Split Payment POS Systems Features Benefits and Hardware Solutions

Are you tired of clunky payment processes that frustrate your customers? Split payment POS systems are transforming how businesses handle transactions, making it easier to split bills and keep everyone happy. As a business owner, I understand the need for reliable, efficient tools to streamline operations. That’s why I’m sharing expert insights on how split payment POS solutions, backed by SDLPOS’s top-tier hardware, can elevate your retail or hospitality business. In this guide, you’ll discover what split payment POS is, why it’s a game-changer, and how to choose the right system for your needs. Let’s get started!

What is Split Payment in POS Systems

Definition and Basic Concept of Split Payment POS

Split payment in a POS system refers to the ability to divide a single transaction into multiple payments using different methods or amounts. Instead of paying the entire bill at once, customers can split the total charge across various payment types or among several payers. This feature is often called split tender POS transactions or payment splitting at the register.

The concept is straightforward: a customer may want to pay part of the bill in cash and the rest with a credit card, or multiple people sharing the bill may each cover their portion separately. Split payment functionality is critical in making checkouts smoother and more flexible.

Common Scenarios for Split Payment Use

You’ll often see split payment POS systems in industries that frequently involve group payments or varied payment preferences, such as:

- Restaurants and cafes: Groups dining together typically want separate checks or want to pay their share individually.

- Retail stores: Customers might use gift cards combined with credit or debit cards to complete a purchase.

- Events and ticket sales: Customers may pay part of a booking with a deposit and settle the rest later or split payment among multiple parties.

- Hospitality: Hotels and resorts where guests split charges for services, meals, and accommodations.

These real-world cases highlight the need for flexible multi-payment POS systems that accommodate diverse and partial payment styles.

Types of Split Payments in POS Systems

Split payment POS features vary but generally fall into three main types:

- Split by amount: The total bill is divided into specific amounts to be paid by different payment methods or people. For example, $40 on a credit card and $20 in cash.

- Split by method: Each payment uses a different payment method for the entire or part of the bill, such as combining a mobile wallet with a debit card.

- Split by invoice or item: The transaction is broken down by product or service line—ideal for scenarios where each person pays for their own items.

Understanding these types helps businesses choose POS hardware and software that best suits their customer flow and payment habits. Solutions like SDLPOS hardware support all these split payment options, allowing for seamless customer experiences in diverse settings.

This foundational understanding of split payment in POS systems clarifies why it’s an essential feature for modern businesses committed to customer convenience and flexible payment processing.

