Ultimate Guide to POS Terminal Devices with Features and Buying Tips

If you’re running a retail store, café, or any business that handles payments daily, you already know how crucial speed and security are at checkout. POS terminal devices have evolved from simple card readers into powerful hubs that handle everything from contactless payments to inventory tracking. Choosing the right POS terminal device not only speeds up transactions but also boosts customer satisfaction and streamlines operations. Ready to discover how modern POS terminals can transform your business? Let’s dive into everything you need to know to pick the perfect device tailored to your needs—with a trusted partner like SDLPOS by your side.

What Are POS Terminal Devices A Core Breakdown

If you’re wondering what exactly POS terminal devices are and why they matter, you’re not alone. These devices are the heart of any retail payment processor setup, handling sales transactions smoothly and securely. Let’s break down their core definition, key components, and how they evolved from simple cash registers to the smart terminals businesses use today.

Core Definition and Key Components of POS Terminal Devices

At its simplest, a POS terminal device is hardware used to process sales transactions. It captures payment information—whether it’s credit, debit, or contactless payment—and communicates that securely with payment networks. The typical components include:

- Processor chipset – the brain that manages transactions and device operations

- Touchscreen display – user interface for input and communication

- Card readers – EMV chip devices and NFC-enabled checkout for contactless payments

- Connectivity ports – USB, Ethernet, or wireless options for integration and communication

- Power supply unit – ensures stable, continuous operation

- Memory and storage – RAM expansion slots and onboard storage for software and transaction data

- Firmware and BIOS – system software enabling device configuration and updates

This combination provides a secure transaction terminal capable of handling multiple payment methods and integrating with back-office systems.

Evolution from Cash Registers to Smart POS Terminals

POS terminal devices have come a long way from traditional cash registers. Early models were mechanical or simple electronic tills that only tracked sales and cash drawer balances. Modern POS terminals are all-in-one enclosures equipped with powerful processors and software integration.

Key changes over time include:

- Shift from cash-only to accepting EMV chip and contactless payments

- Introduction of touchscreen POS machines for better user experience

- Capability to run on various operating systems like Android and Windows

- Integration with mobile POS systems and cloud software, supporting inventory and customer management

- Enhanced security measures, including PCI compliance and encrypted data transmission

These advances not only improve checkout speed but also deliver better analytics and business insights.

Comparison Table Basic vs Advanced POS Terminal Devices

| Features | Basic POS Terminal | Advanced POS Terminal |

|---|---|---|

| Payment Methods | Magnetic stripe only | EMV chip, NFC contactless, mobile wallet |

| User Interface | Physical buttons | Touchscreen with customizable UI |

| Connectivity | Wired Ethernet | WiFi, Bluetooth, 4G LTE options |

| Software Integration | Limited to stand-alone | Full integration with e-commerce, inventory, and CRM |

| Security | Basic encryption | PCI compliant, end-to-end encryption, tokenization |

| Analytics and Reporting | Minimal or none | Real-time sales analytics and cloud syncing |

| Portability | Countertop fixed | Mobile handheld or all-in-one touchscreen |

Whether your business is just starting or growing fast, knowing the gap between basic and advanced devices helps plan better investments.

How SDLPOS Simplifies POS Terminal Device Transitions

Switching from outdated cash registers or basic terminals to modern POS terminal devices can seem daunting. That’s where SDLPOS stands out as a trusted retail payment processor partner. They simplify upgrades by:

- Offering user-friendly devices that support multiple payment types and easy integration

- Providing step-by-step setup guides and quick-start troubleshooting

- Ensuring robust warranty and responsive support to minimize downtime

- Delivering scalable solutions that grow with your business needs, including countertop and mobile options

- Supporting seamless data migration and cloud management to avoid transaction disruption

With SDLPOS’s expertise, businesses transition smoothly to secure, feature-rich POS terminals that improve efficiency and customer satisfaction.

Ready to modernize your checkout experience and handle payments with ease? Explore SDLPOS devices today and discover a hassle-free upgrade path that fits your business perfectly.

Types of POS Terminal Devices Matching Your Business Needs

Choosing the right POS terminal devices is all about matching the hardware to your unique business needs. Let’s break down the main types and what they offer.

Countertop Fixed POS Terminals

These are the classic, stationary devices you’ll find at most retail counters. They usually include a touchscreen or keypad, card readers (often EMV chip devices), and receipt printers.

