Die Zukunft der POS-Technologie in B2B-Transaktionen: Trends und Lösungen

Der aktuelle Stand der B2B-Transaktionen und Lücken, die Legacy-POS-Systeme nicht schließen können

Geschäft-zu-Geschäfts-Transaktionen (B2B) unterscheiden sich erheblich von Verbraucher-Einzelhandelsinteraktionen, und dies stellt einzigartige Herausforderungen für traditionelle Point-of-Sale (POS)-Technologie dar. Im Gegensatz zu B2C-Verkäufen, die typischerweise schnelle Swipes oder Taps für Einzelkäufe beinhalten, erfordern B2B-Transaktionen oft Massenrechnungen, komplexe Handelsbedingungen und Genehmigungen von mehreren Parteien. Diese Faktoren erfordern größere Flexibilität, Genauigkeit und Integrationsfähigkeiten, als es Legacy-POS-Systeme vorgesehen haben.

Wichtige Herausforderungen in aktuellen B2B-Zahlungsprozessen

Mehrere anhaltende Probleme behindern die Effizienz bei B2B-Transaktionen:

- Langsame Abstimmung und manuelle Fehler führen zu betrieblichen Rückschlägen, die Unternehmen jährlich über 1 Billion Euro an verlorener Zeit und Ressourcen kosten.

- Trotz 94% EMV-Akzeptanz bei Unternehmen, bleibt das Risiko von Betrugsversuchen erheblich aufgrund fragmentierter Datensilos bestehen.