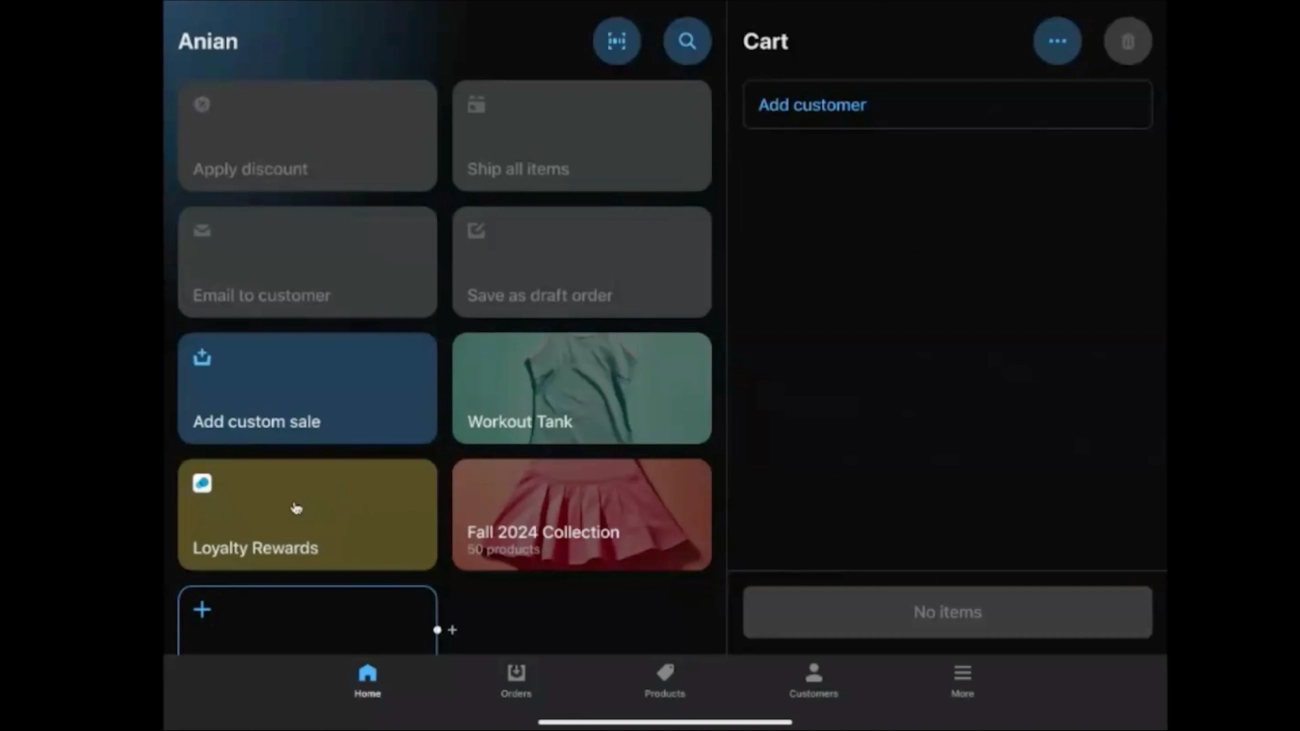

How Split Payment Works in a POS System with Multi-Payment Support

Handling a split payment POS transaction might seem complex, but modern POS systems like SDLPOS make it straightforward for both staff and customers. Here’s a simple step-by-step breakdown of how split payments typically work at the register:

Step-by-Step Workflow of a Split Payment Transaction

Start the Sale

The cashier rings up the total purchase amount as usual.

Select Split Payment Option

Instead of paying the full amount with one method, the cashier chooses the split payment or split tender option on the POS screen.

Define Payment Portions

The amount is divided either by customer request (e.g., half paid in cash, half by card) or by invoice/item—whatever fits the scenario.

Process First Payment

The system processes the first payment method, whether it’s cash, credit/debit card, or mobile wallet.

Process Second Payment or More

Once the first payment is approved, the POS prompts for the next payment method to cover the remaining balance.

Complete Transaction

After all payments are processed, a single receipt showing the full order and split payments is printed or emailed.

Integration of Hardware and Software for Split Payment POS

A smooth split payment experience depends on tight coordination between POS hardware and software:

- Cash registers capture cash payments and show balances clearly.

- Card readers support multiple transactions back-to-back without delays.

- The POS software manages the split logic, making sure the total is correct and each payment is recorded.

- Mobile wallet readers accept payments via popular apps like Apple Pay, Google Wallet, or Samsung Pay, which is essential for contactless split payments.

- SDLPOS devices are built to handle these smoothly, reducing errors and speeding transactions.

Compatibility With Various Payment Methods

An ideal split payment POS system supports multiple payment types seamlessly, such as:

Cash

Quick and simple, cash payments often cover partial amounts or small balances.

Credit and Debit Cards

Most split tender transactions rely on cards—chip, swipe, or contactless.

Mobile Wallets and Contactless Payments

Increasingly popular, mobile wallets speed checkout and support partial payments.

Gift Cards or Store Credits

Some customers like to combine gift cards with cash or card payments.

SDLPOS systems are designed to work with all these methods, letting businesses handle real-world US payment habits efficiently.

Split payment POS functionality means you can serve customers who want to split bills or make partial payments without extra hassle. With the right hardware like cash registers and card readers plus powerful, adaptable software, transactions stay fast and error-free—even when multiple payment types are involved.

Benefits of Split Payment POS Systems for Businesses and Customers

Split payment POS systems bring several practical advantages that improve both the customer experience and business operations. Whether it’s a restaurant, retail store, or event venue, having reliable multi-payment POS capabilities can make a significant difference.

Enhanced Customer Convenience and Satisfaction

Split payment POS features let customers divide their bills easily—whether paying by cash, card, or mobile wallet. This flexibility makes it simple for groups to settle bills separately, supporting common real-world scenarios like friends sharing a meal or colleagues paying their individual tabs. When customers don’t have to jump through hoops or ask staff repeatedly, satisfaction naturally increases. Convenience leads to loyalty and repeat visits.

Increased Sales Opportunity Through Flexible Payment Options

With the ability to accept partial payments or multiple payers in a single transaction, businesses open up new sales avenues. Multi-payment POS systems handle split tender transactions smoothly, so customers can combine payment methods (like part cash, part credit card) without hassle. This flexibility reduces lost sales caused by payment limitations, encouraging customers to spend more confidently.

Efficient Transaction Handling and Reduced Queue Times

Split payment capabilities streamline checkout by managing complex payments quickly. When your POS supports payment splitting at the register, employees spend less time on manual calculations or processing multiple separate transactions. This speeds up service, cuts down wait times, and keeps queues moving—critical during busy hours or high-traffic events.

