POS-Hardware mit flexiblen Finanzierungsplänen für Unternehmen kaufen

Möchten Sie POS-Hardware mit Finanzierungsmöglichkeiten kaufen aber unsicher, wo man anfangen soll? Du bist nicht allein. Viele Geschäftsinhaber möchten hochwertige Point-of-Sale-Systeme, bevorzugen es jedoch, Zahlungen aufzuteilen, anstatt eine große Vorauszahlung zu leisten.

Die Finanzierung Ihrer POS-Hardware ist eine kluge Möglichkeit, Ihren Cashflow stabil zu halten, während Sie Ihre Geschäftstechnologie aufrüsten. In diesem Leitfaden erfahren Sie genau, wie flexible Zahlungspläne erschwingliche POS-Ausrüstung Wirklichkeit werden lassen — und warum die Wahl von SDLPOS für Ihre Finanzierungsbedürfnisse ein Wendepunkt ist.

Bereit, zu erkunden, wie Sie die beste POS-Hardware jetzt bekommen und über die Zeit bezahlen können? Lass uns loslegen!

Was ist POS-Hardware Überblick über POS-Hardware-Komponenten und -Typen bei SDLPOS

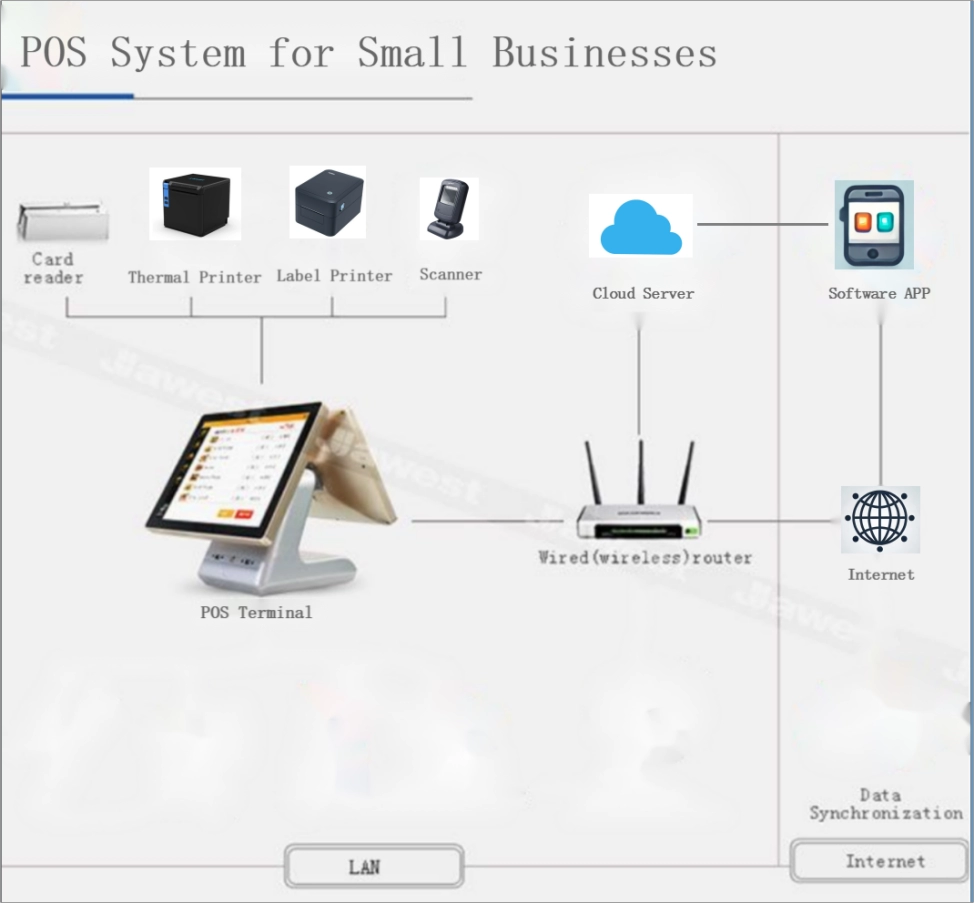

POS-Hardware bezieht sich auf die physischen Geräte, die ein Point-of-Sale-System ausmachen, und ermöglichen es Unternehmen, Transaktionen effizient abzuwickeln. Diese Komponenten sind essenziell für Verkaufsprozesse, Bestandsverwaltung und Kundenservice, was sie für Einzelhändler, Restaurants und dienstleistungsbasierte Unternehmen unverzichtbar macht.