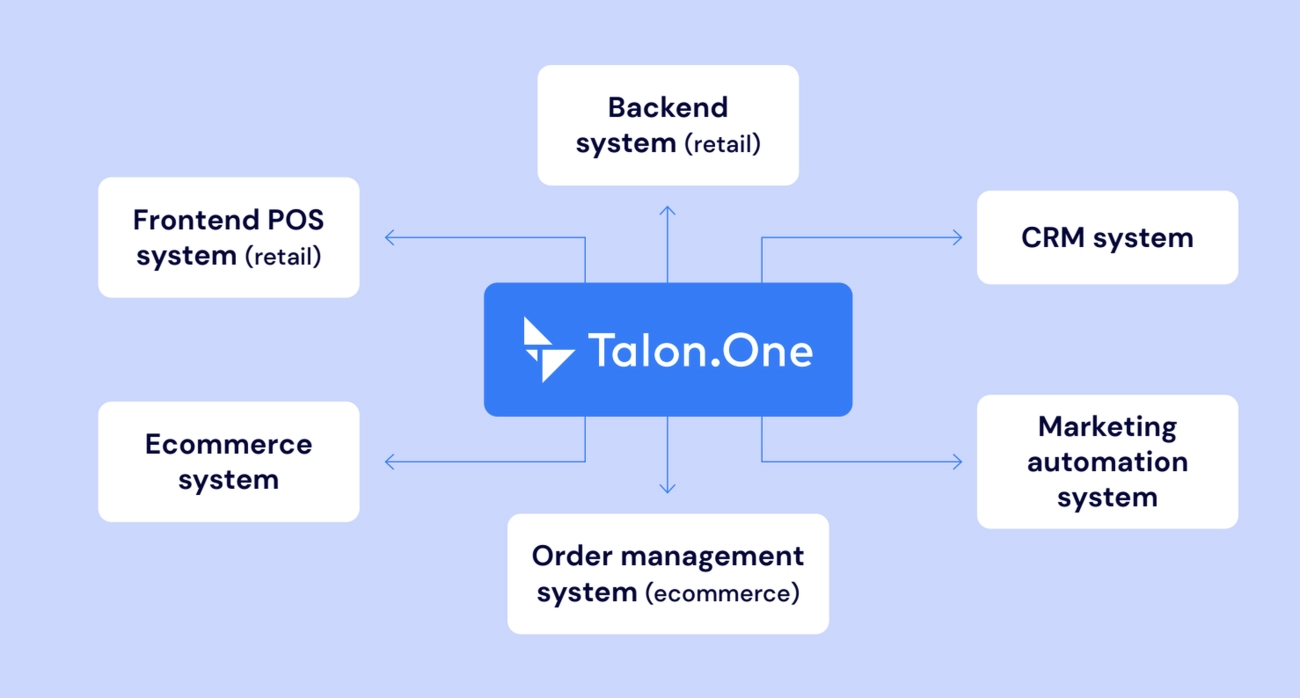

- ERP- und CRM-Systeme haben oft nur begrenzte Integration mit Legacy-POS, was nicht verbundene Datenströme und ineffiziente Arbeitsabläufe zwischen Finanz- und Lieferkettenteams schafft.

Daten-Highlights zur Digitalisierung von B2B-Zahlungen

Der Wandel hin zu digitalen Zahlungen ist im Gange, mit 92% von B2B-Unternehmen, die ihre Zahlungsprozesse aktiv digitalisieren. Viele stehen jedoch noch vor Integrationshürden, die nahtlose Automatisierung und Echtzeit-Transaktionsverfolgung verhindern. Diese Herausforderungen verdeutlichen, warum traditionelle POS-Systeme die Komplexität moderner B2B-Umgebungen nicht vollständig unterstützen können.

Überbrückung der Kluft mit aufkommender POS-Technologie

Aufkommende POS-Technologien sind darauf ausgelegt, diese Lücken zu schließen, indem Zahlungsautomatisierung optimieren, Datenkonnektivität verbessern und Betrugsrisiko verringern. Lösungen, die speziell für B2B entwickelt wurden, können direkt in Enterprise-Resource-Planning- und Customer-Relationship-Management-Plattformen integriert werden, um:

- Echtzeit-Zahlungsabstimmungen

- Automatisierte Genehmigungsworkflows

- Fortschrittliche Betrugspräventionsprotokolle

Durch die Nutzung dieser Innovationen können Unternehmen die operative Effizienz verbessern und sich für skalierbares Wachstum in einem zunehmend digitalen Markt positionieren.

Für einen detaillierten Einblick, wie sich POS-Hardware entwickelt, um diesen neuen Anforderungen gerecht zu werden, erkunden Sie die Entwicklung der Registrierkassentechnologie und überlegen Sie, wie zukunftsorientierte Tools Ihre B2B-Operationen transformieren können.

Top-Trends in der B2B-POS-Technologie Cloud-basierte und mobile POS für Transaktionen in Echtzeit überall

Die Zukunft von POS-Technologie bei B2B-Transaktionen entwickelt sich fest in Richtung cloud-basierte und mobile Lösungen. Im Gegensatz zu traditionellen On-Premise-Systemen bieten Cloud-POS-Plattformen die Flexibilität, Verkaufs- und Zahlungsprozesse von überall aus durchzuführen—egal ob Ihr Team im Außendienst ist oder mehrere Großhandelsstandorte verwaltet.

Warum Cloud- und Mobile-POS für B2B wichtig sind

- Unterstützt die Verarbeitung von Großbestellungen: B2B-Deals beinhalten in der Regel größere Bestellungen und komplexe Rechnungsstellung. Cloud-POS verarbeitet diese hohen Volumina problemlos, ohne die Geschwindigkeit zu beeinträchtigen.

- Echtzeit-Inventarsynchronisation: Mit API-Integrationen zu Lieferketten-Tools aktualisieren sich Ihre Lagerbestände sofort, um Überverkäufe oder Lagerengpässe zu vermeiden.

- Fernzugriff: Vertriebsmitarbeiter im Außendienst oder Händler auf Pop-up-Märkten können Zahlungen auf mobilen Geräten abwickeln, wodurch die Zahlungsabwicklung beschleunigt wird.

- Nahtlose ERP- und CRM-Integration: Cloud-POS-Systeme verbinden die B2B-Zahlungsautomatisierung mit Ihren bestehenden Geschäftsplattformen, um Daten konsistent und zugänglich zu halten.