Better Financial Tracking and Reporting for Businesses

A POS system with split payment support also improves business accounting and reporting accuracy. Each portion of a split transaction is logged separately, offering clearer insights into payment methods and sales patterns. This simplifies reconciliation and helps owners track which tender types are most popular, supporting smarter inventory and cash flow management.

In short, a POS system that handles split payments not only boosts customer ease but also enhances operational efficiency and financial clarity—an all-around win for U.S. businesses aiming to meet diverse payment preferences.

SDLPOS Hardware Solutions Supporting Split Payment POS Systems

When it comes to split payment POS solutions, SDLPOS stands out by offering reliable hardware designed specifically to handle the complexity of multi-payment transactions with ease. Here’s why SDLPOS hardware works so well for businesses needing split payment features.

Features of SDLPOS Cash Register Hardware for Split Payment

SDLPOS cash registers come equipped with robust features that simplify payment splitting at the register:

- Multiple payment method support: Easily process split tenders including cash, credit/debit cards, and mobile wallets.

- Fast transaction processing: Designed to reduce lag, which keeps lines moving especially during busy times.

- Clear, intuitive touchscreen interfaces: Allow cashiers to split bills by amount, method, or invoice quickly without confusion.

- Customizable payment layouts: Tailor split payment options to fit your business’s workflow and common scenarios.

Seamless Integration With Popular POS Software Platforms

One big advantage is that SDLPOS hardware integrates smoothly with major POS software systems popular in the U.S. market. This makes it a breeze to:

- Sync split payment functions without worrying about compatibility.

- Access detailed sales and split payment reports in one place.

- Support diverse use cases from retail environments to hospitality, where hospitality POS split billing is often required.

Durability and User-Friendly Design

SDLPOS devices are built to last, made with materials that endure daily wear and tear in retail and dining environments. Plus, their user interfaces are designed with real cashiers in mind, making it easy to:

- Handle partial payment POS systems reliably.

- Minimize errors during split transactions for a smooth checkout experience.

- Train staff quickly thanks to straightforward hardware and software layouts.

Success Stories and Real-World Use

Many U.S. businesses have adopted SDLPOS hardware to improve their split payment operations. For example:

- A local restaurant chain saw a 20% reduction in checkout times by leveraging SDLPOS’s intuitive hardware for split tabs.

- A multi-location retail store appreciated the consistency of split payment reporting, aiding financial tracking and reconciliation.

These examples highlight how SDLPOS not only supports split payments but enhances overall operational efficiency.

For advancing your split payment system, consider pairing SDLPOS hardware with reliable payment terminals like the contactless payment terminal or mobile payment terminal for smooth, modern transactions.

SDLPOS hardware offers the perfect mix of durability, easy integration, and user-friendly features tailored for the demands of split tender POS transactions in the U.S. Whether you run a busy restaurant or retail store, their solution helps you handle split payments smoothly and professionally.

Local Use and Payment Habits for Split Payment POS Systems

Importance of Local Payment Method Compatibility

When it comes to split payment POS systems, supporting local payment methods is key to meeting customer expectations in the U.S. market. Many customers prefer using different cards, mobile wallets like Apple Pay or Google Pay, or even cash alongside digital payments during a single transaction. Local cards issued by regional banks or credit unions also remain popular, especially in suburban and rural areas.

A POS system that doesn’t accept the payment methods your customers use most often can create friction and slow down checkout times. This is why payment splitting at the register needs to handle a wide range of options effortlessly, from legacy card swipes to contactless mobile wallets. Flexibility ensures smoother transactions and happier customers.

How SDLPOS Supports Regional Payment Methods for Split Payments

SDLPOS hardware is designed with local market habits in mind. Here’s how SDLPOS stands out:

- Multi-payment POS systems compatibility: SDLPOS cash registers and card readers support all major U.S. payment methods—chip cards, magstripe, contactless payments, and mobile wallets.

- Software integration: SDLPOS hardware works seamlessly with popular POS software that handle split tender POS transactions with ease.

- Customizable payment configurations: Businesses can tailor which payment methods are accepted, making split payments fast and error-free.

- Robust connectivity: Reliable hardware ensures smooth processing even during busy hours, vital for hospitality or retail split payment solutions.

Tips for Training Staff to Handle Split Payment Efficiently

Handling split payments can get tricky without proper training. Here are some quick ways to get your team ready:

- Practice common split payment scenarios like splitting by amount or payment type so staff feel confident.

- Highlight the POS split payment feature functions during training, especially how to select multiple payment types quickly.