Wichtige Komponenten der POS-Hardware

- POS-Terminals: Das Hauptgerät, in das Verkaufstransaktionen eingegeben werden. Dies könnte ein Touchscreen-Monitor oder eine traditionelle Computereinrichtung sein.

- Registrierkassen: Sichere Fächer zur Aufbewahrung von Bargeld, oft integriert mit dem Terminal.

- Barcode-Scanner: Geräte, die Produkt-Barcodes scannen, um schnelle und genaue Verkaufsdaten zu erfassen.

- Belegdrucker: Maschinen, die Verkaufsbelege für Kunden drucken.

- Kartenlesegeräte: Hardware, die entwickelt wurde, um Kredit- und Debitkartenzahlungen zu akzeptieren, einschließlich Chip-, Magnetstreifen- und kontaktloser Optionen.

- Kundenanzeigen: Bildschirme, die Transaktionsdetails für Kunden anzeigen.

- Waagen und Tastaturen: Wird in Einzelhandelsumgebungen wie Supermärkten zum Wiegen von Produkten und Eingeben von Codes verwendet.

Verschiedene Arten von POS-Hardware bei SDLPOS erhältlich

At SDLPOS, wir bieten eine große Auswahl an Finanzierungsmöglichkeiten für POS-Hardware für kleine Unternehmen über mehrere Geräte, die darauf ausgelegt sind, Ihren einzigartigen Geschäftsanforderungen gerecht zu werden:

- All-in-One POS-Systeme: Effiziente Geräte, die Touchscreens, Kartenleser und Geldschubladen integrieren und eine einfache Einrichtung ermöglichen.

- Mobile POS-Geräte: Tragbare Terminals, ideal für den Verkauf unterwegs, Food Trucks oder Pop-up-Shops.

- Traditionelle POS-Terminals: Robuste Computer in Kombination mit Peripheriegeräten, die für Geschäfte mit hohem Verkaufsvolumen maßgeschneidert sind.

- Selbstbedienungskioske: Lösungen, die es Kunden ermöglichen, ihre Einkäufe unabhängig zu bearbeiten.

- POS-Kassensysteme: Erschwingliche und zuverlässige Optionen mit Finanzierungsplänen, die kleine Unternehmen bei der Budgetplanung unterstützen.

Jedes Hardwarestück ist mit gängigen Softwareplattformen kompatibel und darauf ausgelegt, mit Ihrem Unternehmen zu wachsen. Durch die Wahl von SDLPOS erhalten Sie Zugang zu erschwinglichen POS-Systemen mit Zahlungsplänen die die Anschaffung der benötigten Technologie für Ihr Unternehmen vereinfachen, ohne Ihr Budget zu belasten.

Das Verständnis der Komponenten und Optionen ist der erste Schritt zur Auswahl der richtigen POS-Hardware für Ihren Betrieb—und die Finanzierung dieser Geräte hilft Ihnen, wettbewerbsfähig zu bleiben und gleichzeitig Ihren Cashflow effektiv zu verwalten.

Warum die Finanzierung von POS-Hardware für Ihr Unternehmen sinnvoll ist

Wenn es um POS-Hardware mit Finanzierungsoptionen kaufen, eine Vorauszahlung ist nicht immer die klügste Entscheidung. Die Finanzierung Ihrer POS-Ausrüstung bietet echte Vorteile, die Ihrem Unternehmen helfen können, flexibel zu bleiben und zu wachsen.

