Compra hardware POS con planes de financiación flexibles para negocios

¿Estás buscando comprar hardware POS con opciones de financiación ¿pero no sabes por dónde empezar? No estás solo. Muchos propietarios de negocios desean sistemas de punto de venta de alta calidad pero prefieren distribuir los pagos en lugar de un gasto inicial grande.

Financiar tu hardware POS es una forma inteligente de mantener tu flujo de efectivo estable mientras actualizas la tecnología de tu negocio. En esta guía, descubrirás exactamente cómo los planes de pago flexibles pueden hacer realidad equipos POS asequibles — además de por qué elegir SDLPOS para tus necesidades de financiación es un cambio radical.

¿Listo para explorar cómo obtener el mejor hardware POS ahora y pagar a plazos? ¡Vamos a ello!

¿Qué es Hardware POS? Visión general de los componentes y tipos de hardware POS en SDLPOS

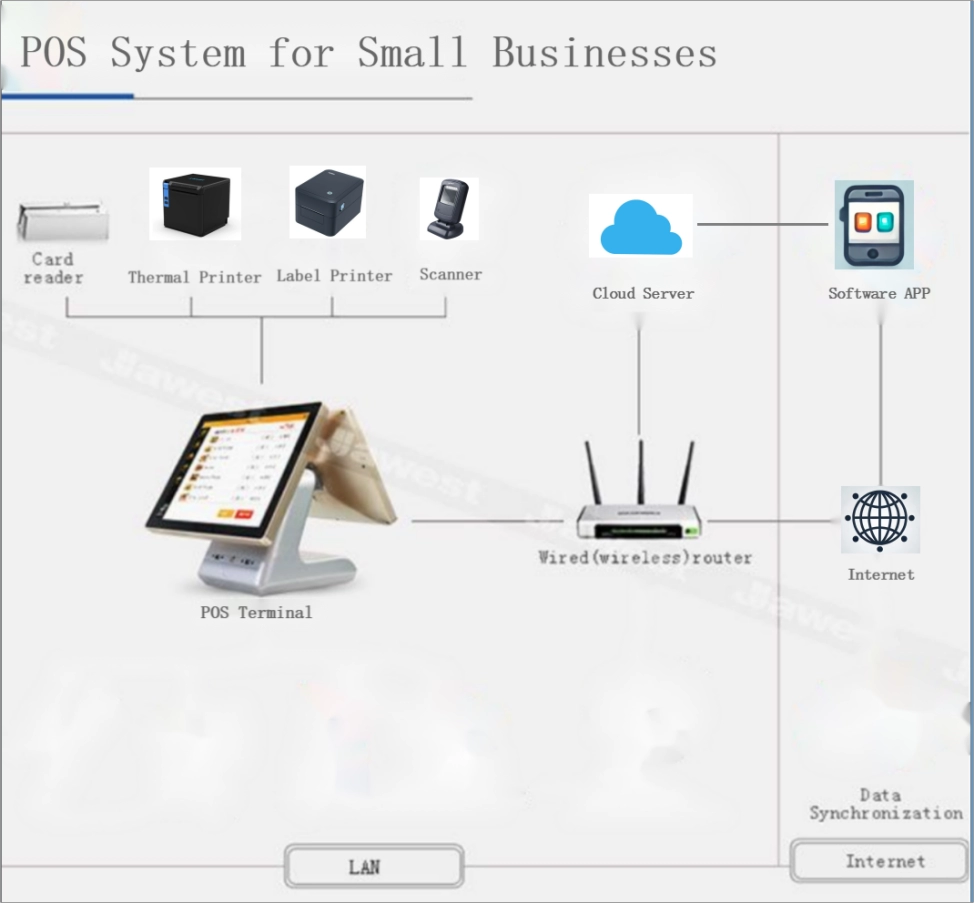

hardware POS se refiere a los dispositivos físicos que componen un sistema de punto de venta, permitiendo a las empresas procesar transacciones de manera eficiente. Estos componentes son esenciales para las operaciones de ventas, gestión de inventario y atención al cliente, haciendo que sean vitales para minoristas, restaurantes y negocios de servicios.

Componentes clave del hardware POS

- Terminales POS: El dispositivo principal donde se ingresan las transacciones de venta. Esto puede ser un monitor táctil o una configuración de ordenador tradicional.

- Cajas registradoras: Compartimentos seguros para almacenar efectivo, a menudo integrados con la terminal.

