Tax Calculation in POS Systems Explained with SDLPOS Hardware

Are you struggling to understand tax calculation in your POS system? Getting it right is crucial for staying compliant and keeping your business running smoothly.

As a business owner, I know how overwhelming it can be to manage sales tax, VAT, or GST while juggling daily operations. That’s why I’m sharing practical insights based on real-world experience to help you master tax calculation with your POS.

In this guide, you’ll discover how POS systems automate tax calculations, why reliable POS hardware like SDLPOS makes a difference, and tips to ensure tax compliance without the headache.

Let’s dive in and simplify POS tax calculation for your business!

Tax Calculation in POS Systems Explained

POS tax calculation refers to the automatic process where a Point of Sale system computes the appropriate tax amount during a transaction. This vital function ensures that businesses charge accurate taxes on each sale, based on local regulations and product specifics.

Common Types of Taxes Handled by POS Systems

POS systems manage a variety of tax types depending on the business location and industry. The most frequently encountered taxes include:

Sales tax: Collected by retailers in most U.S. states and varies by city, county, or state jurisdiction.

Value-Added Tax (VAT): Common internationally, VAT is calculated at each stage of production or distribution.

Goods and Services Tax (GST): Similar to VAT, used mainly in countries like Canada and Australia.

Service tax: Applied to taxable services in certain sectors and regions.

Modern POS software is designed to accommodate these taxes, sometimes simultaneously, especially in businesses operating across multiple jurisdictions.

How POS Software Determines Applicable Tax Rates

Accurate tax calculation hinges on two key factors:

Location-Based Tax Rules

POS systems automatically identify the customer’s or business’s location—using data from the store, shipping address, or IP location—to apply the correct local tax rate. This includes varying rates for states, counties, cities, and special tax districts.

Product Category Tax Rules

Different products and services may be taxed at different rates or even be tax-exempt. POS software categorizes inventory items to apply the proper tax logic. For example, groceries often have reduced or zero sales tax, whereas luxury goods may face higher rates.

By integrating both location and product-specific rules, POS systems provide reliable, automated tax calculations, reducing the risk of undercharging or overcharging customers.

Understanding how tax calculation in POS systems works is essential for businesses aiming to maintain compliance and improve checkout efficiency. In the next section, we will cover how to set up your POS system for accurate tax processing.

Setting Up Tax Calculation in Your POS System

Configuring tax calculation in your POS system is essential for accurate pricing and compliance. Here’s a straightforward step-by-step process to set up tax settings and key concepts to understand like tax zones, nexus, and product tax rules.