Echte Ergebnisse mit Mobile POS bei B2B-Lieferungen

Ein Beispiel: Unternehmen, die Mobile POS für Vor-Ort-B2B-Lieferungen verwenden haben die Bearbeitungszeiten um bis zu 40% reduziert. Dieser Geschwindigkeitsschub verbessert den Cashflow und erhöht die Kundenzufriedenheit durch schnellere Abschlüsse.

SDLPOS Cloud-fähige Systeme

SDLPOS bietet eine Reihe von cloud-fähigen Registrierkassen mit mobilen Erweiterungen speziell für Großhandels- und Mehrstandortunternehmen. Ihre Systeme ermöglichen es Ihnen:

- Einfach zu skalieren, wenn Ihr Geschäft wächst

- Echtzeit-Transaktionsverfolgung von überall aus zu ermöglichen

- Nahtlose Integration mit Lieferketten- und Finanztools

Mit SDLPOS erhalten Sie eine moderne, flexible POS-Plattform, die mit dem Tempo der B2B-Transaktionen und den einzigartigen Anforderungen des deutschen Marktes Schritt hält.

KI und Maschinelles Lernen in B2B-POS-Technologie

Künstliche Intelligenz (KI) und maschinelles Lernen verändern die Spielregeln für B2B POS-Systeme indem sie Zahlungen intelligenter und effizienter machen. Diese Technologien analysieren große Mengen an Transaktionsdaten, um Nachfrage vorherzusagen, Genehmigungen zu automatisieren und personalisierte Handelsangebote basierend auf der einzigartigen Einkaufshistorie Ihres Unternehmens zu erstellen.

Wie KI die Automatisierung von B2B-Zahlungen verbessert

- Nachfrageprognose: Hilft Ihnen, die richtigen Produkte auf Lager zu haben und sich auf Großbestellungen vorzubereiten, ohne Rätselraten.

- Automatisierte Genehmigungen: Beschleunigt Genehmigungen mit mehreren Parteien, die bei B2B-Deals üblich sind, und reduziert Verzögerungen.

- Personalisierte Handelsangebote: Passt Preise und Aktionen an Ihre Volumen-Käufer an, verbessert den Verkauf und die Kundentreue.

Intelligentere Betrugsprävention für Transaktionen mit hohem Wert im B2B-Bereich

Auch bei der Einführung von 94% EMV bleibt Betrug ein Risiko im B2B-Bereich aufgrund von Transaktionen mit hohem Wert und komplexer Rechnungsstellung. KI verbessert Betrugserkennung durch das Markieren ungewöhnlicher Aktivitäten mit Anomalie-Warnungen und hilft, kostspielige Verluste zu verhindern. Das Ergebnis ist eine stärkere Sicherheit in Ihrem Zahlungssystem.

Dynamische Preisgestaltung und Wachstum bei 'Jetzt kaufen, später bezahlen'

KI treibt dynamische Preismodelle an, die sich an Bestellgröße und Käuferverhalten anpassen und es einfacher machen, Deals auszuhandeln, die für beide Seiten funktionieren. Außerdem boomt der Jetzt kaufen, später bezahlen (BNPL) Markt im B2B-Bereich, der voraussichtlich bis 2026 fast 1,5 Billionen Euro erreichen wird. KI unterstützt BNPL, indem sie Risiko bewertet und Kredit automatisch verwaltet, um Zahlungsoptionen zu vereinfachen.

Wichtige Auswirkungen von AI POS auf B2B-Operationen

- Reduziert operative Fehler um bis zu 30%

- Beschleunigt Zahlungszyklen und Genehmigungen

- Verbessert die Genauigkeit bei Handelsbedingungen und Rechnungsstellung

- Steigert die Betrugsprävention mit Echtzeitwarnungen

AI-gesteuerte Transaktionsanalysen werden schnell zu einem wesentlichen Bestandteil in Cloud-POS für Großhandel und Mobiles POS für Außendienst, das nahtlos in bestehende ERP- und CRM-Systeme integriert ist. Dies schafft einen reibungsloseren, intelligenteren Zahlungsfluss, der Zeit und Kosten spart.