- Escáneres de código de barras: Dispositivos que escanean los códigos de barras de los productos para una entrada rápida y precisa de ventas.

- Impresoras de recibos: Máquinas que imprimen recibos de venta para los clientes.

- Lectores de tarjetas: Hardware diseñado para aceptar pagos con tarjeta de crédito y débito, incluyendo opciones con chip, deslizamiento y sin contacto.

- Pantallas para clientes: Pantallas que muestran los detalles de la transacción a los clientes.

- Balanzas y Teclados: Utilizados en entornos minoristas como supermercados para pesar productos e ingresar códigos.

Diferentes tipos de hardware POS disponibles en SDLPOS

At el hardware y las soluciones de SDLPOS, ofrecemos una amplia selección de financiación de hardware POS para pequeñas empresas opciones en múltiples dispositivos diseñados para adaptarse a las necesidades únicas de tu negocio:

- Sistemas POS Todo en Uno: Dispositivos simplificados que integran pantallas táctiles, lectores de tarjetas y cajones de efectivo para una configuración sencilla.

- Dispositivos POS Móviles: Terminales portátiles perfectas para ventas en movimiento, food trucks o tiendas emergentes.

- Terminales POS tradicionales: Computadoras robustas combinadas con dispositivos periféricos diseñados para tiendas de alto volumen.

- Quioscos de autoservicio: Soluciones que permiten a los clientes procesar sus compras de forma independiente.

- Cajas registradoras POS: Opciones asequibles y confiables con planes de financiación para apoyar los presupuestos de pequeñas empresas.

Cada pieza de hardware es compatible con plataformas de software comunes y está diseñada para escalar a medida que crece su negocio. Al elegir SDLPOS, obtiene acceso a sistemas POS asequibles con planes de pago que simplifican la adquisición de la tecnología que su negocio necesita sin afectar su presupuesto.

Comprender los componentes y opciones es el primer paso para seleccionar el hardware POS adecuado para su operación, y financiar estos dispositivos le ayuda a mantenerse competitivo mientras gestiona su flujo de efectivo de manera efectiva.

Por qué la financiación del hardware POS tiene sentido para su negocio

Cuando se trata de comprar hardware POS con opciones de financiación, pagar por adelantado no siempre es la mejor opción. Financiar su equipo POS ofrece beneficios reales que pueden ayudar a su negocio a mantenerse flexible y crecer.

Beneficios de financiar vs pagar al contado

- Preserve su capital de trabajo. En lugar de gastar una gran cantidad de dinero de una sola vez, financiar le permite distribuir los pagos a lo largo del tiempo. De esta manera, mantiene más dinero disponible para operaciones diarias, inventario o esfuerzos de marketing.

- Mejor gestión del flujo de efectivo. Los pagos mensuales son predecibles y más fáciles de presupuestar. Esto reduce la tensión financiera que puede acompañar a compras en una sola exhibición.

- Acceso a la tecnología más reciente. El financiamiento facilita la actualización de tu sistema POS cuando aparecen opciones nuevas y más eficientes, sin necesidad de otro gran desembolso inicial.

- Evita bloquear líneas de crédito. En lugar de agotar las tarjetas de crédito o préstamos para hardware, financiar el hardware POS mediante planes dedicados puede mantener abiertas tus líneas de crédito para otras necesidades del negocio.

Quién puede beneficiarse de los planes de financiamiento de hardware POS

- Pequeñas empresas y startups. Si estás comenzando o expandiéndote, el financiamiento te permite equipar tu tienda o restaurante de manera asequible.

- Negocios con fluctuaciones estacionales. Los pagos flexibles pueden ajustarse a los meses de mayor ingreso, aliviando la presión durante períodos más lentos.

- Negocios establecidos en proceso de actualización. Incluso si ya posees equipo POS, el financiamiento te permite reemplazar o añadir hardware sin interrumpir tu flujo de efectivo.

- Propietarios que buscan opciones de pago flexibles. Ya sea que desees arrendar hardware POS o comprar con pagos mensuales, los planes de financiamiento ofrecen opciones adaptadas a tu presupuesto.

Financiar tu sistema POS es una decisión inteligente para mantenerte competitivo, asegurar el flujo de efectivo y actualizar la tecnología sin el impacto de costos iniciales elevados. Te da la libertad de centrarte en gestionar tu negocio, sin preocuparte por los desembolsos de efectivo.