Pros:

- Stable and reliable for high transaction volumes

- Robust connectivity options with other retail payment processors

- Typically offer stronger security on-site, including PCI compliance

Cons:

- Lack portability—fixed in one spot

- Can take up valuable counter space

- May require more setup and wiring

Mobile Handheld POS Terminals

Mobile POS systems put checkout power right in your employee’s or even customer’s hands. These handheld terminals often come with NFC-enabled checkout features for contactless payments.

Key Features:

- Lightweight and portable for on-the-go sales

- Built-in battery for flexible use

- Wireless connectivity, often via Wi-Fi or cellular data

- Perfect for food trucks, pop-up shops, or busy retail floors where mobility matters

All-in-One Touchscreen POS Systems

These sleek devices integrate payment processing, inventory management, and customer data into one touchscreen machine. They commonly run on Android or Windows operating systems.

Android POS Terminals

- More affordable and customizable

- Access to a wide app ecosystem

- Easy integration with cloud syncing

Windows POS Terminals

- Known for powerful processing and compatibility

- Ideal for businesses needing legacy software support

- Broad peripheral support via USB and Bluetooth

You can find a great selection of these on the touch screen POS terminal page and Windows-based terminals.

Specialized POS Terminal Variants

Beyond traditional models, several specialized types cater to specific business needs:

- Self-Service Kiosks: Allow customers to scan, pay, or place orders independently. Great for fast food and retail environments.

- mPOS: These are compact card readers that plug into smartphones/tablets or connect wirelessly to enable payment anywhere.

- Rugged POS Devices: Built with durable materials to cope with rough environments like warehouses or outdoor markets.

Quick Decision Framework

Ask yourself:

- Do I need mobility or fixed installation?

- What’s my average transaction volume?

- Which payment methods are critical? (EMV chips, NFC, contactless)

- Do I want integrated software features or standalone devices?

Answering these will guide you to the right type of POS terminal device that fits your business model perfectly.

For more details on mobile solutions, check out our wireless POS terminals.

Key Features to Look for in POS Terminal Devices

When choosing POS terminal devices, focusing on the right features ensures your business runs smoothly and stays secure. Here’s what to prioritize:

Payment Flexibility and Security Standards

- Support for multiple payment types: Your POS should handle EMV chip cards, contactless payments (NFC), mobile wallets like Apple Pay and Google Pay, and magstripe cards.

- PCI compliance: This is non-negotiable for secure transactions. Look for devices that meet the latest Payment Card Industry (PCI) standards to minimize fraud risk.

- Encryption and tokenization: Advanced secure transaction terminals protect cardholder data during payment processing.

Integration Capabilities with Software and E-commerce

- Your POS should seamlessly connect with accounting software, inventory management tools, and online sales platforms. This integration capability streamlines operations and reduces manual work.

- Check for compatibility with popular retail payment processors and support for real-time syncing with e-commerce platforms.

Durability Battery Life and User Experience

- If you opt for mobile or handheld POS terminals, long battery life is crucial to prevent downtime during busy hours or events.

- Devices should have rugged designs to withstand daily use, especially in retail or food service environments.

- The user interface should be simple and fast—look for touchscreen POS machines that respond quickly and are easy for staff to navigate.

Advanced Perks Like Cloud Syncing and Analytics

- Modern terminals offer cloud syncing to back up sales data and support remote management across multiple locations.

- Built-in analytics tools help you track sales trends, inventory levels, and customer preferences, giving you important insights without extra software.

Feature Comparison Matrix Including SDLPOS Models

| Feature | Basic POS Devices | Advanced POS Devices | SDLPOS Models |

|---|---|---|---|

| Payment Types | EMV chip, magstripe | EMV chip, NFC, mobile wallets | Full range including contactless |

| Security Compliance | PCI basic | PCI DSS certified, tokenization | Advanced encryption, PCI certified |

| Software Integration | Limited | Full integration options | Extensive with popular platforms |

| Battery Life | Fixed terminals only | 8+ hours on handhelds | Long-lasting batteries in mobile |

| User Interface | Numeric keypad | Touchscreen, easy-to-use UI | Highly responsive touchscreen |

| Data Syncing & Analytics | Offline sales tracking | Cloud syncing, real-time data | Integrated cloud sync and analytics |

Choosing SDLPOS terminal devices means you get reliable hardware built for the US market with strong support for payment security, software integration, and user-friendly features that improve both staff efficiency and customer experience.