Die Integration von KI und maschinellem Lernen in Ihr B2B-POS-System ist nicht nur ein technisches Upgrade—es ist ein strategischer Schritt, der Wachstum, Sicherheit und Effizienz in einem wettbewerbsintensiven Markt fördert.

Blockchain und Embedded Finance für sichere, transparente B2B-Abrechnungen

Blockchain wird zu einem Schlüsselakteur in der Zukunft der POS-Technologie für B2B-Transaktionen. Ihre unveränderlichen Ledger bedeuten, dass Rechnungen manipulationssicher sind, und Smart Contracts können Zahlungen automatisieren, ohne Verzögerungen oder manuelle Eingriffe. Diese Technologie schafft ein transparentes, sicheres System, das Unternehmen hilft, traditionelle Zahlungsprozesse zu vereinfachen.

Wie Blockchain B2B-Zahlungen verbessert

- Vereinfachung grenzüberschreitender Geschäfte durch Reduzierung der Transaktionsgebühren um bis zu 50%.

- Angebote Embedded-Finance-Optionen wie virtuelle Karten für Lieferanten, die Zahlungszyklen beschleunigen und den Cashflow verbessern.

- Ermöglicht Tokenisierung, das sensible Zahlungsdaten schützt und hilft, Betrug bei komplexen B2B-Transaktionen zu verhindern.

- Unterstützt die Integration mit bestehenden ERP- und CRM-Systemen, um den Wechsel für Großhändler und Händler reibungsloser zu gestalten.

Bis 2030 wird erwartet, dass die Tokenisierung im B2B-Zahlungsverkehr auf 1,2 Billionen Euro, was ihre Rolle bei Betrugsprävention und sicheren Zahlungen unterstreicht.

Warum Embedded Finance im B2B-POS wichtig ist

Embedded Finance verbindet Zahlungslösungen nahtlos mit POS-Systemen, sodass Unternehmen:

- Finanzierungsoptionen sofort während der Transaktion nutzen können.

- Die Liquidität verbessern, ohne zusätzliche Hürden zu überwinden.

- Schnellere Abrechnungen ermöglichen, damit Lieferketten effizient weiterlaufen.

SDLPOS Blockchain-Fähigkeiten

SDLPOS bietet blockchain-kompatible Module speziell für Großhandels- und B2B-Umgebungen entwickelt. Diese Module helfen Unternehmen, Compliance und Transparenz zu wahren, während sie von schnelleren, sichereren Abrechnungen profitieren. Das System integriert Blockchain in Ihren bestehenden Workflow und ermöglicht:

- Automatisierte, fehlerfreie Rechnungsstellung.

- Intelligentere Betrugsprävention, verbunden mit POS-Daten.

- Bessere Kostenkontrolle durch reduzierte Zahlungsabwicklungsgebühren.

Die Wahl von SDLPOS bedeutet Investition in POS-Technologie, die für die Sicherheits- und Skalierungsherausforderungen von B2B-Zahlungen heute und in Zukunft entwickelt wurde.

Kontaktlose und biometrische Innovationen, die die Zukunft der B2B-POS-Technologie vorantreiben

Da immer mehr B2B-Unternehmen Zahlungen abwickeln hochvolumigen Transaktionen, Geschwindigkeit und Sicherheit waren noch nie so wichtig. Der Aufstieg von kontaktlosen Zahlungen und biometrischen Verifizierungen verändert die Art und Weise, wie Unternehmen Sammelrechnungen und Lieferantenfreigaben verwalten—schneller, sicherer und hygienischer.

Schnellere Transaktionen mit NFC-QR-Codes und Gesichtserkennung

Near Field Communication (NFC) und QR-Codes ermöglicht Käufern und Verkäufern, Zahlungen nur durch Antippen oder Scannen abzuschließen—ohne mit Bargeld oder Karten zu hantieren. Für Unternehmen, die Pop-up-Märkte, Messen oder Lieferantenveranstaltungen veranstalten, bedeutet dies, Dutzende oder Hunderte von Transaktionen ohne Verzögerung abzuwickeln.

