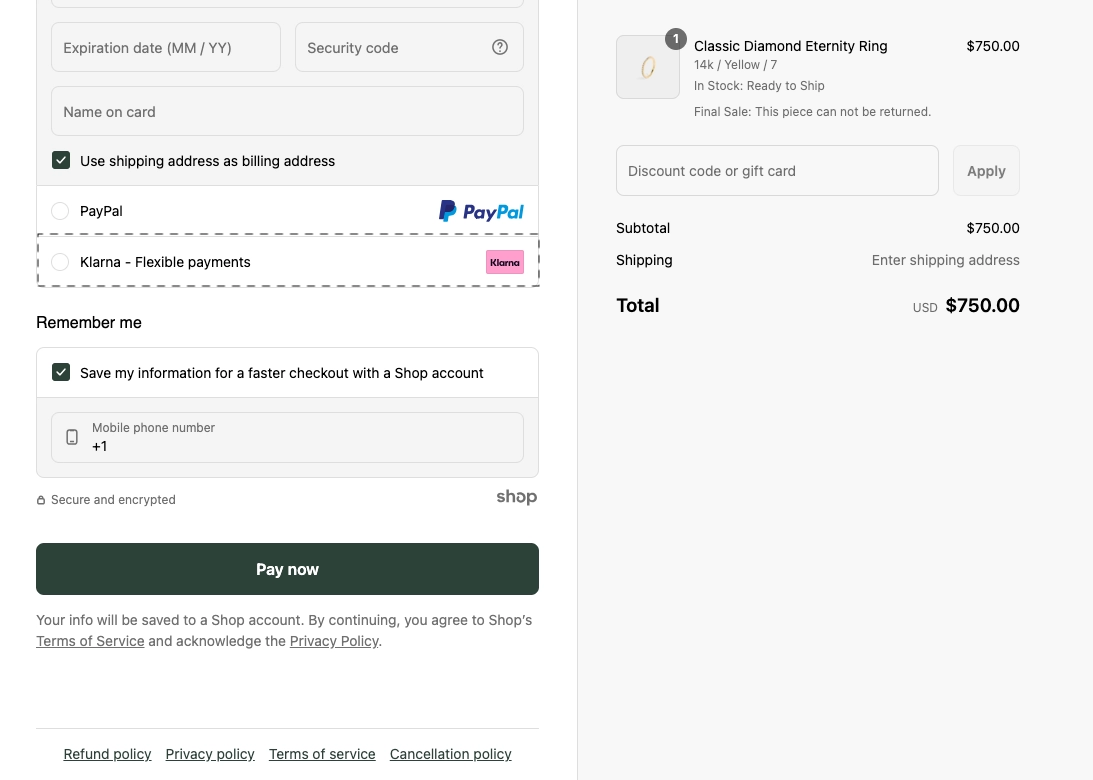

- Multiple Payment Options: Modern cash registers often support hybrid payment solutions, allowing customers to pay with cash, cards, or digital wallets seamlessly. Offering diverse payment methods keeps your sales flowing.

- Clear and Accurate Receipts: Providing fast, accurate receipts builds customer trust and encourages repeat business. Customers appreciate knowing their purchase details are correct without delay.

- Reduced Errors and Miscommunications: Cash registers minimize manual entry errors, which means fewer disputes or hold-ups during checkout — helping keep the buying process smooth and hassle-free.

- Improved Staff Efficiency: When your retail team can rely on a cash register system that’s easy to use and dependable, they can focus more on customer service and upselling rather than troubleshooting payment issues.

A modern cash register enhances the entire checkout flow, helping you turn customer visits into quick sales while improving the overall shopping experience. This is especially important for small and mid-sized retailers looking to compete effectively without investing in expensive POS systems right away.

For retailers preparing to grow, upgrading or switching to a cash register system that supports faster checkouts can be a real game-changer. If you want more insights on scalable solutions that blend cash registers with advanced POS hardware, check out resources like benefits of upgrading to a POS system or cash register hardware trends in 2025.

In short, faster, smoother customer experiences powered by efficient cash registers lead directly to higher sales and happier customers.

Growth and Scalability Benefits

Provide Actionable Sales Data for Informed Decisions with Cash Registers

One of the biggest advantages of using a cash register in retail today is access to actionable sales data. Unlike manual methods, modern cash registers – especially those integrated with point of sale systems for retail – collect detailed sales information automatically. This data helps retailers of all sizes, especially small businesses, make smarter decisions that impact daily operations and long-term growth.

Here’s why actionable sales data from your cash register matters:

- Track Best-Selling Products: Quickly identify which items are moving fastest so you can adjust stock levels and promotions accordingly. This reduces wasted inventory and boosts profitability.

- Analyze Sales Trends: Daily or weekly sales reports reveal patterns like peak hours or seasonal demand, helping you optimize staff schedules and marketing strategies.

- Measure Customer Preferences: Understanding customer buying behavior through sales data assists in tailoring your product mix, improving customer satisfaction and loyalty.

- Monitor Discounts and Returns: Detect unusual return rates or discount usage that might indicate issues or opportunities for better pricing strategies.

- Plan Inventory More Accurately: Integrating sales reports with inventory tracking with POS ensures you reorder just the right amount, minimizing overstock or stockouts.

By leveraging these sales insights, retailers turn raw numbers into clear, actionable reports. This gives a huge edge over relying on guesswork or spreadsheets. And because data is available in real-time or at the end of each day, you can respond quickly to changing market conditions.

If you want to dive deeper into how your cash register system can generate valuable business insights, check out helpful resources like benefits of upgrading retail hardware or how POS hardware supports retail automation.

In , a cash register isn’t just for ringing up sales—it’s a key tool for collecting and analyzing data that leads to informed decisions, helping your retail business scale efficiently and stay competitive.

Easy Scalability to POS Hybrids Without Overhaul

One of the biggest advantages of using a cash register in your retail store today is its future-proof edge. As business needs change, especially with how customers prefer to pay, having a system that scales easily is a game-changer. Many modern cash registers are designed to integrate smoothly with hybrid point of sale systems for retail, meaning you don’t have to scrap your entire setup when you want to add digital payment options or advanced software features.

Here’s why this matters:

Seamless integration with digital tools

You can start with a simple cash register and later connect it to card readers, mobile wallets, or cloud-based inventory systems. This lets you upgrade step-by-step instead of paying for a full POS overhaul.

Cost-effective growth

For small to medium stores watching their budget, this means you invest only when ready, avoiding upfront costs from buying expensive new equipment.

Maintain staff familiarity

Employees won’t have to relearn software from scratch, since your cash register system coordinates with new POS tools, keeping checkout fast and familiar.

Adapt for customer preferences

As customers increasingly expect faster, contactless options, scalable hybrid solutions let you meet these demands without disrupting your daily business.

Protect your data and records

Hybrid systems keep your sales reporting accurate and your books audit-ready, combining receipt printing in retail with digital tracking.

In short, easy scalability means your business stays flexible and ready for the future without sacrificing reliability or breaking the bank. Whether you’re purely cash-based now or want to move toward a hybrid cash digital payment solution, starting with a solid cash register lets you build on a strong foundation.