Step-by-Step POS Tax Setup

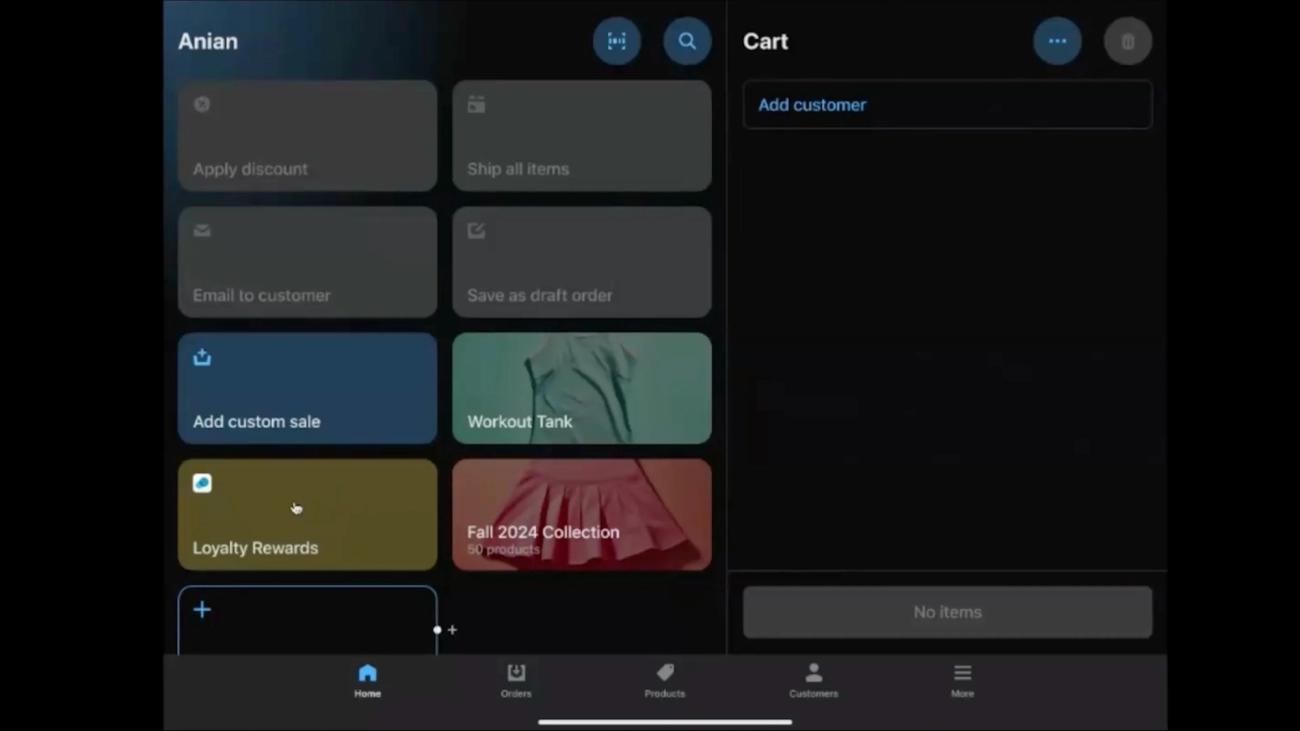

Access Tax Settings

Open your POS software settings or admin panel and locate the tax configuration section, often labeled “Tax Setup” or “Sales Tax.”

Define Tax Zones and Nexus

Tax zones are geographic areas where specific tax rates apply, such as states, counties, or cities.

Nexus refers to your business’s tax connection to a state—where you have physical presence, employees, or significant sales—triggering tax collection obligations.Add Applicable Tax Rates

Input the relevant tax rates for each tax zone. These rates could include:

- State and local sales tax

- VAT or GST for applicable products

- Service tax for services if required

Assign Tax Rules by Product Category

Some products or services have different tax rules. For example, essentials like groceries might be tax-exempt, while luxury items incur full tax. Set tax rules based on product categories to ensure correct tax application.

Set Up Tax Exemptions and Special Conditions

Configure any exemptions such as nonprofit sales, tax holidays, or resale certificates.

Test the Configuration

Run test transactions to verify the system calculates taxes correctly based on the configured rules and location.

Understanding Tax Zones Nexus and Product Tax Rules

- Tax Zones make sure your POS system applies the right tax rate depending on the customer’s location or your store’s operations.

- Nexus is important because it defines where you must charge sales tax. Some states require tax collection if you meet certain sales thresholds, even without a physical location.

- Product Tax Rules reflect tax laws for specific goods/services, ensuring your POS doesn’t overcharge or undercharge taxes.

Common Challenges and Troubleshooting Tips

Incorrect tax rate application due to outdated rates or misconfigured zones.

Tip: Regularly update your POS tax rates or enable automatic updates.Multiple jurisdictions overlap causing confusion in determining which tax rate applies.

Tip: Use software that manages jurisdiction priorities or consolidated rates automatically.Tax exemption certificates not validated properly leading to improper tax charges.

Tip: Maintain an organized system for tracking and applying exemptions.Software glitches after updates causing tax calculation errors.

Tip: Always test tax functionality after system updates or upgrades.

Setting up your tax calculation correctly in your POS system not only helps you comply with sales tax laws but also avoids penalties and customer confusion. Most modern POS systems simplify this by including tools for automatic rate updates and clear tax rule management, saving you time and hassle.

Compliance and Accuracy in POS Tax Calculation

Accurate tax calculation in POS systems is critical for any business. Getting it wrong isn’t just a small mistake — it can lead to serious legal, financial, and reputational risks. Incorrect sales tax, VAT, GST, or service tax charges can trigger audits, fines, and even damage customer trust. That’s why keeping your POS tax setup compliant and error-free is a top priority.

Risks of Incorrect Tax Calculation

- Legal issues: Undercharging or overcharging tax may violate state or federal tax laws, leading to penalties.

- Financial losses: Businesses may face fines or have to pay back taxes with interest.

- Reputation damage: Customers expect transparent and accurate pricing; errors may hurt your brand’s credibility.