In der Zwischenzeit, biometrische Werkzeuge wie Gesichtserkennung fügen eine zusätzliche Sicherheitsebene und Geschwindigkeit hinzu, reduzieren manuelle Prüfungen und schützen vor Betrug. Diese technischen Funktionen unterstützen eine schnelle Identitätsüberprüfung bei gleichzeitiger Wahrung der Hygiene—ein Gewinn für geschäftige B2B-Umgebungen, die auf Effizienz setzen.

Unterstützung des Wandels hin zu digitalen Geldbörsen im B2B

Die Nutzung digitaler Geldbörsen im B2B wächst schnell, mit etwa 15% jährlichem Wachstum bei speziell für Geschäftszahlungen entwickelten Apps. Dieser Trend spiegelt eine breitere Bewegung hin zu Mobiles POS für Außendienst und kontaktloser Sammelrechnungsstellung, wider, die Unternehmen dabei hilft, Zahlungen sowohl im Büro als auch unterwegs zu optimieren.

Marktausblick und Einfluss

Bis 2025 wird erwartet, dass der mobile POS-Markt eine Reichweite von $49 Milliarden allein in Deutschland. Dieses Wachstum wird durch die Nachfrage nach schnelleren, sichereren Möglichkeiten zur Abwicklung komplexer B2B-Zahlungen angetrieben, bei denen herkömmliches Wischen oder manuelle Rechnungsstellung einfach nicht mehr ausreicht.

Warum das für Ihr Geschäft wichtig ist

- Große Bestellungen schneller abwickeln ohne Personal oder Reibungsverluste hinzuzufügen

- Betrugsrisiken reduzieren mit biometrischer Verifizierung und verschlüsselter kontaktloser Technologie

- Hybride Zahlungsmodelle unterstützen die digitale Geldbörsen und traditionelle Rechnungsstellung kombinieren

- Kundenerlebnis verbessern bei Pop-ups, Händlermessen und vor Ort arbeitenden Verkaufsteams

Eingebaut kontaktlose und biometrische Innovationen in Ihr POS-System zu integrieren, geht es nicht nur darum, Schritt zu halten – es geht darum, Ihre B2B-Transaktionen reibungsloser, sicherer und zukunftsfähig zu machen.

Nachhaltigkeit und Omnichannel-Integration in der B2B-POS-Technologie

Während sich B2B-Transaktionen weiterentwickeln, sind Nachhaltigkeit und Omnichannel-Integration zu den wichtigsten Trends geworden, die die Zukunft der POS-Technologie gestalten. Unternehmen legen heute Priorität auf umweltfreundliche Hardware und papierlose Belege die Umwelt-, Sozial- und Governance-Ziele (ESG) unterstützen. Dieser Wandel reduziert nicht nur Abfall, sondern zeigt auch das Engagement eines Unternehmens für Nachhaltigkeit – eine wachsende Erwartung von Partnern und Kunden gleichermaßen.

Energieeffiziente Hardware und papierlose Belege

- Energieeffiziente POS-Geräte geringerer Stromverbrauch, was Unternehmen hilft, Kosten zu senken und gleichzeitig ihren ökologischen Fußabdruck zu verkleinern.

- Papierlose digitale Belege vereinfachen die Aufzeichnung, reduzieren Papiermüll und beschleunigen Transaktionsprozesse in Hochvolumen-B2B-Umgebungen.

Dies passt gut zu B2B-Einkaufstrends, bei denen Unternehmen darauf abzielen, Abläufe zu optimieren und gleichzeitig Nachhaltigkeitsstandards zu erfüllen.

Omnichannel-Systeme für hybride B2B-Modelle

Im B2B, Omnichannel-POS-Lösungen Kombinieren Sie mehrere Vertriebskanäle—wie E-Procurement-Plattformen mit persönlicher Großbestellung—um ein einheitliches Erlebnis zu schaffen. Dies ist entscheidend für Großhändler und Lieferanten, die in hybriden Modellen operieren und sowohl Online-Bestellungen als auch persönliche Verhandlungen verwalten.