Vorteile der Finanzierung gegenüber Vorauszahlung

- Erhalten Sie Ihr Betriebskapital. Anstatt eine große Summe auf einmal auszugeben, ermöglicht die Finanzierung, Zahlungen über einen Zeitraum zu verteilen. So behalten Sie mehr Geld für den täglichen Betrieb, Lagerbestand oder Marketingmaßnahmen.

- Bessere Cashflow-Management. Monatliche Zahlungen sind vorhersehbar und leichter im Budget zu planen. Dies reduziert die finanzielle Belastung, die mit Einmalzahlungen verbunden sein kann.

- Zugang zur neuesten Technologie. Die Finanzierung erleichtert das Upgrade Ihres POS-Systems, wenn neuere, effizientere Optionen auf den Markt kommen—ohne dass Sie eine weitere große Anfangsinvestition tätigen müssen.

- Vermeidung der Bindung von Kreditlinien. Anstatt Kreditkarten oder Kredite für Hardware zu maximieren, kann die Finanzierung von POS-Hardware mit speziellen Plänen Ihre Kreditlinien für andere geschäftliche Bedürfnisse offen halten.

Wer kann von POS-Hardware-Finanzierungsplänen profitieren

- Kleine Unternehmen und Start-ups. Wenn Sie gerade erst starten oder wachsen, ermöglicht Ihnen die Finanzierung, Ihren Laden oder Ihr Restaurant erschwinglich auszustatten.

- Unternehmen mit saisonalen Schwankungen. Flexible Zahlungen können auf umsatzstärkere Monate abgestimmt werden, um den Druck in ruhigeren Perioden zu verringern.

- Etablierte Unternehmen, die aufrüsten. Auch wenn Sie bereits POS-Geräte besitzen, ermöglicht Ihnen die Finanzierung, Hardware zu ersetzen oder hinzuzufügen, ohne Ihren Cashflow zu stören.

- Eigentümer, die flexible Zahlungsoptionen suchen. Ob Sie POS-Hardware leasen oder mit monatlichen Zahlungen kaufen möchten, Finanzierungspläne bieten Optionen, die auf Ihr Budget zugeschnitten sind.

Die Finanzierung Ihres POS-Systems ist ein kluger Schritt, um wettbewerbsfähig zu bleiben, den Cashflow aufrechtzuerhalten und Technik ohne hohe Anfangskosten aufzurüsten. Sie gibt Ihnen die Freiheit, sich auf den Betrieb Ihres Geschäfts zu konzentrieren, ohne sich um finanzielle Belastungen sorgen zu müssen.

Finanzierungsoptionen für POS-Hardware bei SDLPOS

Bei SDLPOS verstehen wir, dass die Investition in POS-Hardware eine große Anfangsinvestition für Unternehmen sein kann. Deshalb bieten wir flexible POS-Finanzierungspläne an, die auf Ihre Bedürfnisse zugeschnitten sind und Ihnen helfen, die richtige Ausrüstung zu erhalten, ohne Ihren Cashflow zu belasten.

Übersicht über POS-Hardware-Finanzierungspläne

Wir bieten mehrere Finanzierungsoptionen an, darunter:

- Leasing von POS-Hardware: Monatliche Festbeträge zahlen mit der Option auf Upgrade oder Kauf zu einem späteren Zeitpunkt.

- Kreditbasierte Zahlungspläne: Zahlungen über einen festgelegten Zeitraum mit wettbewerbsfähigen Zinssätzen verteilen.

- Erschwingliche POS-Systeme mit Zahlungsplänen speziell für kleine Unternehmen entwickelt, die überschaubare monatliche Zahlungen für Terminals, Registrierkassen und andere wichtige Geräte suchen.

Diese Pläne sind darauf ausgelegt, Unternehmen dabei zu helfen, Betriebskapital zu erhalten, während sie dennoch Zugang zur neuesten Technologie haben.

Zulassungskriterien und So beantragen Sie

Die meisten in Deutschland ansässigen Unternehmen können sich für unsere POS-Gerätefinanzierung qualifizieren, einschließlich:

- Einzelunternehmen, GmbHs und Aktiengesellschaften.