Opciones de financiamiento para hardware POS en SDLPOS

En SDLPOS, entendemos que invertir en hardware POS puede representar un gran costo inicial para las empresas. Por eso ofrecemos planes de financiamiento POS flexibles adaptados a tus necesidades, ayudándote a obtener el equipo adecuado sin afectar tu flujo de efectivo.

Resumen de planes de financiamiento de hardware POS

Ofrecemos varias opciones de financiamiento, incluyendo:

- Arrendamiento de hardware POS: Pague cantidades fijas mensuales con opción de actualizar o comprar más tarde.

- Planes de pago basados en préstamos: Distribuya los pagos en un período establecido con tasas de interés competitivas.

- Sistemas POS asequibles con planes de pago diseñados específicamente para pequeñas empresas que buscan pagos mensuales manejables en terminales, cajas registradoras y otros equipos esenciales.

Estos planes están diseñados para ayudar a las empresas a preservar el capital de trabajo mientras acceden a la última tecnología.

Criterios de elegibilidad y cómo solicitar

La mayoría de las empresas en España pueden calificar para nuestro financiamiento de equipos POS, incluyendo:

- Propietarios únicos, sociedades de responsabilidad limitada y corporaciones.

- Empresas con licencia comercial válida y finanzas estables.

- Empresas nuevas o existentes con al menos un umbral mínimo de crédito.

Solicitar es sencillo:

- Complete nuestro formulario de solicitud en línea rápido en el sitio web de SDLPOS.

- Proporcione documentos básicos como su licencia comercial y estados financieros recientes o información crediticia.

- Obtenga una decisión de crédito rápida, a menudo en 24-48 horas.

Términos y condiciones transparentes

Creemos en una comunicación clara y transparente. Esto es lo que puede esperar:

- Sin tarifas ocultas—lo que ve es lo que paga.

- Tasas de interés fijas o pagos de arrendamiento dependiendo de la opción de financiamiento.

- Términos flexibles de 12 a 48 meses según su presupuesto.

- Opciones fáciles de renovación o actualización al final de su plazo.

- Directrices claras sobre qué sucede si desea devolver o comprar el hardware.

Guía paso a paso para financiar hardware POS con SDLPOS

- Elija su hardware POS: Seleccione entre nuestra amplia gama de terminales, cajas registradoras y accesorios.

- Solicite en línea: Envíe su solicitud y documentos rápidamente a través de nuestro sitio web.

- Revise su oferta de financiamiento: Le proporcionaremos términos claros que reflejen su perfil crediticio y empresarial.

- Firme el acuerdo: Una vez que esté de acuerdo con el plan, finalice la documentación digitalmente.

- Reciba su equipo: Su hardware POS se envía rápidamente después de la aprobación.

- Inicie su plan de pagos: Realice pagos mensuales asequibles alineados con su flujo de efectivo.

Al financiar su equipo POS con SDLPOS, obtiene acceso a financiamiento competitivo para equipos POS diseñado para negocios locales en España. Nuestro objetivo es hacer que la actualización o adquisición de nuevo hardware sea lo más sencilla y rentable posible, apoyando su crecimiento.

Cómo Elegir el Hardware POS Adecuado para las Necesidades de su Negocio con Opciones de Financiación

Seleccionar el hardware POS es un paso crucial para cualquier negocio, especialmente cuando planea comprar hardware POS con opciones de financiación. El sistema adecuado aumenta la eficiencia, mejora la experiencia del cliente y se ajusta a su presupuesto. Esto es lo que debe tener en cuenta:

Factores a Considerar al Elegir Hardware POS

Industria y Tipo de Negocio

Las diferentes industrias tienen necesidades distintas. Por ejemplo, los restaurantes suelen requerir pantallas táctiles, impresoras de cocina y escáneres de código de barras, mientras que las tiendas minoristas pueden centrarse más en escáneres de código de barras, cajones de efectivo y impresoras de tickets. Entender el tipo de negocio le ayuda a evitar pagar por funciones que no necesita.

Volumen de transacciones

Si su negocio maneja muchos clientes diariamente, invierta en hardware que pueda soportar altos volúmenes de transacciones sin retrasos ni caídas. Los sistemas más lentos o configuraciones más simples pueden ser adecuados para tiendas más pequeñas, pero los negocios en crecimiento necesitan soluciones escalables.

Capacidades de integración

Su hardware POS debe funcionar sin problemas con su software existente, procesadores de pago y otras herramientas como programas de gestión de inventario y contabilidad. La compatibilidad es clave para evitar problemas en el futuro.