How POS Systems Help Maintain Compliance

Modern POS software plays a big role in reducing tax calculation errors by:

- Automatically updating tax rates based on changing laws and local requirements, including sales tax, VAT, and GST.

- Applying correct tax rules for specific products and locations, preventing manual mistakes.

- Providing audit-ready reports to help with tax filings and compliance checks.

Reliability of SDLPOS Hardware in Tax Computations

The hardware you use matters too. SDLPOS offers robust and reliable cash register hardware designed to sync perfectly with tax calculation software. This dependable hardware ensures:

- Smooth and fast tax computations at checkout without lag.

- Proper integration with updated tax software for real-time accuracy.

- Reduced chances of technical glitches affecting tax charges.

By pairing trusted SDLPOS hardware with compliant POS software, businesses can effectively avoid tax errors, stay up to date with tax laws, and protect themselves from costly compliance issues.

Integration of Tax Calculation with POS Hardware

Having compatible and reliable POS hardware is essential for flawless tax processing. When your hardware and tax calculation software work smoothly together, it eliminates errors and speeds up transactions. That’s why pairing your POS system with trusted hardware like SDLPOS cash register hardware matters.

Why Hardware Compatibility Matters for Tax Calculation

- Accurate tax application: The POS hardware must communicate perfectly with your software to apply the correct tax rates based on location and product type.

- Faster checkout times: Solid hardware reduces delays in tax computations, keeping lines moving during busy hours.

- Reduced errors: A well-integrated system cuts down on manual override needs that often introduce tax calculation mistakes.

How SDLPOS Supports Seamless Tax Calculation

SDLPOS cash registers are designed with tax calculation in mind. They provide:

- Built-in tax tables: These registers store up-to-date tax rate info for instant retrieval.

- Stable connection to POS software: Ensures that tax updates and product tax rules sync properly.

- Custom tax field configurations: Makes it easy to handle complex situations like multiple tax jurisdictions and exemptions.

- Reliable processing power: Handles complex tax computations without slowing down your transaction flow.

Real-World Scenarios Showing Hardware and Software Synergy

- Multi-location business: One retailer with stores in different states uses SDLPOS hardware paired with POS software that automatically adjusts tax rates per location. This saves manual input and keeps tax compliance tight.

- Retailer with varied products: A shop selling groceries and beverages benefits from the hardware’s ability to recognize different tax categories and apply the right VAT or sales tax rate without delay.

- Seasonal tax changes: When tax holidays or temporary exemptions happen, SDLPOS register and POS software update tax settings simultaneously, ensuring the right taxes are charged at the point of sale.

By choosing SDLPOS hardware that integrates well with your tax calculation software, you get a reliable, smooth-running system that handles all sales tax, VAT, or GST concerns with ease. This combo not only keeps your business compliant but also improves customer experience through accurate, transparent pricing.

Benefits of Automating Tax Calculation in POS Systems

Automating tax calculation in your POS system offers clear advantages that go beyond just saving time. Here’s why making the switch to automated tax calculations is a smart move for any U.S. retailer or business owner.

Save Time and Increase Efficiency

Manual tax calculations eat up valuable time during busy checkout hours. When your POS sales tax setup is automated, the system instantly applies the right tax based on location and product type. This boosts transaction speed and lets your staff focus on customer service rather than number crunching. Over time, this efficiency translates into smoother operations and better customer flow.

Reduce Human Error in Tax Calculation

Errors in tax calculations are costly and damaging. With sales tax automation POS tools, you minimize mistakes from manually inputting rates or exemptions. The system consistently applies the correct VAT calculation in POS systems or other relevant taxes such as GST or service tax without confusion, even across multiple jurisdictions.

Streamline Audit and Reporting Processes

Automated tax calculation means your POS systems for retail tax keep an accurate, real-time record of all tax collected. This helps during audits or tax filing season by providing clean, reliable reports. You don’t have to sift through receipts or spreadsheets. Instead, you get detailed insights that make compliance easier and reduce headaches with tax authorities.

Build Customer Trust Through Transparent Pricing

Customers appreciate knowing exactly what they’re paying, including taxes. Automated tax calculations ensure that taxes appear clearly on their receipts and are factored correctly into the total price. This transparency enhances trust and prevents surprises at checkout, which is crucial for repeat business and a positive brand reputation.