- Ermöglicht Echtzeit-Inventarupdates über alle Kanäle hinweg

- Erleichtert nahtlose Integration mit Supply-Chain-Management-Tools

- Bietet genaue Auftragsverfolgung und Rechnungsstellung, unabhängig davon, wo der Verkauf stattfindet

Beispiel Green POS Einfluss auf Lieferketten

Umweltbewusste Organisationen, die grüne POS-Technologie einführen,

- sehen bedeutende Vorteile:

- Reduzierter CO2-Fußabdruck durch weniger Hardware-Abfall und Energieverbrauch

- Erhöhte Effizienz durch einheitliche Datenflüsse zwischen Beschaffung und Lieferantensystemen

Verbesserter Ruf durch Erfüllung unternehmerischer Nachhaltigkeitsverpflichtungen.

Die Anpassung von POS-Systemen zur Unterstützung dieser umweltfreundlichen und omnichannel-Strategien fördert nicht nur den Umweltschutz, sondern auch operative Exzellenz. Für mehr Informationen darüber, wie POS-Hardware in moderne Einzelhandelsökosysteme integriert wird, besuchen Sie Einzelhandelstechnologietrends Die Entwicklung der Registrierkassentechnologie.

Wichtigste Erkenntnisse

- Nachhaltigkeit im B2B-POS bedeutet energiesparende Geräte und papierlose Prozesse.

- Omnichannel-Integration vereint online und persönliche Großtransaktionen mühelos.

- Grüne POS-Systeme reduzieren die CO2-Bilanz der Lieferkette und steigern gleichzeitig die Effizienz.

Als B2B-Verkäufer bereitet Sie die Annahme dieser Trends darauf vor, Kundenanforderungen und Compliance-Anforderungen nachhaltig zu erfüllen und gleichzeitig Ihre Transaktionsabläufe zu verbessern.

Herausforderungen bei der Implementierung und Lösungen für die Einführung von B2B-POS

Die Einführung neuer POS-Technologien im B2B-Bereich ist nicht ohne Hürden. Das Verständnis dieser Herausforderungen und das Wissen, wie man sie überwindet, sind entscheidend für jedes Unternehmen, das modernisieren möchte.

Häufige Barrieren bei der Einführung von B2B-POS

- Hohe Anfangskosten: Upgrades von Altsystemen können zwischen $3.000 und $50.000, kosten, eine erhebliche Investition für viele Großhandels- und Vertriebsunternehmen.

- Risiken bei der Datenmigration: Das Verschieben sensibler Rechnungs- und Zahlungsdaten von älteren ERP- oder CRM-Systemen in neue POS-Plattformen birgt Risiken von Datenverlust, Ungenauigkeiten oder Ausfallzeiten.

- Mitarbeiterschulung: Mitarbeiter, die an manuelle oder veraltete Systeme gewöhnt sind, benötigen oft Zeit und Unterstützung, um sich an neue Arbeitsabläufe anzupassen, was den täglichen Betrieb stören kann.

- Integrationsherausforderungen: B2B-Transaktionen basieren auf komplexer Rechnungsstellung, Handelsbedingungen und Mehrparteiengenehmigungen, was eine nahtlose Integration mit bestehenden Lieferketten-Tools und ERPs erschwert.

Praktische Lösungen für eine reibungslose Einführung von B2B-POS

Eine erfolgreiche Einführung hängt von cleveren Strategien ab, die Störungen minimieren und den Ertrag maximieren:

- Schrittweise Rollouts: Schrittweise Implementierung neuer POS-Systeme in Abteilungen oder Standorten, um Risiken zu minimieren und dem Personal Zeit zur Anpassung zu geben.

- Starke Partnerschaften mit Anbietern: Enge Zusammenarbeit mit Anbietern wie SDLPOS, die die Bedürfnisse im Großhandel und B2B verstehen und praktische Unterstützung bieten können.

- Plug-and-Play-Technologien: Wählen Sie Lösungen wie SDLPOS’s cloudfähige Registrierkassen mit mobilen Erweiterungen, die minimalen Einrichtungsaufwand erfordern und die Einführung beschleunigen.