- Unternehmen mit einer gültigen Gewerbeanmeldung und stabilen Finanzen.

- Neue oder bestehende Unternehmen mit mindestens einem minimalen Kreditrahmen.

Die Bewerbung ist einfach:

- Füllen Sie unser schnelles Online-Bewerbungsformular auf der SDLPOS-Website aus.

- Stellen Sie grundlegende Dokumente wie Ihre Gewerbeanmeldung und aktuelle Finanzberichte oder Kreditinformationen bereit.

- Erhalten Sie eine schnelle Kreditentscheidung, oft innerhalb von 24-48 Stunden.

Transparente Geschäftsbedingungen

Wir glauben an klare, offene Kommunikation. Hier ist, was Sie erwarten können:

- Keine versteckten Gebühren—was Sie sehen, ist was Sie bezahlen.

- Feste Zinssätze oder Leasingraten je nach Finanzierungsoption.

- Flexible Laufzeiten von 12 bis 48 Monaten je nach Ihrem Budget.

- Einfache Verlängerungs- oder Upgrade-Optionen am Ende Ihrer Laufzeit.

- Klare Richtlinien, was passiert, wenn Sie die Hardware zurückgeben oder kaufen möchten.

Schritt-für-Schritt-Anleitung zur Finanzierung von POS-Hardware mit SDLPOS

- Wählen Sie Ihre POS-Hardware: Wählen Sie aus unserem breiten Sortiment an Terminals, Registrierkassen und Zubehör.

- Online bewerben: Reichen Sie Ihre Bewerbung und Unterlagen schnell über unsere Website ein.

- Überprüfen Sie Ihr Finanzierungsangebot: Wir bieten klare Bedingungen, die Ihr Kredit- und Geschäftsprofil widerspiegeln.

- Unterschreiben Sie die Vereinbarung: Sobald Sie dem Plan zustimmen, finalisieren Sie die Unterlagen digital.

- Erhalten Sie Ihre Ausrüstung: Ihre POS-Hardware wird nach Genehmigung umgehend versendet.

- Starten Sie Ihren Zahlungsplan: Tätigen Sie erschwingliche monatliche Zahlungen, die mit Ihrem Cashflow übereinstimmen.

Durch die Finanzierung Ihrer POS-Ausrüstung mit SDLPOS erhalten Sie Zugang zu wettbewerbsfähiger POS-Ausrüstungsfinanzierung maßgeschneidert für lokale Unternehmen in Deutschland. Unser Ziel ist es, die Aufrüstung oder den Erwerb neuer Hardware so reibungslos und kosteneffizient wie möglich zu gestalten und gleichzeitig Ihr Wachstum zu unterstützen.

Wie Sie die richtige POS-Hardware für Ihre Geschäftsbedürfnisse mit Finanzierungsoptionen auswählen

Die richtige auszuwählen POS-Hardware ist ein entscheidender Schritt für jedes Unternehmen, insbesondere wenn Sie planen POS-Hardware mit Finanzierungsmöglichkeiten kaufen. Das richtige System steigert die Effizienz, verbessert die Kundenerfahrung und passt zu Ihrem Budget. Hier sind die wichtigsten Punkte:

Faktoren, die bei der Auswahl von POS-Hardware zu berücksichtigen sind

Branche und Geschäftstyp

Verschiedene Branchen haben unterschiedliche Bedürfnisse. Zum Beispiel benötigen Restaurants in der Regel Touchscreens, Küchen Drucker und Barcode-Scanner, während Einzelhandelsgeschäfte sich mehr auf Barcode-Scanner, Kassenschubladen und Belegdrucker konzentrieren könnten. Das Verständnis Ihres Geschäftstyps hilft Ihnen, für Funktionen zu bezahlen, die Sie nicht benötigen.