In , automating your tax calculation with a reliable POS system reduces effort, avoids costly mistakes, simplifies tax reporting, and builds a trustworthy shopping experience. For U.S. businesses, especially those dealing with complex sales tax rules, this automation isn’t just a bonus—it’s essential for smooth, accurate, and compliant operations.

Choosing the Right POS System and Hardware for Your Business Needs

Selecting the best POS system for tax calculation means focusing on features that keep your business compliant, efficient, and ready for any sales scenario. Here’s what to look for when it comes to tax capabilities and why pairing your software with reliable hardware like SDLPOS cash register systems makes a big difference.

Key Features in Tax Calculation Capabilities

When evaluating POS software, prioritize these tax-related features:

- Automatic tax rate updates: Tax rates change often, especially across states and cities. Your POS should update rates automatically to avoid compliance issues.

- Multiple tax jurisdiction support: If you sell in more than one area, the system must calculate taxes based on each jurisdiction’s rules — covering sales tax, VAT, GST, and service taxes as needed.

- Product tax classification: Different products often have different tax rates (e.g., groceries vs clothing). The POS should support setting and applying these rules accurately.

- Tax exemptions and holidays: The system should recognize tax holidays and handle exempt customers or products without manual overrides.

- Tax reporting and audit features: Look for built-in reports that help you file taxes and handle audits easily.

Why SDLPOS Hardware Is the Best Companion

SDLPOS hardware is designed to work seamlessly with tax calculation software, ensuring that your checkout process runs smoothly with no tax errors. Here’s why pairing SDLPOS hardware with your POS software is a smart choice:

- Reliability: SDLPOS cash registers have a strong track record for uptime, meaning your tax calculations won’t get interrupted by hardware failures.

- Integration: Their systems sync directly with tax-calculating POS software, so you get real-time tax rates without extra steps.

- Speed: Quick and accurate tax computations during checkout improve customer experience, especially important in busy retail environments.

- Local support: SDLPOS hardware providers often understand the U.S. retail market well, offering tailored solutions for tax compliance.

Recommendations Based on Business Type

Different businesses have varying POS tax calculation needs. Here’s a quick guide:

| Business Type | Recommended Tax Features | Why SDLPOS Hardware Helps |

|---|---|---|

| Small Retail Shops | Easy sales tax setup, automatic updates | Affordable hardware that’s easy to deploy |

| Restaurants & Cafes | Service tax, multiple tax classes, tip handling | Fast receipt printing and integration |

| Multi-location Retail | Nexus management, tax zone handling | Scalable hardware for multiple outlets |

| E-commerce Hybrids | Combined offline and online tax calculation | Hardware that supports inventory & POS sync |

Choosing the right POS system with advanced tax calculation features and pairing it with SDLPOS hardware is crucial for smooth, compliant, and efficient business operations. It saves time, reduces errors, and keeps your customer experience free of tax headaches.

FAQs about POS Tax Calculation and Sales Tax Automation

How often do tax rates update in POS systems

POS systems typically update tax rates automatically whenever there’s a change at the local, state, or federal level. Many software providers push these updates regularly—sometimes monthly or quarterly—to ensure your business stays compliant without manual intervention. For peace of mind, check if your POS offers automatic tax rate updates or requires you to update rates manually.

Can POS systems calculate taxes for multiple jurisdictions

Absolutely. Modern POS software handles tax calculations across multiple jurisdictions, which is crucial for businesses operating in several states or cities with different tax rules. The system uses your store’s location or the customer’s shipping address to apply the correct sales tax, VAT, GST, or other taxes based on relevant rules and nexus laws.

What happens during tax holidays or exemptions

During tax holidays or exemptions, your POS should automatically apply the temporary tax-free status to qualifying products or transactions. It’s important to configure your POS software correctly, so it recognizes these timeframes and product categories and removes tax accordingly. If the software isn’t correctly set, you might risk charging tax when you shouldn’t or miss out on compliance with local laws.

How do returns and refunds affect tax calculation

When processing returns or refunds, POS systems must adjust the tax amounts to reflect the original sale accurately. This means:

- Removing the applicable sales tax along with the item price.

- Generating proper documentation for your records.

- Ensuring that your financial reports and tax submissions account for these adjustments.

A reliable POS system will streamline this process to avoid errors that could lead to tax reporting issues.

Using a POS system with strong sales tax automation and regular POS tax rates update support reduces headaches around compliance. It handles complex tax scenarios across regions and circumstances, letting you focus more on your business and less on tax rules.