- ROI-Rechner: Nutzen Sie Tools, um die Gesamtkosten des Eigentums (TCO) und die erwarteten Einsparungen zu prognostizieren. SDLPOS berichtet von einem 22% besseren TCO mit cloudbasierten Systemen, was langfristige Investitionen transparenter macht.

- Laufende Schulungen und Support: Regelmäßige Mitarbeiterschulungen gewährleisten einen reibungslosen Übergang und reduzieren manuelle Fehler, die B2B-Unternehmen jährlich Milliarden kosten.

Erfolg in der Praxis

Ein anonymer B2B-Großhändler, der SDLPOS nutzt, verzeichnete eine 35% Reduktion der Transaktionszeiten nach der Umstellung auf ein cloudbasiertes POS mit mobilen und API-Integrationen. Dies führte zu schnelleren Rechnungsstellungen, effizienterer Abstimmung und weniger Fehlern bei der Massenbestellabwicklung.

Durch die direkte Ansprache dieser Implementierungsbarrieren und die Wahl skalierbarer, modularer Lösungen können Unternehmen die vollen Vorteile der nächsten Generation von B2B-POS-Technologie nutzen.

Wie SDLPOS Ihr Unternehmen für den Erfolg im B2B-POS positioniert

Wenn es um Zukunftssicherstellung Ihrer B2B-Transaktionen, SDLPOS hebt sich durch eine Vielseitiges Sortiment an Kassensystemen für POS-Systeme speziell entwickelt für die sich entwickelnden Bedürfnisse von Großhandels- und Mehrstandortunternehmen. Ihre Lösungen integrieren KI-gestützte Werkzeuge, die intelligenteres, skalierbareres Zahlungsautomatisierung ermöglichen, die perfekt zu Hochvolumen-B2B-Workflows passt.

SDLPOS zukunftsorientierte POS-Lösungen für B2B

Cloud-basierte und modulare Systeme

SDLPOS bietet cloudfähige Kassensysteme die eine Echtzeit-Synchronisation an mehreren Standorten unterstützen. Dies erleichtert die Massenauftragsabwicklung, Bestandsverwaltung und nahtlose API-Integration mit Ihren bestehenden ERPs und CRMs.

KI-Integration für intelligentere Abläufe

Modelle sind mit KI-gesteuerten Funktionen wie vorausschauende Analysen, Betrugserkennung, und dynamischer Preisgestaltung ausgestattet, die die Genauigkeit und Geschwindigkeit bei komplexen B2B-Transaktionen verbessern.

Skalierbare und flexible Einrichtung

Egal, ob Sie ein Großhändler sind, der ein mobiles POS vor Ort benötigt, oder ein Distributor, der Mehrparteien-Genehmigungen verwaltet – die modularen Upgrades von SDLPOS bedeuten, dass Sie mit Ihrem Wachstum skalieren können ohne die Kopfschmerzen vollständiger Systemüberholungen.

Einfache Schritte, um mit SDLPOS zu starten

Folgen Sie diesen praktischen Schritten, um Ihre B2B-Zahlungsautomatisierung in Gang zu bringen:

Überprüfen Sie Ihre aktuellen Zahlungssysteme

Verstehen Sie Ihre bestehende Konfiguration, identifizieren Sie Integrationsherausforderungen und heben Sie hervor, welche Funktionen für B2B-Skalierung und Sicherheit fehlen.

Planen Sie eine Demo von SDLPOS-Integrationen

Sehen Sie aus erster Hand, wie SDLPOS mit Ihren Lieferketten-Tools synchronisiert und die Rechnungsstellung sowie Genehmigungen optimiert.

Mit modularen Upgrades skalieren

Beginnen Sie einfach mit Kern-Cloud-POS-Einheiten und fügen Sie KI-Module, Blockchain-Sicherheitsfunktionen oder Embedded-Finance-Optionen hinzu, je nach den Anforderungen Ihres Geschäfts – und behalten Sie die Kontrolle über Kosten und Komplexität.