Transaktionsvolumen

Wenn Ihr Unternehmen täglich viele Kunden bedient, investieren Sie in Hardware, die mit hohen Transaktionsvolumina Schritt halten kann, ohne Verzögerungen oder Ausfallzeiten. Langsamere Systeme oder einfachere Setups sind für kleinere Geschäfte möglicherweise ausreichend, aber wachsende Unternehmen benötigen skalierbare Lösungen.

Integrationsmöglichkeiten

Ihre POS-Hardware sollte reibungslos mit Ihrer bestehenden Software, Zahlungsabwicklern und anderen Tools wie Inventarverwaltung und Buchhaltungsprogrammen zusammenarbeiten. Kompatibilität ist entscheidend, um später Kopfschmerzen zu vermeiden.

Skalierbarkeit und Aufrüstbarkeit

Wählen Sie POS-Systeme, die mit Ihrem Unternehmen wachsen. Die Finanzierung von POS-Geräten erleichtert das Upgrade, wenn Ihr Unternehmen expandiert, daher sollten Sie Hardware in Betracht ziehen, die zusätzliche Funktionen oder Geräte unterstützen kann.

Beliebte Hardwarepakete, die von Kunden bei SDLPOS finanziert werden

Viele unserer Kunden entscheiden sich für bewährte Hardware-Bundles, die auf ihre Unternehmensgröße und Bedürfnisse abgestimmt sind. Einige beliebte Optionen sind:

- Einzelhandelsbundle: Barcode-Scanner, Belegdrucker, Kassenschublade und Touchscreen-Monitor.

- Restaurant-Bundle: Touchscreen-POS-Terminal, Küchen-Drucker, mobile Bestell-Tablets und integrierte Zahlungsterminals.

- Mobil und unterwegs: Kompakte Kartenlesegeräte und Tablets, ideal für Food Trucks, Pop-up-Stores oder kleine Dienstleister.

Diese Bundles werden oft mit flexiblen Zahlungsplänen angeboten, was es kleinen und wachsenden Unternehmen erleichtert, sich das zu leisten, was sie brauchen, ohne die Liquidität zu belasten.

FAQ zu Hardware-Kompatibilität und Garantien

Kann ich die Hardware mit meiner aktuellen Software verwenden?

Die meisten SDLPOS-Hardware unterstützt beliebte POS-Softwareplattformen. Wir empfehlen, die Kompatibilität vor dem Kauf zu prüfen, und unser Team steht bereit, um zu helfen.

Was ist mit Garantien?

Alle neue Hardware, die über SDLPOS finanziert wird, ist mit einer Herstellergarantie versehen. Erweiterte Garantieoptionen sind ebenfalls verfügbar, um zusätzliche Sicherheit zu bieten.

Kann ich später weitere Geräte hinzufügen?

Ja, unsere Finanzierungspläne sind auf Skalierbarkeit ausgelegt, sodass Sie zusätzliche Geräte leasen oder finanzieren können, wenn Ihr Unternehmen wächst.

Die richtige Wahl treffen POS-Hardware mit Finanzierungsoptionen geht darum, Ihre aktuellen Bedürfnisse mit zukünftigem Wachstum in Einklang zu bringen. Bei SDLPOS machen wir es einfach, Ihr Unternehmen mit Technologie auszustatten, die in Ihr Budget passt und Ihre Abläufe reibungslos laufen lässt.

Vergleich von POS-Hardware-Finanzierungsanbietern Warum SDLPOS wählen

Wenn es um POS-Hardware finanzieren, nicht alle Anbieter sind gleich. Bei SDLPOS verstehen wir die Bedürfnisse kleiner Unternehmen in Deutschland und bieten Lösungen, die den Kauf von POS-Geräten einfach, erschwinglich und zuverlässig machen.

Transparente Preisgestaltung Ohne versteckte Gebühren

Eines der größten Anliegen bei der Finanzierung sind unerwartete Kosten. SDLPOS bietet klare, transparente Preise damit Sie genau wissen, was Sie monatlich bezahlen. Unsere POS-Finanzierungspläne sind unkompliziert, ohne Überraschungsgebühren oder komplizierte Kleingedruckte. Diese Transparenz schafft Vertrauen und hilft Ihnen, Ihr Budget besser zu planen.