Benefits of Upgrading to Modern POS Terminal Devices

Upgrading your POS terminal devices is more than just swapping hardware – it fundamentally improves how your business runs. Whether you’re a small retail store or managing multiple locations, modern point of sale hardware delivers tangible benefits that affect your bottom line and customer satisfaction.

Efficiency Gains and Faster Checkouts

Modern POS terminals streamline the checkout process. Features like contactless payment terminals, EMV chip devices, and NFC-enabled checkout speed up transactions. Faster payments mean shorter wait times for customers and a smoother flow during busy hours.

- Quick card reads and mobile wallet acceptance reduce friction.

- Touchscreen POS machines simplify order entry and minimize errors.

- Cloud syncing keeps sales data instantly updated and accessible.

This efficiency helps staff serve more customers without sacrificing service quality.

Security Compliance and Fraud Reduction

Keeping transactions secure is critical. Upgrading to secure transaction terminals built with the latest security protocols ensures your business stays PCI compliant and protected against fraud.

- EMV chip technology cuts down counterfeit card fraud.

- Encrypted payment processes secure sensitive data.

- Regular firmware updates keep POS systems current with evolving security standards.

By investing in advanced hardware, you reduce the risk of costly security breaches and protect customer trust.

Scalability for Multi-location Businesses

Modern POS devices can easily scale as your business grows. Whether you’re adding stores or expanding product lines, today’s retail payment processors and mobile POS systems integrate seamlessly across locations.

- Centralized inventory and sales management across terminals.

- Real-time data syncing for accurate, unified reporting.

- Options to add or relocate countertop fixed terminals or mobile handheld POS devices with ease.

This flexibility saves time, avoids costly reconfigurations, and supports a growing customer base.

Cost Savings and Return on Investment

Though a new POS terminal device means upfront costs, the long-term savings are significant.

- Reduced transaction times mean more sales per hour.

- Lower error rates reduce losses and refunds.

- Cloud-based software cuts down on IT overhead.

- Warranty-backed models like SDLPOS reduce maintenance expenses.

For example, many U.S. retailers see ROI within the first year after upgrading, thanks to improved operational efficiency and fewer fraud incidents.

Customer Experience Improvements

Your customers notice when checkout is quick and hassle-free. Upgrading POS terminals brings a modern, user-friendly experience that encourages repeat business.

- Faster, secure payment options including contactless and mobile pay.

- Clear on-screen prompts and receipts improve transparency.

- Self-service kiosks reduce lines and empower shoppers.

Case Study Teaser: One mid-sized retailer upgraded to SDLPOS Android POS terminals and reported a 25% boost in customer satisfaction scores along with faster checkout times during peak shopping days.

Upgrading your POS terminal devices isn’t just about technology—it’s about improving every aspect of your business operations. From faster checkouts to growth-ready scalability and enhanced security, modern POS systems deliver measurable benefits that keep you competitive in today’s U.S. retail landscape.

How to Choose the Right POS Terminal Device for Your Business

Selecting the right POS terminal device can make a huge difference in how smoothly your business runs. Here’s a straightforward guide to help you make the best choice, especially if you’re working with SDLPOS or any other trusted supplier.

Assess Your Business Needs First

- Transaction Volume: Know your daily sales numbers. High-traffic stores need faster, more robust terminals with quicker payment processing. Smaller shops might do fine with a mobile POS system or countertop card reader.

- Budget: Set a clear budget but don’t cut corners on essentials like security and reliability. Often, spending a bit more upfront saves money long term with better durability and features.

Check Compatibility With Existing Systems

- Registers and Software: If you’re upgrading, ensure the new POS device works seamlessly with your current cash registers and software. Many POS terminals support widely used software, but checking compatibility avoids headaches.

- E-commerce Integration: If you sell online, a terminal that syncs sales data easily with your website or inventory tools is a must.

Evaluate Your Supplier and Warranty Options

- Choose a supplier known for reliability and support, like SDLPOS, which offers solid warranties and customer service.

- Ask about repair or replacement policies as well as how easy it is to get help if something goes wrong.

- Good support makes a difference when issues pop up during busy hours.

Watch Out for Common Pitfalls

- Network Dependence: Test your local network. Some terminals rely heavily on Wi-Fi or cellular connections—if your area has poor signal, look for devices with offline transaction capabilities.