Escalabilidad y Actualización

Elija sistemas POS que crezcan con su negocio. Financiar el equipo POS facilita las actualizaciones cuando su negocio se expanda, por lo que considere hardware que pueda soportar funciones o dispositivos adicionales.

Paquetes de Hardware Populares Financiados por Clientes en SDLPOS

Muchos de nuestros clientes optan por paquetes de hardware probados y confiables que se ajustan al tamaño y necesidades de su negocio. Algunas opciones populares incluyen:

- Paquete Minorista: Escáner de código de barras, impresora de tickets, cajón de efectivo y monitor táctil.

- Paquete para Restaurantes: Terminal POS táctil, impresora de cocina, tablets para pedidos móviles y terminales de pago integrados.

- Móvil y en Movimiento: Lector de tarjetas compacto y tablets ideales para food trucks, puestos temporales o pequeños proveedores de servicios.

Estos paquetes suelen ofrecer planes de pago flexibles, facilitando que los pequeños y en crecimiento negocios puedan adquirir lo que necesitan sin afectar su flujo de efectivo.

Preguntas frecuentes sobre compatibilidad de hardware y garantías

¿Puedo usar el hardware con mi software actual?

La mayoría del hardware SDLPOS soporta plataformas de software POS populares. Recomendamos verificar la compatibilidad antes de la compra, y nuestro equipo está listo para ayudar.

¿Qué hay de las garantías?

Todo el hardware nuevo financiado a través de SDLPOS viene con una garantía del fabricante. También están disponibles opciones de garantía extendida para mayor tranquilidad.

¿Puedo agregar más dispositivos más tarde?

Sí, nuestros planes de financiación están diseñados pensando en la escalabilidad, por lo que puedes arrendar o financiar equipos adicionales a medida que tu negocio crece.

Elegir el sistema correcto hardware POS con opciones de financiación se trata de equilibrar tus necesidades actuales con el crecimiento futuro. En SDLPOS, facilitamos que tu negocio se adapte a la tecnología que se ajusta a tu presupuesto y mantiene tus operaciones funcionando sin problemas.

Comparando proveedores de financiación de hardware POS Por qué elegir SDLPOS

Cuando se trata de financiación de hardware POS, no todos los proveedores son iguales. En SDLPOS, entendemos las necesidades de las pequeñas empresas españolas y ofrecemos soluciones que facilitan la compra de equipos POS, asequibles y confiables.

Precios transparentes sin tarifas ocultas

Una de las mayores preocupaciones al financiar es la aparición de costos inesperados. SDLPOS ofrece precios claros y transparentes para que sepas exactamente cuánto pagarás cada mes. Nuestros planes de financiación POS son sencillos, sin tarifas sorpresa ni letra pequeña complicada. Esta transparencia genera confianza y te ayuda a planificar mejor tu presupuesto.

Aprobación rápida y condiciones flexibles

Entendemos que el tiempo importa en los negocios. Nuestro proceso de aprobación rápida significa que puedes financiar tu hardware POS y ponerlo en marcha más rápido que muchos competidores. Además, ofrecemos opciones de pago flexibles, incluyendo arrendamiento de hardware POS o distribuir tus pagos en varios meses, para que el plan se adapte a tu flujo de caja, no al revés.

Soporte integral al cliente y servicio postventa

Comprar sistemas POS con planes de pago no se trata solo del hardware. SDLPOS destaca por ofrecer soporte continuo después de su compra. Ya sea que necesite ayuda con la instalación, resolución de problemas o actualización, nuestro equipo está listo para asistir. Sabemos que una operación fluida y una resolución rápida de problemas son clave para el éxito de su negocio.

Historial comprobado a través de testimonios de clientes

No solo confíe en nuestra palabra. Muchas empresas locales han confiado en SDLPOS para su financiación de hardware POS para pequeñas empresas y han visto resultados reales. Los clientes valoran nuestro servicio receptivo, opciones de financiamiento honestas, y hardware de calidad. Sus historias de éxito destacan cómo elegir SDLPOS les ayudó a gestionar costos y hacer crecer su negocio con confianza.

Elegir SDLPOS para su financiamiento de equipos POS significa trabajar con un socio que pone su negocio en primer lugar—ofreciendo las mejores ofertas de financiamiento POS, términos claros y soporte que perdura mucho después de que llegue su hardware.