Schnelle Genehmigung und flexible Konditionen

Wir wissen, dass Zeit im Geschäft zählt. Unser schneller Genehmigungsprozess bedeutet, dass Sie Ihre POS-Hardware schneller finanzieren und in Betrieb nehmen können als bei vielen Wettbewerbern. Außerdem bieten wir flexible Zahlungsmöglichkeiten, einschließlich Leasing von POS-Hardware oder Ratenzahlung über mehrere Monate, sodass der Plan zu Ihrem Cashflow passt – und nicht umgekehrt.

Umfassender Kundensupport und After-Sales-Service

Der Kauf von POS-Systemen mit Zahlungsplänen ist nicht nur eine Frage der Hardware. SDLPOS hebt sich durch laufende Unterstützung nach dem Kaufhervor. Ob Sie Hilfe bei der Installation, Fehlerbehebung oder Aufrüstung benötigen, unser Team steht bereit. Wir wissen, dass reibungsloser Betrieb und schnelle Problemlösung entscheidend für den Erfolg Ihres Unternehmens sind.

Nachweislicher Erfolg durch Kundenreferenzen

Nehmen Sie nicht nur unser Wort dafür. Viele lokale Unternehmen haben SDLPOS für ihre Finanzierungsmöglichkeiten für POS-Hardware für kleine Unternehmen vertrauen und echte Ergebnisse gesehen. Kunden schätzen unsere schnelle Service, ehrliche Finanzierungsoptionen, und hochwertige Hardware. Ihre Erfolgsgeschichten zeigen, wie die Wahl von SDLPOS ihnen geholfen hat, Kosten zu verwalten und ihr Geschäft mit Vertrauen auszubauen.

Die Wahl von SDLPOS für Ihre POS-Gerätefinanzierung bedeutet, mit einem Partner zusammenzuarbeiten, der Ihr Geschäft in den Mittelpunkt stellt—und bietet beste POS-Finanzierungsangebote, klare Bedingungen und Unterstützung, die lange nach der Ankunft Ihrer Hardware anhält.

Das Antragsverfahren für POS-Hardwarefinanzierung bei SDLPOS

Einfaches Online-Bewerbungsformular

Die Bewerbung bei POS-Hardware mit Finanzierungsmöglichkeiten kaufen bei SDLPOS ist ein unkomplizierter Prozess. Wir bieten ein einfaches Online-Bewerbungsformular das darauf ausgelegt ist, Ihnen Zeit zu sparen. Kein kompliziertes Papierkram oder lange Wartezeiten—nur ein schnelles Formular, das grundlegende Geschäftsdaten sammelt.

Benötigte Unterlagen

Um loszulegen, halten Sie diese Dokumente bereit:

- Gewerbeanmeldung – Nachweis, dass Ihr Unternehmen offiziell registriert ist

- Finanzberichte – Aktuelle Auszüge, die die finanzielle Gesundheit Ihres Unternehmens zeigen

- Identifikation – Eigentümer-ID oder Sozialversicherungsnummer zur Verifizierung

Diese Dokumente helfen uns, Ihre Berechtigung für Finanzierungsmöglichkeiten für POS-Hardware für kleine Unternehmen zu überprüfen und den besten Finanzierungsplan für Ihre Bedürfnisse zu erstellen.

Was Sie während der Genehmigung erwarten können

Unser Team prüft Ihren Antrag schnell, in der Regel innerhalb von 24 bis 48 Stunden. Bei Genehmigung erhalten Sie klare Bedingungen und Zahlungsplan-Details – keine versteckten Gebühren oder Überraschungen. Wir konzentrieren uns auf transparente Finanzierungsoptionen für POS-Systeme damit Sie informierte Entscheidungen treffen können.