Bereit, die Transaktionsgeschwindigkeit zu verbessern, Betrugsprävention zu erhöhen und komplexe Genehmigungen zu vereinfachen? Kontaktieren Sie SDLPOS für eine kostenlose Beratung, die auf Ihre B2B-Operationen zugeschnitten ist. Unsere Experten helfen Ihnen, eine POS-Strategie zu entwickeln, die Ihre Zahlungsprozesse transformiert und Ihr Geschäft wettbewerbsfähig hält.

Weitere Informationen darüber, wie Sie Ihre Einzelhandels-Hardware zukunftssicher machen können, finden Sie unter Wie Sie Ihre Einzelhandels-Hardware zukunftssicher machen.

Die Zukunft der POS-Technologie in B2B-Transaktionen: Akzeptieren Sie den Wandel oder riskieren Sie, zurückzufallen

Die Welt der B2B-Zahlungen entwickelt sich schnell, und POS-Technologie steht im Mittelpunkt dieser Transformation. Wenn Sie möchten, dass Ihr Unternehmen wettbewerbsfähig bleibt, ist es entscheidend, diese neuen Werkzeuge jetzt zu übernehmen. Die wichtigsten Trends, die wir behandelt haben—Cloud-basierte Systeme, KI-gesteuerte Transaktionsanalysen, Blockchain für sichere B2B-Abrechnungen, kontaktlose Optionen und nachhaltige Hardware—alle adressieren die größten Schmerzpunkte bei B2B-Zahlungen:

- Effizienz: Effizientere Rechnungsstellung, schnellere Transaktionsabwicklung und reduzierte manuelle Fehler sparen wertvolle Zeit und Geld.

- Sicherheit: Fortschrittlicher Betrugsprävention wie EMV, KI-Anomalieerkennung und Blockchain schützen hochpreisige Geschäfte.

- Wachstum: Intelligenter Daten-Einblick und flexible Zahlungsoptionen eröffnen Türen zu mehr Umsatz und besseren Beziehungen zu Lieferanten.

Mit fast 92% an B2B-Unternehmen, die Zahlungen digitalisieren, stehen diejenigen, die zögern, vor längeren Abgleichzeiten, teurer Betrugsanfälligkeit und verpassten Umsatzchancen.

Vorausblick auf den $21.2T B2B POS-Markt

Bis 2028 wird prognostiziert, dass der B2B POS-Markt auf $21.2 Billionen. ansteigen wird. Das ist eine große Erinnerung daran, dass Investitionen in die richtige POS-Technologie nicht mehr optional sind – sie sind eine Notwendigkeit. Proaktiv zu sein bedeutet:

- Cloud-basierte und mobile POS-Systeme schrittweise einzuführen, um flexible Verkaufsumgebungen zu unterstützen

- Nutzung KI und maschinelles Lernen um Fehler zu reduzieren und Käuferbedürfnisse vorherzusagen

- Das Hinzufügen Blockchain und Embedded Finance für sichere, transparente Zahlungen

- Integration Kontaktlose und biometrische Tools um Massen-Transaktionen zu beschleunigen

- Verpflichtung zu nachhaltigen, omnichannel Lösungen die den heutigen umweltbewussten Anforderungen entsprechen

Handeln Sie mit SDLPOS

Bereit für den Sprung? Laden Sie die 2025 B2B POS Roadmap PDF herunter, um einen klaren Plan zu erhalten und zu sehen, wie SDLPOS Ihnen helfen kann, ein zukunftsfähiges Zahlungssystem aufzubauen. Von modularen Upgrades bis hin zu Plug-and-Play-Kassen, die sich in Ihr ERP und CRM integrieren, ist SDLPOS darauf ausgelegt, Kosten zu senken, Sicherheit zu verbessern und mit Ihren wachsenden Anforderungen zu skalieren.

Lassen Sie veraltete Legacy-POS-Systeme Ihr Geschäft nicht ausbremsen. Nutzen Sie die Evolution der B2B-Zahlungsautomatisierung und positionieren Sie Ihr Unternehmen noch heute für langfristigen Erfolg.