- Avoid overly complex machines if your staff isn’t tech-savvy; simplicity boosts speed and reduces mistakes.

- Check if the terminal meets PCI compliance and supports EMV chip and contactless payments (NFC).

Step-by-Step Buyer’s Guide With SDLPOS

- List Your Needs: Write down your must-have features like touchscreen, mobile payments, or cloud syncing.

- Set a Budget Range: Consider upfront cost and monthly fees for software or payment processing.

- Compare Devices: Use feature comparison charts focusing on SDLPOS models and competitors in the retail payment processors market.

- Test Devices: Whenever possible, try demo units or watch video reviews to see real usage.

- Confirm Support: Confirm warranty length and customer support availability with SDLPOS or your supplier.

- Plan for Expansion: If growing, choose scalable options that fit multiple locations without extra hassle.

Choosing the right POS terminal device is about matching technology to your specific needs while trusting a reliable supplier like SDLPOS. This approach keeps transactions secure, quick, and hassle-free for U.S. businesses aiming to grow with confidence.

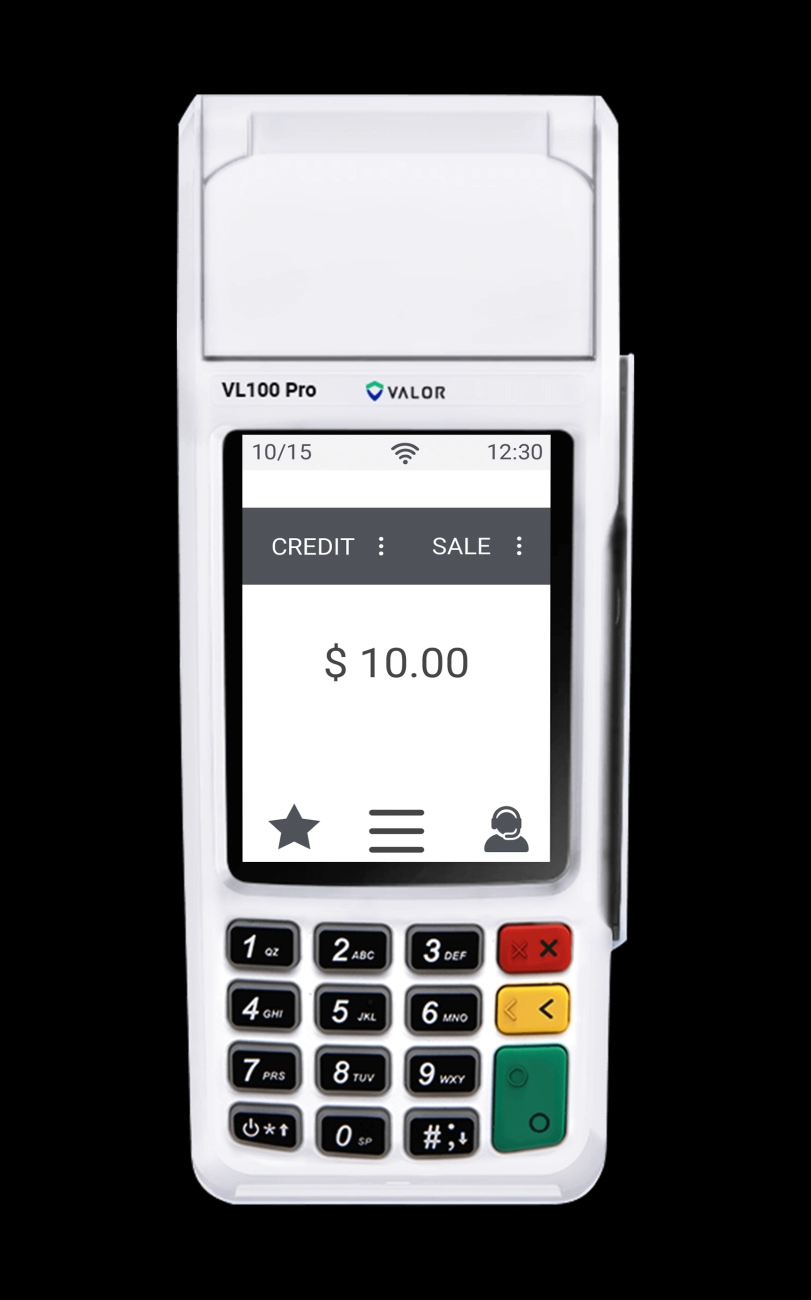

Spotlight SDLPOS POS Terminal Devices Your Trusted Cash Register POS Supplier

When it comes to reliable POS terminal devices for your business, SDLPOS stands out as a trusted supplier in the United States market. With years of experience serving retail, hospitality, and service industries, SDLPOS combines quality hardware with easy-to-use software, helping you make fast and secure transactions every day.