Zeitrahmen vom Antrag bis zum Erhalt Ihrer Hardware

Sobald der Antrag genehmigt ist und Sie die Finanzierungsvereinbarung unterschreiben, ist hier der erwartete Zeitplan:

- 1 bis 3 Werktage: Abschluss Ihrer Hardwareauswahl und Bestellung

- 3 bis 7 Werktage: Versand und Lieferung an Ihren Standort überall in Deutschland

- Einrichtungsunterstützung: Wir bieten Unterstützung, um Ihr POS-System schnell einsatzbereit zu machen

wichtige Punkte

- Einfach Online-Antrag mit minimalem Aufwand

- Erfordert Gewerbeberechtigung und Finanzdokumente

- Schneller Genehmigungsprozess (in der Regel 1-2 Tage)

- Schnelle Lieferung und Unterstützung bei der Einrichtung nach Abschluss der Finanzierung

Mit SDLPOS ist die Finanzierung Ihrer POS-Ausrüstung so gestaltet, dass sie nahtlos von Anfang bis Ende verläuft. Unser Ziel ist es, Ihrem Unternehmen die richtige POS-Hardware-Leasingoptionen oder Kaufplan zu bieten, um reibungslos zu laufen, ohne Cashflow-Probleme.

Tipps zur Verwaltung Ihres POS-Finanzierungsplans

Eine kluge Verwaltung Ihrer POS-Hardware-Finanzierung hilft Ihnen, unnötige Kosten zu vermeiden und Ihr Geschäft reibungslos am Laufen zu halten. Hier sind einige bewährte Praktiken, um das Beste aus Ihrem POS-Finanzierungsplan herauszuholen und Ihr Wachstum zu unterstützen.

Rechtzeitige Zahlungen zur Priorität machen

- Bleiben Sie bei den Zahlungen vorne: Verspätete Zahlungen können zu Gebühren führen und sich negativ auf Ihre Kreditwürdigkeit auswirken, was zukünftige Finanzierungen erschwert.

- Erinnerungen setzen oder Zahlungen automatisieren: Verwenden Sie Kalenderbenachrichtigungen oder automatische Zahlungsoptionen, um Fälligkeitstermine nicht zu verpassen.

- Überprüfen Sie Ihren Zahlungsplan: Verstehen Sie Ihre monatlichen Verpflichtungen klar, damit Sie Ihren Cashflow ohne Überraschungen planen können.

Finanzierung für Geschäftswachstum nutzen

- Freigesetztes Kapital verwenden: Finanzierung ermöglicht es Ihnen, das Betriebskapital zu erhalten. Lenken Sie diese Einsparungen auf die Erweiterung des Inventars, Marketing oder Einstellungen.

- Technologie ohne hohe Anfangskosten aufrüsten: Investieren Sie kontinuierlich in die neueste POS-Hardware, um wettbewerbsfähig zu bleiben, mit Finanzierungsplänen, die die Kosten verteilen.

- Planen Sie für Skalierbarkeit: Wählen Sie Finanzierungsoptionen, die es Ihnen ermöglichen, Geräte hinzuzufügen oder aufzurüsten, wenn Ihr Unternehmen wächst, um Ihre Systeme aktuell und effizient zu halten.

Optionen für Geräteupgrades oder Rückgaben erkunden

- Überprüfen Sie Ihre Vertragsbedingungen: Einige Pläne bieten Optionen, während oder nach der Finanzierungsdauer auf neuere Modelle aufzurüsten.

- Trade-in- oder Rückgaberegelungen: Verstehen Sie, ob Sie geleaste Geräte zurückgeben oder ältere POS-Hardware gegen neuere Systeme eintauschen können.

- Konsultieren Sie uns: SDLPOS bietet flexible Optionen zum Aufrüsten oder Austauschen Ihrer POS-Hardware, um den sich ändernden Geschäftsanforderungen gerecht zu werden.

Proaktiv und informiert zu sein über Ihre POS-Gerätefinanzierung hilft Ihnen, Fallstricke zu vermeiden und Ihren Zahlungsplan zu nutzen, um ein stärkeres Geschäft aufzubauen. Für weitere Details zu Finanzierungsoptionen und Hardware besuchen Sie unsere POS-Hardware-Finanzierungsseite.