El proceso de solicitud para financiamiento de hardware POS en SDLPOS

Formulario de solicitud en línea sencillo

Solicitar en comprar hardware POS con opciones de financiación en SDLPOS es un proceso sencillo. Ofrecemos un Formulario de solicitud en línea simple diseñado para ahorrarte tiempo. Sin papeleo complicado ni largas esperas, solo un formulario rápido que recopila detalles básicos del negocio.

Documentación que necesitarás

Para comenzar, ten listos estos documentos:

- Licencia comercial – Prueba de que tu negocio está registrado oficialmente

- Estados financieros – Estados recientes que muestren la salud financiera de tu negocio

- Identificación – Documento de identidad del propietario o número de Seguridad Social para verificación

Estos documentos nos ayudan a verificar tu elegibilidad para financiación de hardware POS para pequeñas empresas y adaptar el mejor plan de financiamiento a tus necesidades.

Qué esperar durante la aprobación

Nuestro equipo revisa tu solicitud rápidamente, generalmente en 24 a 48 horas. Si se aprueba, recibirás términos claros y detalles del plan de pagos—sin tarifas ocultas ni sorpresas. Nos enfocamos en opciones de financiamiento transparentes para sistemas POS para que puedas tomar decisiones informadas.

Cronograma desde la solicitud hasta recibir tu hardware

Una vez aprobado y firmes el acuerdo de financiamiento, esto es lo que puedes esperar:

- 1 a 3 días hábiles: Finaliza tu selección de hardware y realiza tu pedido

- 3 a 7 días hábiles: Envío y entrega en tu ubicación en cualquier parte de España.

- Soporte de configuración: Ofrecemos orientación para poner en marcha tu sistema POS rápidamente

de Puntos Clave

- Fácil solicitud en línea con el mínimo inconveniente

- Requiere licencia comercial y documentos financieros

- Proceso de aprobación rápido (generalmente 1-2 días)

- Entrega rápida y soporte de configuración después de que se finalice la financiación

Con SDLPOS, financiar tu equipo POS está diseñado para ser una experiencia fluida de principio a fin. Nuestro objetivo es conseguir que tu negocio tenga la mejor Opciones de arrendamiento de hardware POS o plan de compra para mantenerte en marcha sin problemas de flujo de efectivo.

Consejos para gestionar tu plan de financiación POS

Gestionar inteligentemente la financiación de tu hardware POS te ayuda a evitar costos innecesarios y mantiene tu negocio funcionando sin problemas. Aquí tienes algunas mejores prácticas para aprovechar al máximo tu plan de financiación POS y apoyar tu crecimiento.

Haz de los pagos puntuales una prioridad

- Mantente al día con los pagos: Los pagos atrasados pueden generar tarifas y afectar negativamente tu puntuación de crédito, dificultando futuras financiaciones.

- Configura recordatorios o automatiza pagos: Utiliza alertas del calendario u opciones de pago automático para evitar perder fechas de vencimiento.

- Revisa tu calendario de pagos: Comprende claramente tus obligaciones mensuales para que puedas planificar tu flujo de efectivo sin sorpresas.

Aprovecha el financiamiento para el crecimiento empresarial

- Utiliza el dinero liberado: El financiamiento te permite conservar el capital de trabajo. Dirige estos ahorros hacia la expansión del inventario, marketing o contratación.

- Actualiza la tecnología sin costos iniciales elevados: Invierte continuamente en el hardware POS más reciente para mantenerte competitivo, utilizando planes de financiamiento que distribuyen el gasto.

- Planifica para la escalabilidad: Elige opciones de financiamiento que te permitan agregar o actualizar equipos a medida que crece tu negocio, manteniendo tus sistemas actualizados y eficientes.

Explora opciones de actualización o devolución de equipos

- Revisa los términos de tu contrato: Algunos planes ofrecen opciones para actualizar a modelos más nuevos durante o después de tu período de financiamiento.

- Políticas de intercambio o devolución: Comprende si puedes devolver equipos en leasing o intercambiar hardware POS antiguo por sistemas más nuevos.

- Consulta con nosotros: SDLPOS ofrece opciones flexibles para actualizar o intercambiar tu hardware POS para adaptarse a las necesidades cambiantes de tu negocio.

Ser proactivo y estar informado sobre tu financiamiento de equipos POS te ayuda a evitar obstáculos y a usar tu plan de pagos para fortalecer tu negocio. Para más detalles sobre opciones de financiamiento y hardware, visita nuestro Página de financiación de hardware POS.