Brand Overview and Commitment

SDLPOS is committed to delivering durable and high-performance point of sale hardware tailored for American businesses. From contactless payment terminals and EMV chip devices to all-in-one touchscreen POS machines, SDLPOS focuses on innovation and practicality. Their solutions are built to handle busy environments, streamline payments, and support your growth with scalable technology.

Featured Product Highlights

- Countertop and mobile POS terminals designed for flexibility and dependability

- Android POS terminals and Windows-based systems for varied business needs

- Encrypted POS terminals ensuring secure transaction processing

- Devices with long battery life, fast processors, and multiple I/O ports for connectivity

- Seamless integration with modern retail payment processors and e-commerce platforms

Explore SDLPOS device options including rugged POS terminals and compact POS terminals for specific environments. (Check product details here All-in-One POS Terminal) and (Encrypted POS Terminal)

Unique Selling Points and Integration Ease

What sets SDLPOS apart is its focus on:

- Easy integration with existing systems and cloud services

- Strong compliance with PCI security standards and fraud prevention tools

- Devices that support NFC-enabled checkout and multiple payment types

- User-friendly interfaces designed for quick staff adoption

- Comprehensive warranties and ongoing technical support to ensure minimal downtime

Testimonials and Proof Points

Many U.S. retailers and restaurants have upgraded their checkout experience with SDLPOS terminals, reporting faster transaction times and improved security. Business owners appreciate the robust build quality, excellent tech support, and clear ROI. For example, a multi-location retailer noted a 30% drop in checkout lines after switching to SDLPOS mobile payment terminals.

Call to Action with Discount Code

Ready to upgrade your checkout system? Visit SDLPOS today for exclusive deals on advanced POS terminal hardware components and smart terminals. Use code SDLPOSUSA10 at checkout for a 10% discount on your first purchase. Start simplifying your payment process with SDLPOS — where technology meets trust.

Explore more on SDLPOS POS Terminal devices and get started.

Implementation and Maintenance Tips for POS Terminal Devices

Setting up and maintaining your POS terminal devices properly is key to smooth daily operations and long-term success. Here’s how you can get started and keep things running without hiccups.

Quick Start Setup and Troubleshooting

- Unpack and Inspect Equipment: Check all components like card readers, power supplies, and cables before installation to avoid early surprises.

- Follow the Manufacturer’s Setup Guide: Use the provided instructions or setup wizards to get your device online quickly.

- Connect to Secure Network: Always link your POS terminal to a secure, reliable network (preferably wired or encrypted Wi-Fi).

- Firmware Updates: Keep your firmware updated to improve security and fix bugs. Many devices support over-the-air updates.

- Basic Troubleshooting Tips:

- Restart the device to resolve momentary freezes.

- Check network connectivity if transactions fail.

- Inspect hardware connections if peripherals don’t respond.

- For detailed hardware components that affect setup, see POS Terminal Hardware Components.

Staff Training and Update Best Practices

- Hands-On Training: Ensure all users know how to operate the terminal confidently, including processing payments, refunds, and voids.

- Security Awareness: Train staff to recognize suspicious activities and to handle cardholder data properly to ensure PCI compliance.

- Regular Updates: Keep staff informed of software updates and new features to maximize device use.

- Create Quick Reference Guides: Have easy-to-follow instructions or FAQs available at the counter or inside the terminal interface.

- Role-Based Access: Implement different user levels to limit sensitive functions to authorized personnel only.

Long-Term Care Cleaning and Audits

- Clean Screens and Card Readers Weekly: Use soft microfiber cloths and recommended cleaning agents to avoid damage.

- Inspect for Wear and Tear: Routinely check cables, connectors, and display screens to catch issues before they impact sales.

- Run Transaction Audits: Regularly review transaction logs to detect anomalies or inconsistencies early.