- Train on troubleshooting errors to reduce transaction delays—knowing how to void or adjust partial payments quickly matters.

- Emphasize clear communication with customers during checkout to confirm each payer’s amount and payment method.

- Encourage using SDLPOS user-friendly interfaces designed to minimize confusion and speed up split billing.

By focusing on local payment habits and thorough staff training, businesses can maximize the benefits of SDLPOS split payment POS systems and deliver smooth, hassle-free transactions every time.

How to Choose the Right POS System with Split Payment Capability

Finding the right POS system split payment feature for your business means focusing on both hardware and software that handle multiple payment types smoothly. Here’s what you want to keep an eye on:

Key Features to Look For

Hardware Compatibility: Make sure the POS supports various payment hardware like cash drawers, contactless card readers, and mobile payment terminals. Devices should work well together for payment splitting at the register without glitches.

Software Flexibility: The POS software has to manage different split scenarios—splitting by amount, by method (card, cash, wallet), or even by invoice. It should offer an intuitive interface to make split tender POS transactions quick and error-free.

Multi-Payment Support: Look for systems that accept cash, credit/debit cards, mobile wallets, and local payment options common in your area. Systems compatible with regional payment habits prevent lost sales.

Reporting and Tracking: Good POS software provides detailed reports on split payments. This helps keep track of partial payments and customer billing.

Questions to Ask Vendors

- Does your hardware fully support split payments across different payment methods?

- Can your software handle complex split payment scenarios easily?

- Is the system compatible with popular mobile wallets and local payment options?

- How fast is the transaction process during split payments?

- Do you offer training or support for staff on handling split payments?

- What security features protect split payment transactions?

Why SDLPOS Stands Out as a Hardware Provider

SDLPOS offers durable, reliable cash register hardware designed to simplify split payment processes. Their devices integrate seamlessly with top POS software platforms, ensuring smooth retail split payment solutions and hospitality POS split billing alike. SDLPOS hardware supports various payment types, including contactless and mobile wallets, perfectly fitting U.S. market needs.

- User-friendly design helps staff quickly handle multiple payers or partial payments.

- Built tough for busy environments so your hardware won’t slow you down.

- Local payment method support is boosted by SDLPOS’s focus on regional compatibility—perfect for U.S. businesses adapting to evolving payment trends.

- Plus, their proactive support and clear interfaces minimize errors and speed up checkout.

Choosing SDLPOS means investing in hardware that confidently handles the complexities of split payments—so your business can improve customer satisfaction and boost sales effortlessly.

Common Challenges with Split Payment POS Systems and How to Overcome Them

Handling split payment POS transactions can bring some challenges that, if unmanaged, might slow down service or cause mistakes. Here are the main issues businesses face and how SDLPOS hardware and solutions make these easier to tackle.

Complexity in Processing Split Payments

Splitting a bill or transaction can get complicated when multiple payment methods or amounts are involved. It’s easy for errors to happen if the system isn’t straightforward.

How to overcome this:

- Use POS hardware with intuitive user interfaces that guide staff step-by-step through split payment options.

- Choose systems that allow automatic calculations for each payment portion, reducing manual errors.

- Train employees regularly on best practices so they feel confident using split tender features.

Error Handling During Transactions

Mistakes like incorrect amounts or partial payment failures can frustrate both customers and staff. Without reliable error detection, these issues can lead to longer queues and lost sales.

How SDLPOS helps:

- SDLPOS cash registers are built with robust software integration to alert users when input is invalid or a payment method doesn’t go through.

- The hardware supports quick edits and easy cancellation if a part of the transaction needs adjustment.

- Real-time verification and prompts reduce the chance of errors making it to the final sale.

Hardware Compatibility and Payment Method Support

Not all POS hardware supports every payment type equally, and older devices may struggle with contactless split payments or multiple simultaneous payment methods.

SDLPOS solutions include:

- Designed compatibility with a wide range of payment options including cards, mobile wallets, and cash, essential for multi-payment POS systems in the US market.

- Hardware built for fast processing and seamless switching between payment types during a single transaction.

- Durable, user-friendly devices that keep transactions smooth, even during busy service times.

Managing Speed and Customer Flow

Complicated split payment processes can slow down the checkout line, hurting customer satisfaction and sales.

Solutions to improve speed:

- SDLPOS devices support quick split payment handling through clear screens and minimal button presses.

- Integrated software helps staff navigate complex splits without leaving the checkout screen multiple times.

- Training materials from SDLPOS emphasize workflow efficiency, so users handle partial payments smoothly.

By addressing these common challenges, SDLPOS helps businesses provide faster, error-free split payment POS transactions. This keeps customers happy and operations running efficiently.