- Backup Data Frequently: Schedule automatic backups or manual backups if cloud syncing isn’t supported.

- Prevent Overheating: Ensure adequate ventilation if the terminal is fanless, or keep it away from direct heat sources.

Tips for Seasonal Peak Management

- Increase Staff Training Before Peak Periods: Arm your team with knowledge to handle higher transaction volumes without delays.

- Verify Network Bandwidth: Ensure your internet connection can handle traffic spikes to avoid downtime during busy hours.

- Have Backup Devices Ready: Consider renting or keeping spare POS terminals on hand, especially during holidays or sales events.

- Schedule Extra Maintenance: Perform thorough system checks before peak seasons to catch potential issues.

- Utilize Cloud Syncing and Analytics: Use real-time data to monitor sales trends and optimize checkout speed.

These steps will help you keep your countertop card readers, mobile POS systems, and other terminal types running reliably. Proper setup and ongoing care can significantly improve payment processing speed, reduce downtime, and maintain security compliance.

For specialized devices, you can also explore our guides on contactless payment terminals and mobile payment terminals that offer additional setup tips.

FAQs About POS Terminal Devices Your Common Questions Answered

When it comes to POS terminal devices, there’s often confusion about how they differ from full POS systems, security compliance, and other practical concerns. Let’s clear up the most frequent questions you might have.

What is the Difference Between a POS Terminal and a Full POS System

- POS terminal devices are hardware units used primarily to process payments—think of countertop card readers or mobile POS systems that handle transactions like contactless payments via NFC.

- A full POS system includes the terminal plus software for inventory, sales tracking, reporting, and customer management. It’s a more comprehensive solution.

- In essence, the terminal is a key part of the system, but the full POS setup acts as the operational hub that keeps your business running smoothly beyond just checkout.

Are POS Terminal Devices PCI Compliant

- PCI compliance refers to meeting the Payment Card Industry Data Security Standards (PCI DSS), which is crucial for safely handling credit and debit card info.

- Most modern POS terminals, especially those with EMV chip readers and contactless payment features, come pre-certified to meet PCI standards.

- However, your business is responsible for maintaining overall PCI compliance through proper use, regular updates, secure networks, and staff training.

- Make sure to ask your POS supplier about PCI validation reports and firmware update protocols to keep your terminals secure.

Can POS Terminals Work with Multiple Payment Types

- Yes, modern POS terminals support various payment methods: EMV chip cards, magnetic stripe, NFC contactless payments (Apple Pay, Google Pay), and even QR code scanning sometimes.

- Flexibility here helps you deliver a faster, smoother checkout, which is essential for US retail and dining environments.

Do I Need Internet to Use POS Terminals

- Most POS terminal devices work best with stable internet connectivity for real-time payment processing, cloud syncing, and integration with e-commerce platforms.

- Some devices offer offline modes that store transactions temporarily and sync when reconnected. This is useful for mobile POS systems or areas with spotty connectivity.

- Testing your local network setup is crucial before committing to a model, so make sure to verify Wi-Fi or Ethernet options with your vendor.

How Often Should POS Terminal firmware and Software be Updated

- Regular updates are vital for security patches, compliance with new payment standards, and performance improvements.

- Many terminals support automatic firmware updates, but manual checks are good practice, especially before peak sales seasons.

- Work with suppliers who provide easy access to update protocols and clear instructions on staff training for applying these safely.

Can POS Terminals Integrate with My Existing Software and Hardware

- Integration capabilities vary, but many modern POS terminal devices offer plug-and-play compatibility with popular inventory, CRM, and accounting software.

- Look for terminals supporting open APIs or platforms like Android POS terminals, which allow broader customization.

- Consider your existing registers, barcode scanners, and receipt printers when choosing to avoid extra costs.

What Should I Know About Durability and Maintenance of POS Terminals

- Since POS terminals are high-use devices, especially touchscreen POS machines, durability matters.

- Look for features like fanless designs, rugged enclosures, and extended battery life for mobile units.

- Regular cleaning and audits, plus vendor support for troubleshooting, prolong device life and keep your setup running smoothly.

By understanding these key FAQ topics, you can better navigate the choice and operation of your POS terminal devices. If you want a hassle-free switch or an upgrade that fits your business workflow, brands like SDLPOS provide clear guidance, trusted PCI compliance, and dependable support tailored to US customers.